- Ethereum’s netflow neutrality hinted at accumulation, with potential volatility forward.

- Energetic addresses and Open Curiosity surged, signaling rising retail curiosity.

Ethereum [ETH], buying and selling at $3,135 at press time, gained merely 0.6% over the previous 24 hours.

This modest uptick is available in distinction to Bitcoin’s [BTC] spectacular efficiency, because the king coin hit a brand new all-time excessive of $97,836 after a 4.9% day by day enhance.

Bitcoin’s rally has pushed the broader crypto market larger, however Ethereum has lagged behind, with a 2% decline in its weekly efficiency.

Regardless of Ethereum’s comparatively subdued value motion, market dynamics counsel that ETH is perhaps gearing up for vital motion.

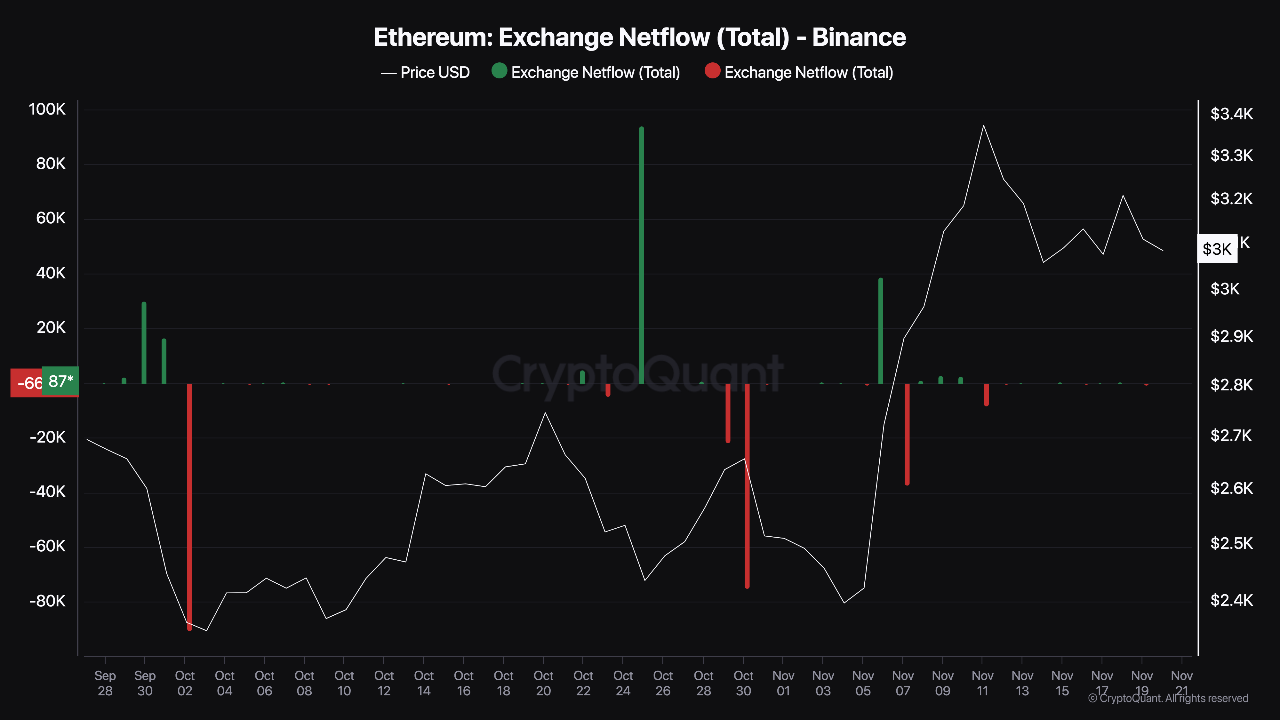

A CryptoQuant analyst often known as Darkfost highlighted an intriguing pattern in Ethereum’s netflow on Binance, which has just lately turned impartial.

