- Ethereum registered losses of two.70% over the past 24 hours

- As traders flip to purchase the dip, Ethereum should reclaim $2,350 for a possible rally

During the last two weeks, Ethereum [ETH] has seen some excessive volatility on the charts. Over this era, ETH’s value has climbed to an area excessive of $2.7k. Quite the opposite, the interval has additionally seen the altcoin drop under $2,000 for the primary time since November 2023.

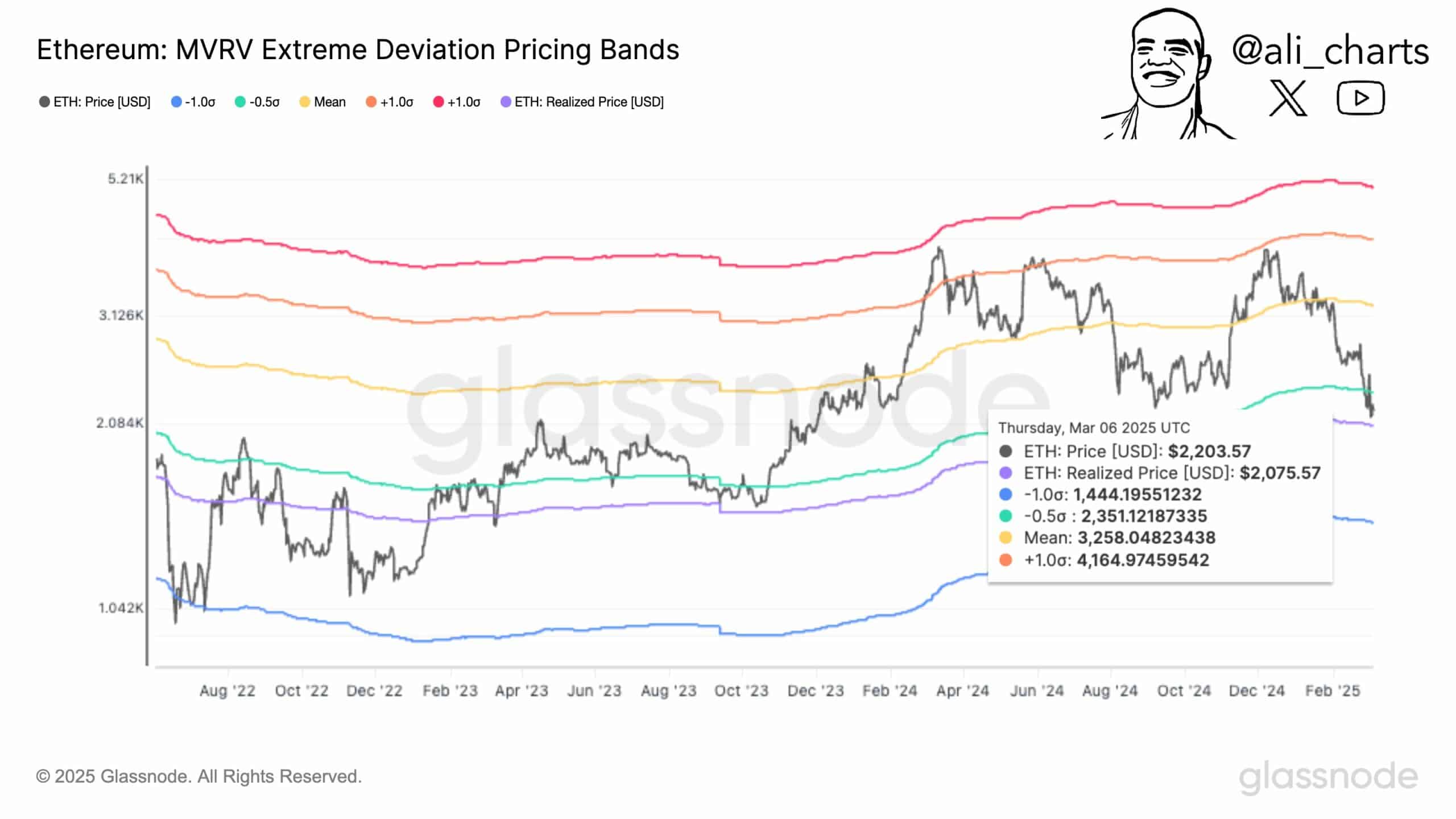

The most recent value fluctuation has left key stakeholders sharing completely different opinions, with some nonetheless optimistic about ETH. Certainly one of them is Ali Martinez, with the crypto analyst hinting at a possible rally to $3,260 citing pricing bands and the MVRV.

