- ETH traded above the $2,700 worth degree within the final buying and selling session.

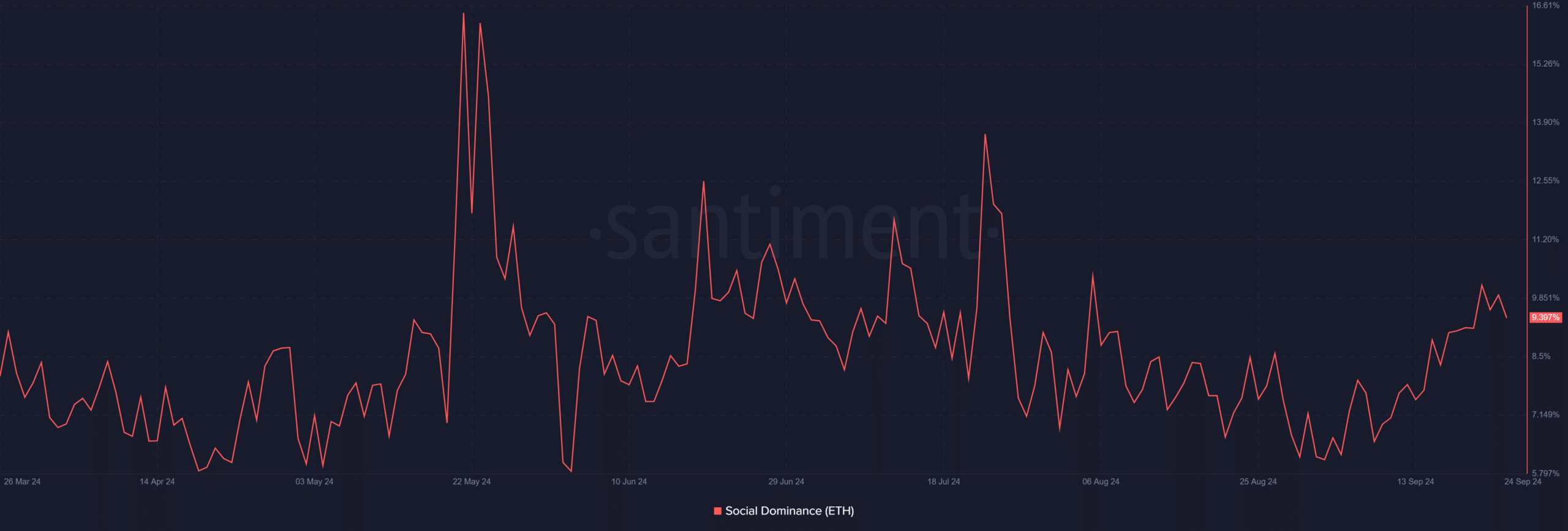

- At press time, the ETH social dominance was near 10%.

Ethereum [ETH] has lately damaged by its short-term resistance after staying beneath its transferring averages for the reason that finish of July, a interval throughout which it witnessed a demise cross. The second-largest cryptocurrency has additionally seen an uptick in market chatter over the previous few weeks, together with rising curiosity from by-product merchants.

Ethereum sees elevated social dominance

Evaluation from Santiment reveals that Ethereum’s social dominance has noticeably elevated lately. On twenty first September, social dominance rose to over 10%.

Though it barely dipped to round 9.9% by twenty third September, this marks the primary time in about seven weeks it reached such ranges.

This rise signifies a surge in discussions about Ethereum, reflecting the heightened consideration the asset is receiving. The elevated social dominance correlates with Ethereum’s latest worth actions, suggesting that market sentiment is popping extra bullish.