What this implies for Ethereum

Ethereum’s netflow on Binance confirmed a stability between deposits and withdrawals on the alternate.

Based on Darkfost, the impartial netflow suggested that Ethereum was in an accumulation part, with buyers neither displaying robust shopping for nor promoting strain.

The impartial netflow might level to a possible buildup of momentum in Ethereum’s market.

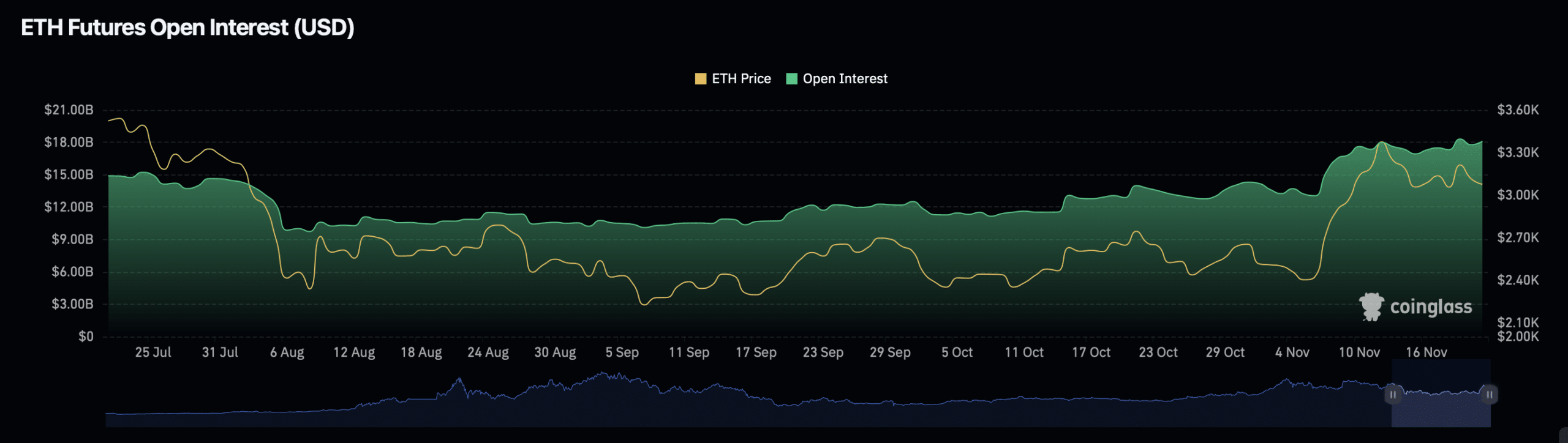

Darkfost elaborated that rising Open Curiosity in Ethereum Futures, which was nearing an all-time excessive on Binance at press time, might sign an impending value motion.

Open Curiosity measures the whole variety of excellent spinoff contracts, and its enhance typically precedes heightened market exercise.

This stability of netflows and rising Open Curiosity could symbolize what the analyst describes as “the calm earlier than the storm,” with the potential for ETH to expertise a major value shift in both route.

