- Ethereum confirmed robust assist above $2,600, with a attainable rally to $3,200 or $4,000.

- Rising institutional curiosity and energetic community utilization signaled potential upward value motion.

Ethereum [ETH] has proven robust assist above $2,600, signaling that it could proceed on its upward trajectory. At press time, Ethereum is buying and selling at $2,702.21, reflecting a 0.67% enhance over the past 24 hours.

Nonetheless, the true query is whether or not ETH can maintain its momentum lengthy sufficient to interrupt by way of these crucial ranges.

ETH technical evaluation: Will the momentum final?

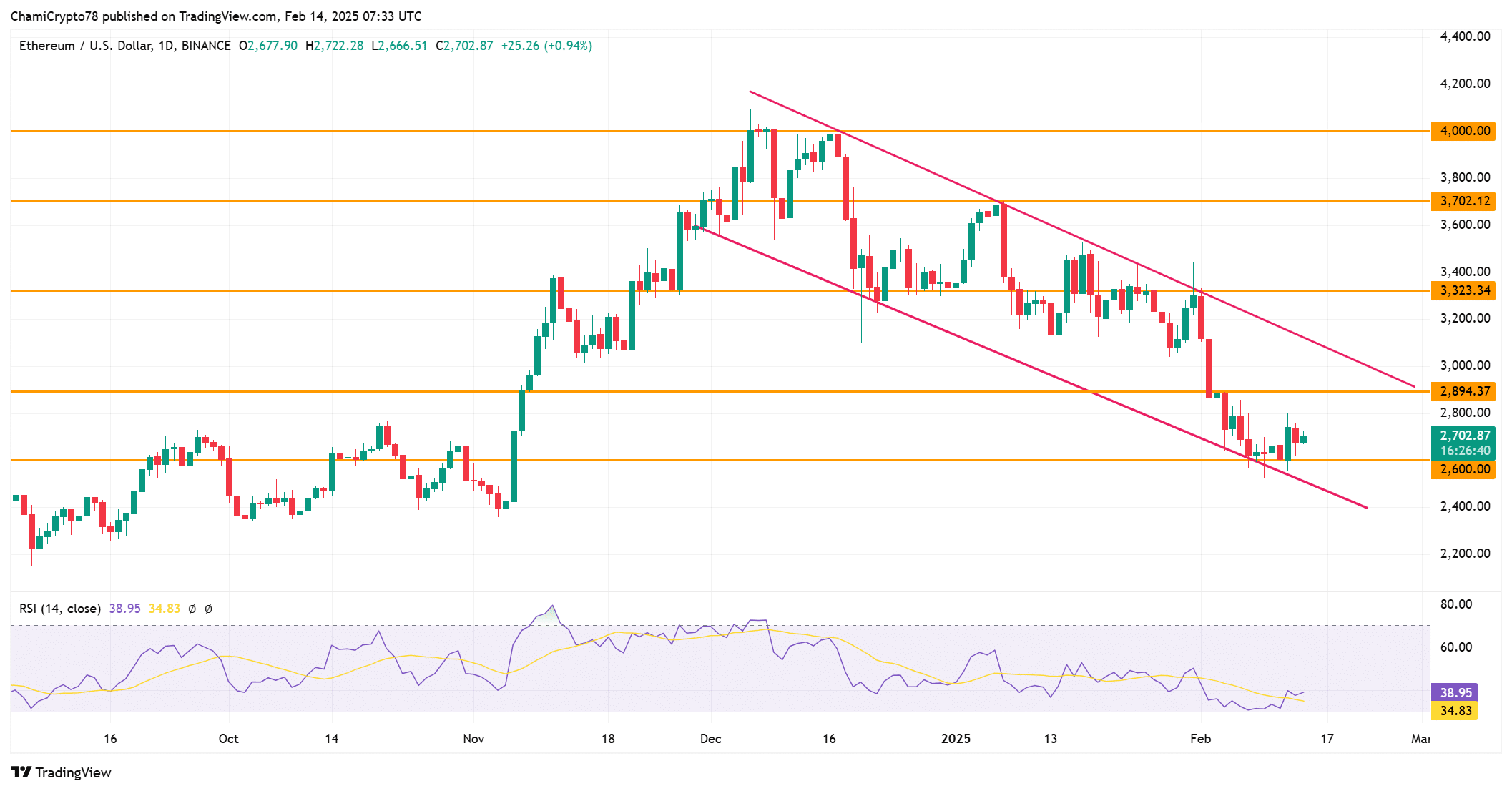

ETH’s current value motion means that it may very well be coming into a bullish section. The chart exhibits Ethereum buying and selling inside a well-defined channel, with important resistance at $2,800, $3,200, and $3,400.

If ETH can break above the $2,800 resistance, it may pave the best way for a rally towards $3,200 or $4,000. On the time of writing, the RSI was at 38.95, indicating that there’s nonetheless room for additional upside potential.

Nonetheless, Ethereum might want to overcome the challenges posed by the downward-sloping channel and keep above key assist ranges to keep up its bullish development.

Institutional curiosity is booming: How will it have an effect on the value?

Ethereum is seeing growing institutional curiosity, significantly with 21Shares’ filing for an Ethereum staking ETF. This transfer represents a possible enhance in demand for Ethereum, as institutional traders could flock to stake their ETH by way of the ETF.

A profitable approval may additional solidify Ethereum’s position within the institutional market and elevate its value.

On condition that Ethereum’s provide may turn into extra constrained on account of staking, it would see additional upward stress as demand rises.

ETH every day energetic addresses: What do they inform us?

