The chart displays a traditional divergence: whales are shopping for the dip whereas retail hesitates.

This habits typically precedes directional shifts in market momentum — both a breakout backed by institutional help or extended compression if retail stays sidelined.

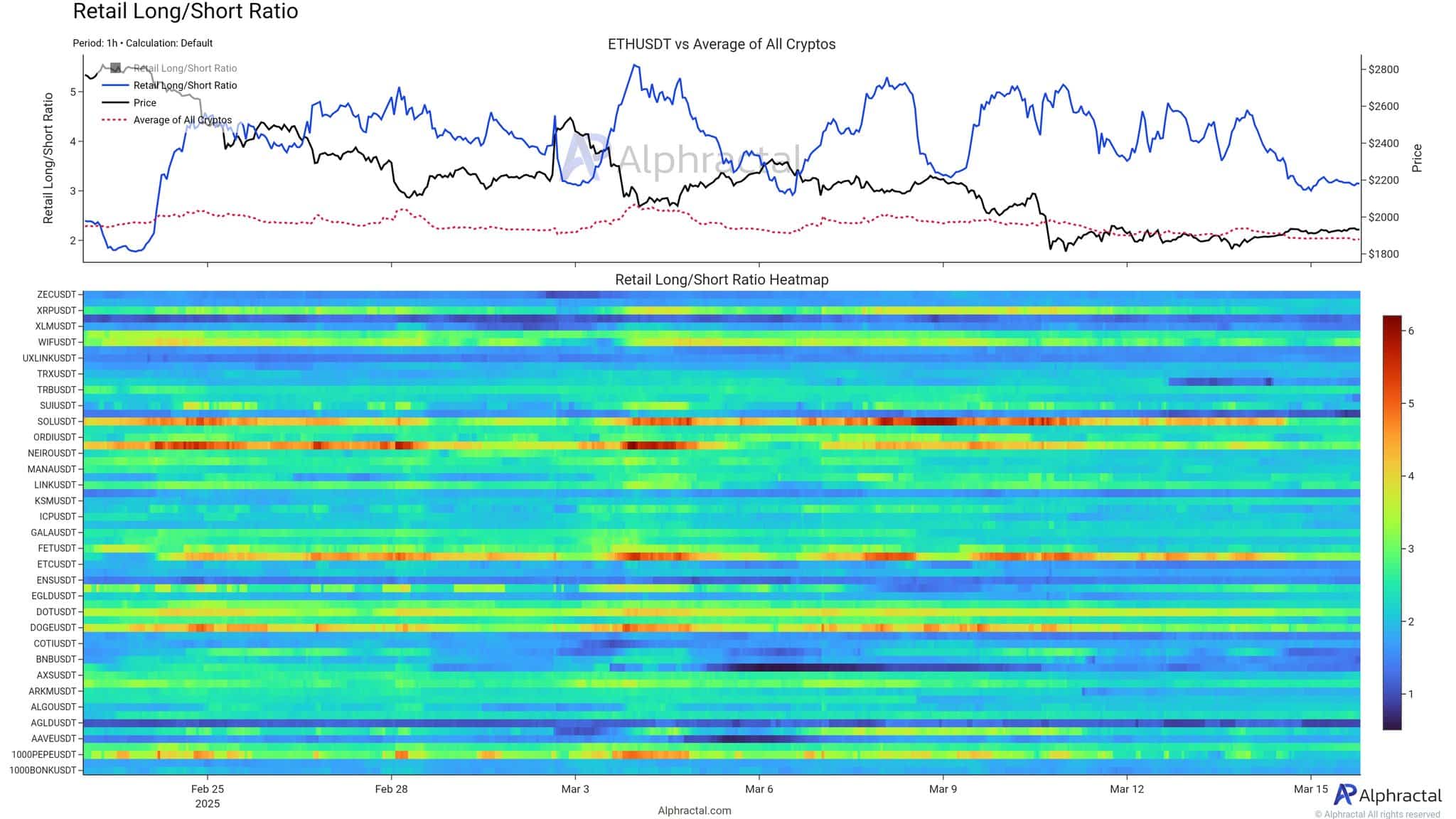

Retail deleveraging and the narrowing lengthy/quick ratio

Retail merchants, as soon as confidently positioned for upside, are retreating.

The retail lengthy/quick ratio for ETHUSDT – which reached highs above 5.5 in early March — has steadily declined to round 3, pointing to clear deleveraging.

As volatility pale, so did retail enthusiasm. The ratio’s decline towards 3 means that a good portion of retail merchants are closing positions or adopting a extra impartial stance.

In comparison with late February — when the ratio hovered round 2.5 and climbed with worth momentum — this current pullback indicators fading conviction amongst smaller holders.

Whereas this reset could also be wholesome, unwinding overly aggressive longs, it additionally highlights the dearth of recent demand from retail individuals.

Market neutrality and dealer fatigue

Taken collectively, these tendencies paint an image of broad market neutrality. Whales are shopping for — however cautiously. Retail isn’t bearish — simply disengaged.