Can Ethereum rally to $3,260 on the charts?

In his evaluation, Martinez noticed that the prevailing market circumstances have left $2,350 as probably the most important resistance degree for the altcoin.

Subsequently, if ETH breaks out of this degree and strikes above it, it might set off important shopping for momentum and try the following important degree round $3260. Reclaiming this degree might have a psychological impact by confirming a bullish pattern shift. This might entice traders to purchase the altcoin and take lengthy positions.

In accordance with Martinez, with Ethereum’s costs dropping under its MVRV, it has created an ideal shopping for alternative. Traditionally, shopping for at this ranges has normally offered probably the most returns – A pattern that has persevered since 2016.

Due to this decline, it might appear traders have turned to purchasing the dip.

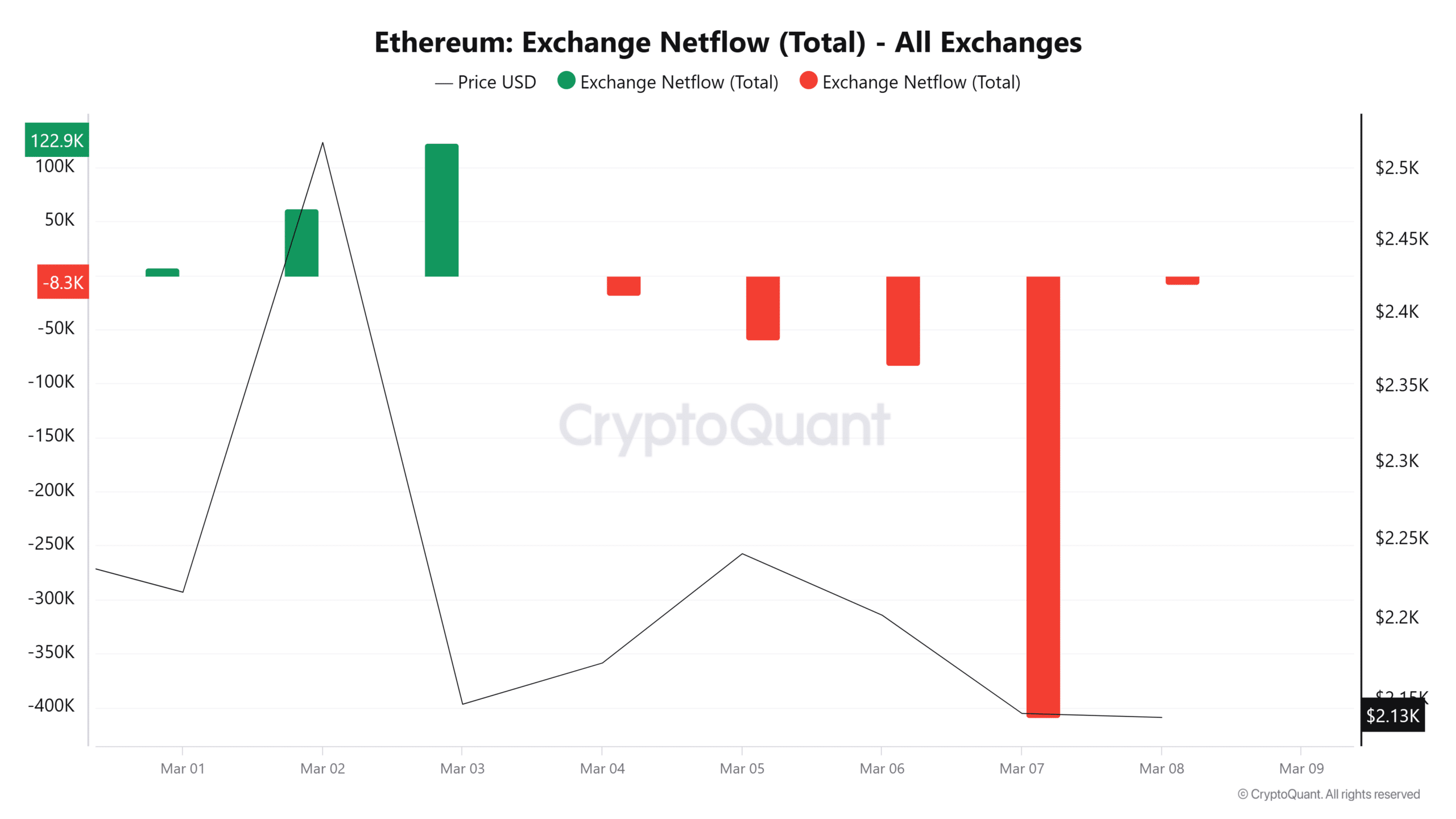

This shopping for exercise might be evidenced by Ethereum’s Trade netflows which have remained damaging over the past 4 days. A damaging netflow means consumers are dominating the market, with extra trade outflows than inflows.

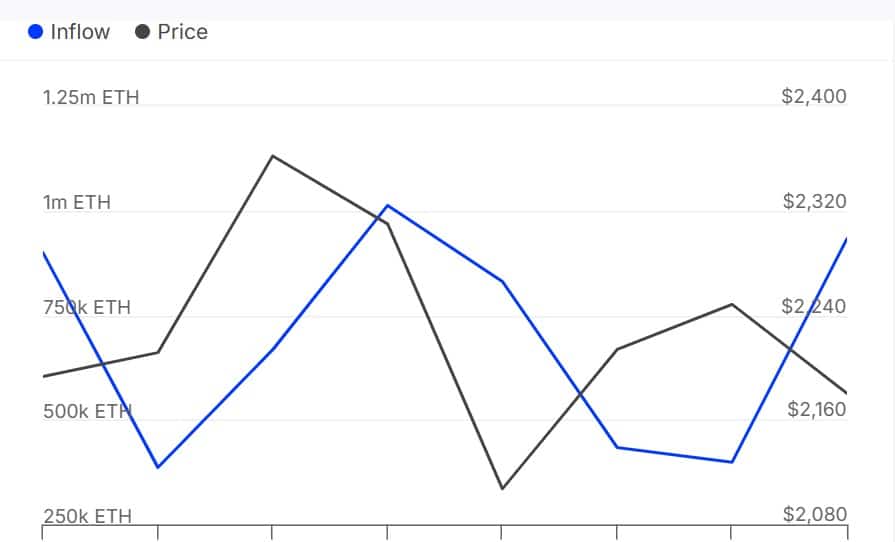

Taking a look at whale exercise, this shopping for exercise is extra prevalent amongst whales. In accordance with IntoTheBlock, Ethereum whales are again out there having amassed over 932.79k ETH tokens over the previous day.

Equally, massive holders’ netflows spiked to 474.89k. This urged that there have been extra capital inflows from whales than outflows. When whales flip to accumulation, it alludes to robust bullish sentiments as they anticipate the worth to rebound. This might make the dip an ideal shopping for alternative.