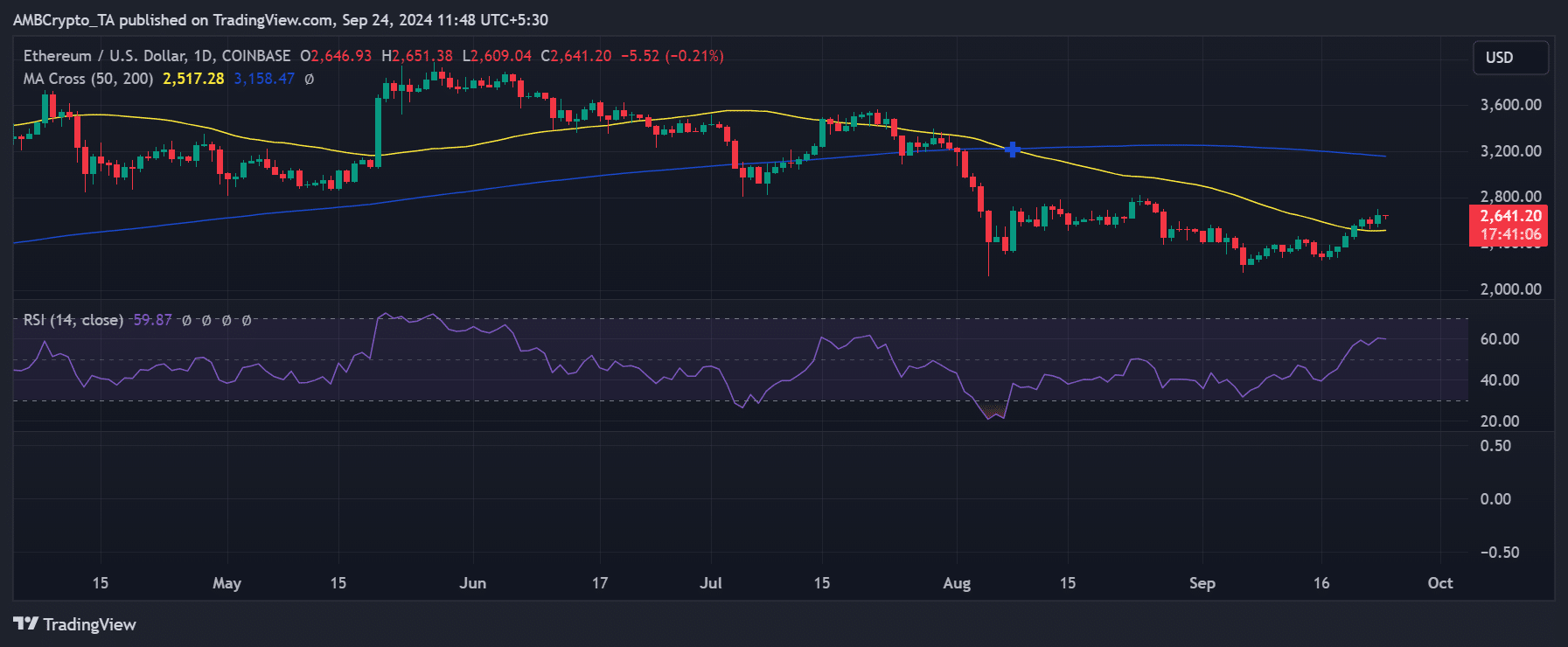

Ethereum worth breaks short-term resistance

Inspecting Ethereum’s worth chart sheds mild on the rising social curiosity. Over the previous seven days, ETH has seen consecutive beneficial properties.

It broke above its short-term transferring common (yellow line) on twentieth September after a 3.90% improve that pushed its worth to round $2,562.

By the top of the final buying and selling session, Ethereum was buying and selling at roughly $2,642 and even surpassed the $2,700 mark at one level. Additionally, the short-term transferring common has now flipped to turn out to be a stronger assist degree.

Additional evaluation signifies that the subsequent vital resistance is on the $2,800 worth degree. If ETH breaks by it, the $3,000 threshold may very well be retested. This worth improve has additionally boosted curiosity from by-product merchants.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

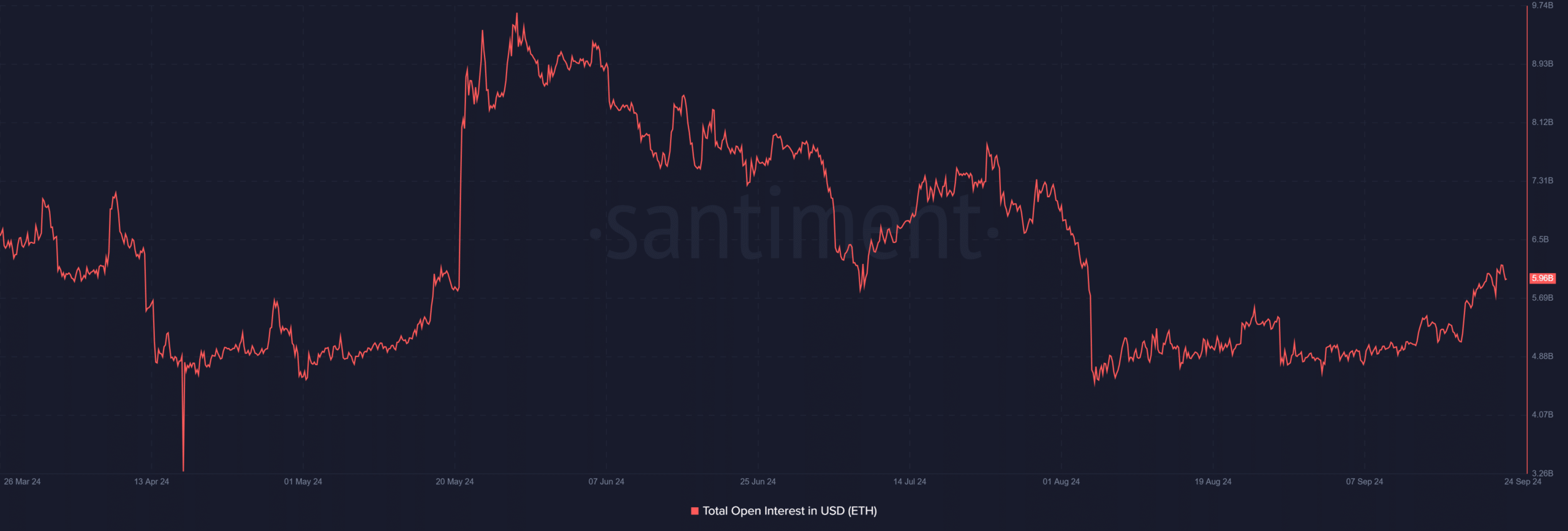

Open curiosity sees elevated quantity

One other key indicator exhibiting constructive momentum is Ethereum’s open curiosity. Current evaluation reveals that open curiosity climbed to over $6 billion on twenty third September, the best in about seven weeks.

The surge in open curiosity suggests an inflow of funds from by-product merchants, seemingly motivated by Ethereum’s latest worth rally. If these constructive indicators proceed, ETH could also be on monitor to retest the $3,000 worth vary shortly.