For a lot of merchants, particularly in perpetual futures markets, this low-action atmosphere is irritating. Situations are neither bullish sufficient to justify aggressive longs nor bearish sufficient to warrant significant shorts.

ETH’s worth has mirrored the broader decline throughout crypto belongings (as seen in each charts’ pink dotted traces), reinforcing the view that this isn’t an Ethereum-specific lull; it’s a part of a wider market cool-down.

Nonetheless, such neutrality typically precedes volatility growth. The market is coiling; the one uncertainty is the route.

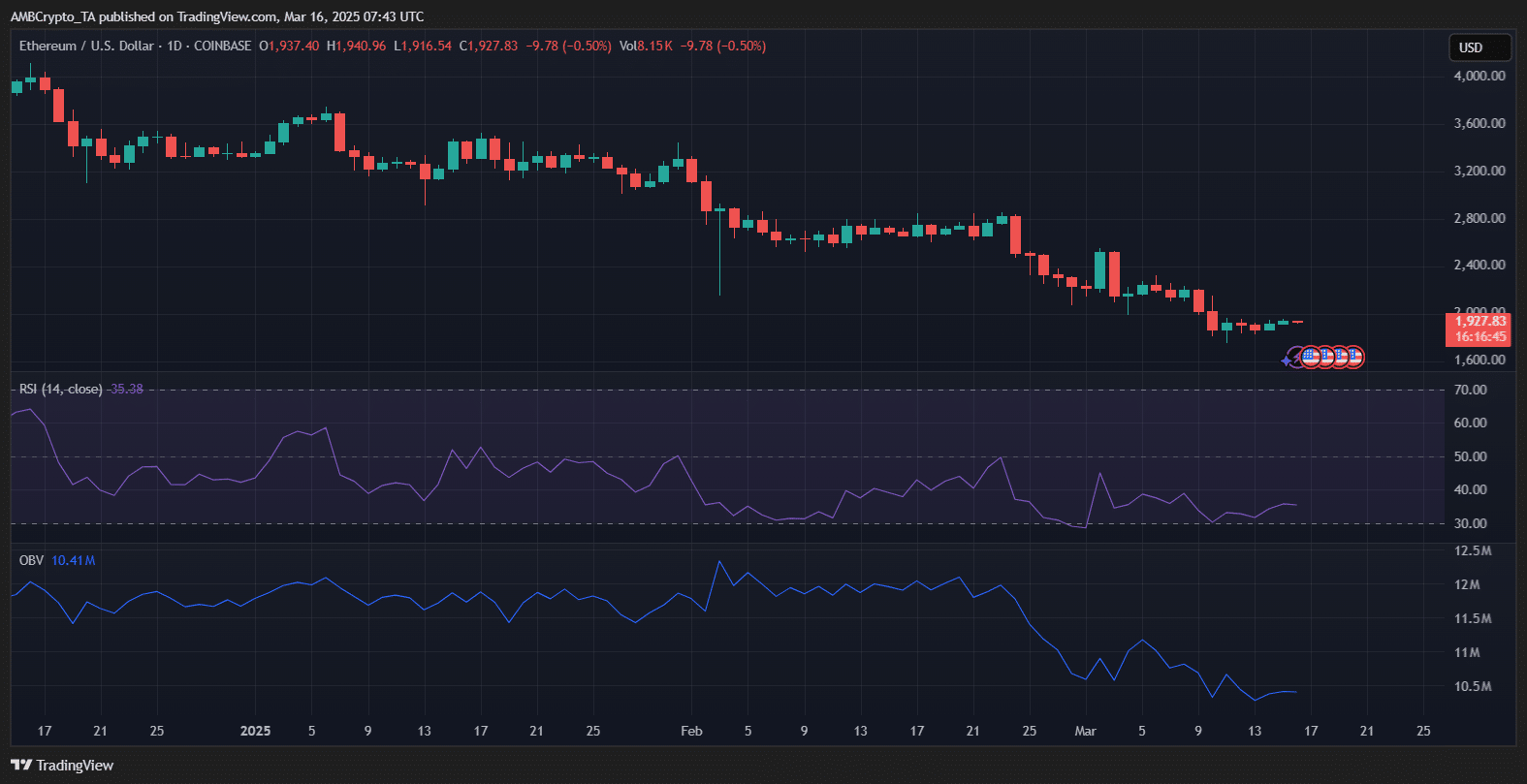

Ethereum worth outlook

Ethereum is displaying indicators of stagnation just under $2,000. The RSI hovers at 35, preserving ETH in bearish territory with out being deeply oversold — suggesting restricted upside momentum within the quick time period.

In the meantime, the OBV continues its downward pattern, signaling weak shopping for stress regardless of current worth consolidation.

The declining quantity and muted RSI trace at a continued sideways grind or a minor pullback until shopping for exercise picks up. For now, Ethereum lacks the technical energy for a breakout.

With out a clear catalyst, ETH is more likely to stay range-bound between $1,850 and $2,000.