Rising Open Curiosity and Energetic Deal with development

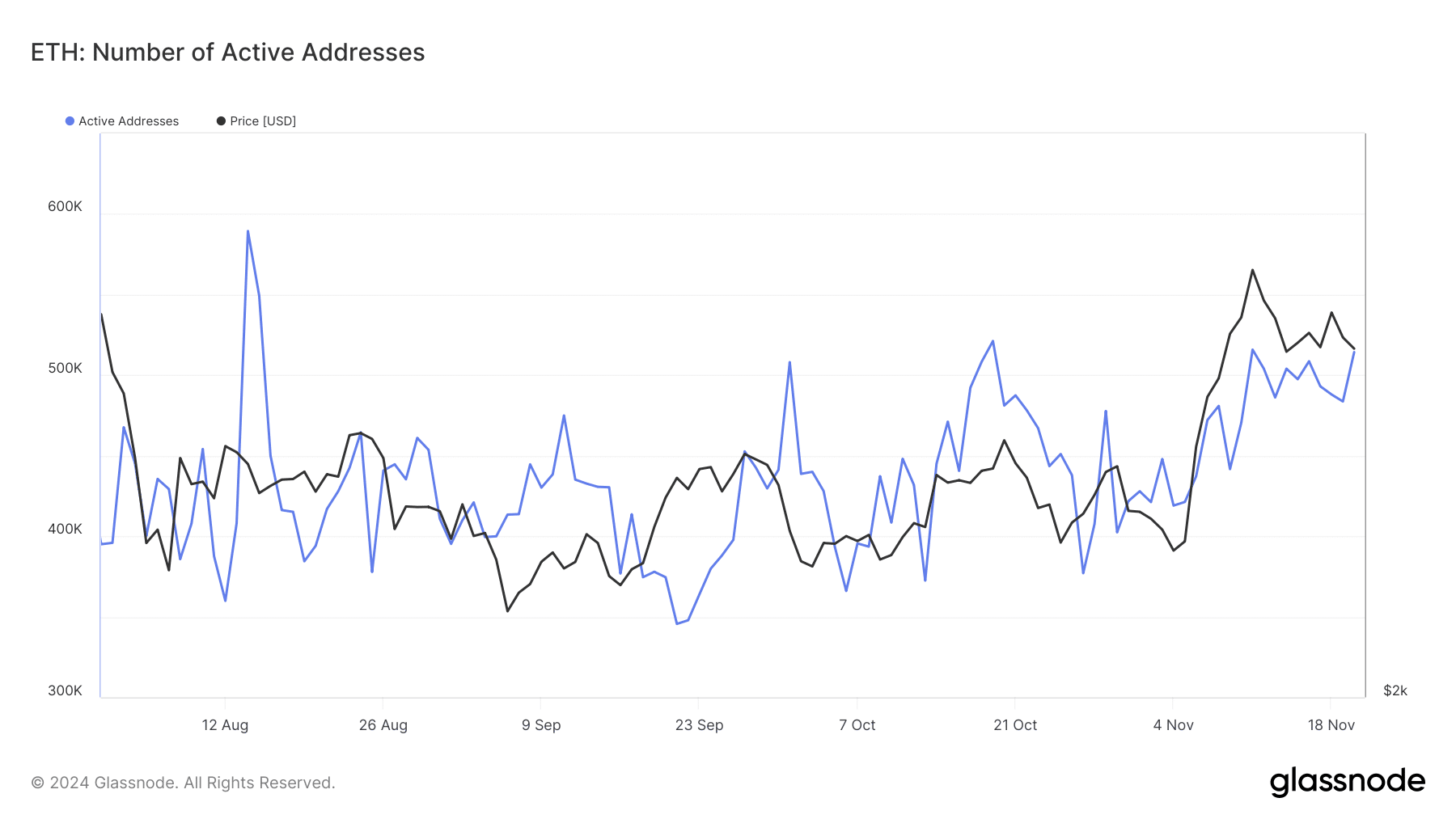

Ethereum’s fundamentals additionally confirmed optimistic indicators of market engagement. Data from Glassnode revealed that ETH’s lively addresses, a measure of retail participation, have been steadily growing.

After dipping beneath 500,000 earlier this month, the variety of lively addresses has risen to 514,000 as of the twentieth of November.

This development in lively addresses prompt renewed curiosity from retail buyers, which might assist ETH’s value within the close to time period.

Elevated exercise typically correlates with larger buying and selling volumes and larger value volatility, hinting at the opportunity of upward momentum.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Moreover, Ethereum’s Open Interest within the Futures markets has surged by 3.86%, reaching $18.56 billion. This rise is accompanied by a considerable 40.41% enhance in Open Curiosity quantity, at $42.88 billion at press time.

These figures indicated rising engagement in Ethereum’s derivatives markets, highlighting investor curiosity in each short-term and long-term alternatives.