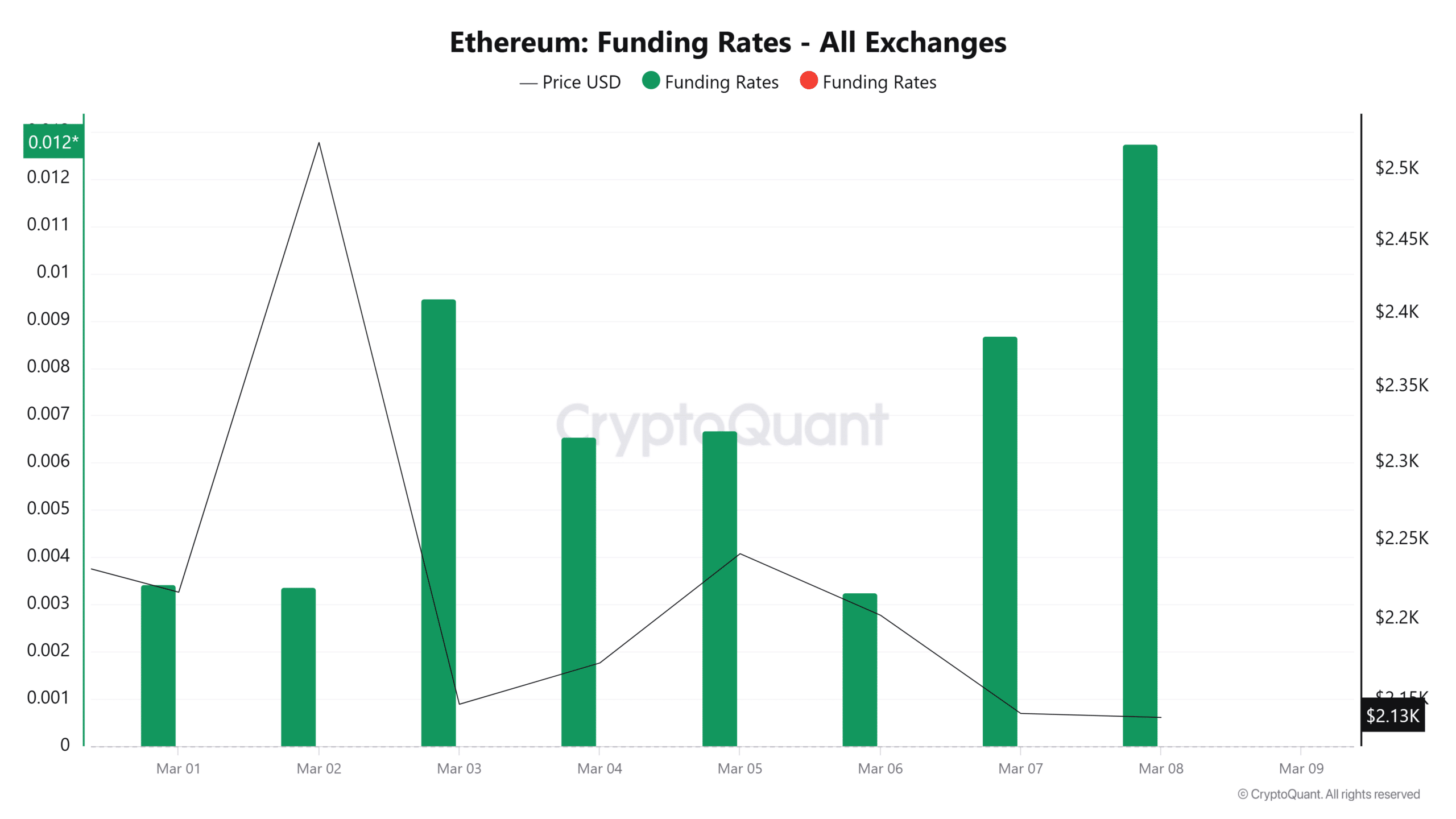

This bullishness might be additional confirmed by the rising funding price, with the identical climbing to a weekly excessive of 0.01.

When the funding price rises, it implies that merchants are paying funding charges to carry their lengthy positions. Since this uptick is backed by elevated accumulation, it supported a possible value rally.

What subsequent for ETH’s value motion?

In conclusion, Ethereum’s consumers have entered the market – Each whales and retailers. With sellers seeming exhausted, ETH could also be well-positioned for restoration. If the demand witnessed over the previous day holds, we might see ETH reclaim $2,325 and try a rally in the direction of $2.7k.

Nevertheless, if the transfer by bulls fails, we might see the altcoin proceed buying and selling between $2,114 and $2,300. To hit the degrees predicted by Martinez, it has to first reclaim $2.7k and $3k – Unlikely within the quick time period until macroeconomic information turns favorable.