Ethereum’s community utilization stays strong, with every day energetic addresses exceeding 524,000. This means a wholesome degree of engagement and rising adoption, each of that are essential for long-term value appreciation.

Robust community exercise indicators elevated belief in Ethereum’s decentralized functions, which might result in greater demand for ETH.

Subsequently, the constant rise in energetic customers may very well be an vital consider Ethereum’s value potential.

ETH change reserves: What does it sign concerning the market?

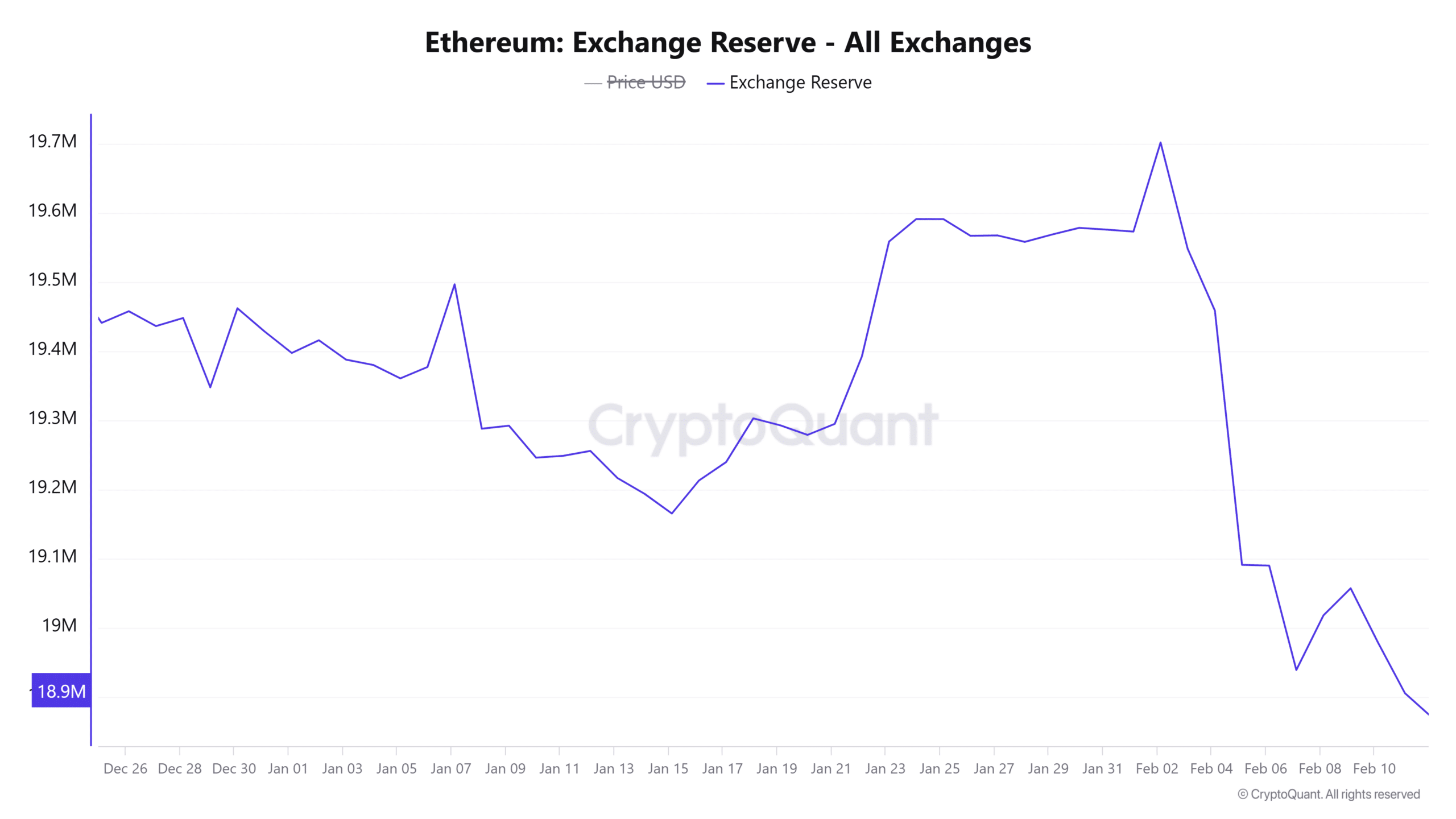

Ethereum’s Trade Reserves, at the moment at 18.8841 million ETH, have elevated barely by 0.02%. Rising Trade Reserves often point out greater promoting stress as merchants deposit extra ETH to exchanges for potential promoting.

Basically, a rise in reserves can sign market volatility and a better probability of value swings.

Whereas a rising reserve may counsel extra liquidity, it additionally highlights the potential for elevated market volatility that would influence short-term value actions.

Bulls and bears: Which facet has the benefit?

Presently, the market sentiment for Ethereum is essentially bullish, with 114 bulls in comparison with 105 bears. This means that traders are usually optimistic about ETH’s near-term prospects.

Nonetheless, if the value falters and experiences a pointy pullback, bearish sentiment may rise.

Subsequently, Ethereum wants to keep up its upward momentum to maintain the bulls in management and push towards greater ranges.

Given Ethereum’s robust assist at $2,600, rising institutional curiosity, energetic community utilization, and growing change reserves, it’s prone to preserve its bullish momentum.

If Ethereum continues to carry above key assist ranges, it has a robust likelihood of reaching $3,200 and even $4,000.

Subsequently, Ethereum’s value has a excessive probability of breaking these key resistance factors quickly.