- Ethereum’s OI and whale inflows surged, signaling institutional conviction behind the latest rally.

- ETH liquidations and technicals level to a possible breakout above $2,714 as shorts get squeezed.

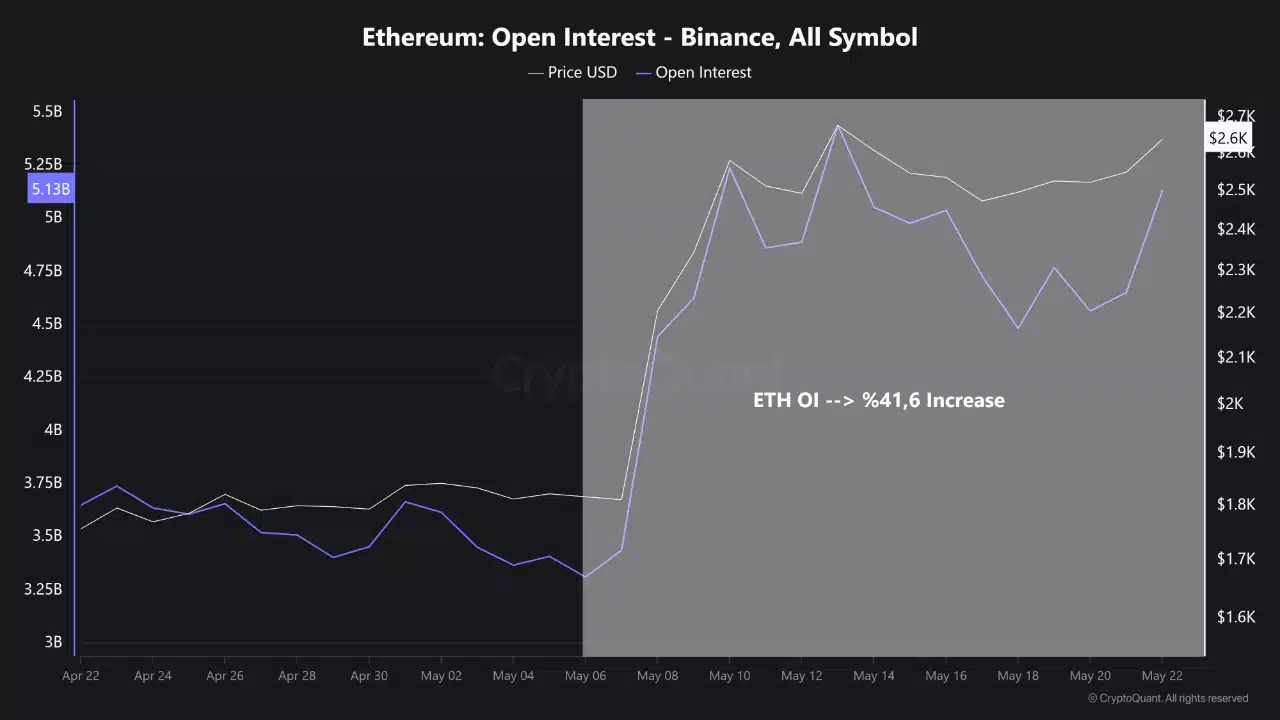

Ethereum’s [ETH] Futures market has proven exceptional power over the previous month.

Open Curiosity (OI) on Binance jumped from $3.6B to $5.1B—up 41.6%—with the full ETH OI throughout all exchanges now close to $17B.

This uptick alerts sturdy institutional and derivatives-driven conviction behind ETH’s rally.

Importantly, this transfer just isn’t speculative; it aligns with an nearly 65% value rise from $1,600 to $2,663.72.

Subsequently, Ethereum’s latest surge seems greater than a short lived spike—it displays a structurally supported rally backed by strong participation within the derivatives market.

Whale Inflows speed up

In simply seven days, Ethereum’s Massive Holders Netflow rose 22.8%, extending a large 30-day improve of 1057.08% and a 90-day soar of 392.80%.

This surge suggests sustained accumulation from institutional entities and long-term holders.

Furthermore, the timing of those inflows corresponds with Ethereum’s breakout above $2,600, confirming that deep-pocketed traders proceed to guess on additional upside.

Whereas accumulation persists, ETH Alternate Reserves have elevated by 3.93%, totaling $51.17B. Sometimes, rising reserves may point out upcoming promote stress as extra ETH turns into out there on exchanges.

Nevertheless, this rise might as a substitute replicate rotational liquidity, the place merchants deposit ETH for derivatives publicity or to hedge positions.

ETH faces main hurdle at $2,714

Ethereum was buying and selling round $2,663, simply shy of a robust resistance band between $2,714 and $2,741. The Stochastic RSI sat above 79, indicating overbought circumstances, whereas Bollinger Bands sign diminished volatility.

A decisive shut above $2,741 would possible open the door to a breakout rally towards $3,000. Nevertheless, failure to breach this zone might set off a short-term retracement to $2,581.

Subsequently, ETH sits at a vital technical juncture that might dictate the near-term trajectory for each itself and the broader altcoin market.

Shorts get squeezed

Derivatives information confirms rising bear capitulation.

On the twenty third of Might, ETH liquidations confirmed quick positions price $17.88M being worn out throughout exchanges. Binance and Bitfinex led the liquidations, whereas lengthy positions solely accounted for $12.56M.

This continued squeeze has amplified ETH’s rally, particularly as Open Curiosity and Whale Netflows each help the transfer.

Can ETH break $2,714 and set off the subsequent altcoin wave?

Ethereum seems well-positioned to interrupt above the $2,714 resistance, backed by sturdy on-chain and derivatives metrics.

The sharp rise in Whale Inflows, continued quick liquidations, and a 41.6% surge in OI verify stable bullish momentum. Whereas reserves have risen barely, this has not weakened the broader bullish setup.

Subsequently, a profitable breakout above $2,714 would possible mark the start of a brand new altcoin rally, with ETH main the cost.