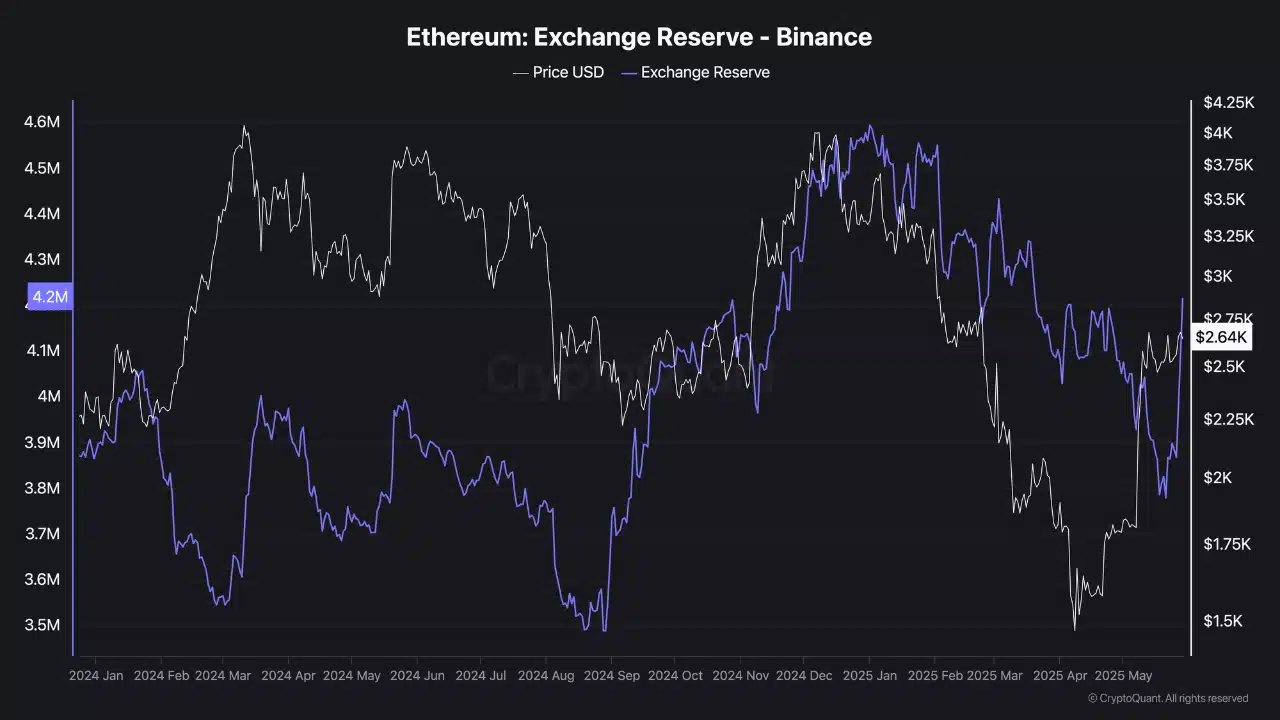

- Ethereum’s Trade Reserves on Binance climbed sharply, hinting at rising sell-side stress.

- ETH faces dense liquidation resistance between $2,700 and $2,830, capping upward momentum.

Ethereum [ETH] remained locked in a slender vary between $2,400 and $2,700, however Binance on-chain knowledge revealed a mounting threat beneath the floor.

Infact, Binance Trade Reserves spiked to ranges final seen earlier than earlier sell-offs, pointing to an increase in tokens being moved to exchanges—usually an indication of mounting promote stress.

This was compounded by regular outflows, at the same time as the worth briefly held above $2,600. As of writing, ETH traded at $2,623.84 after a 3.60% every day drop.

Why do destructive netflows persist regardless of sideways value motion?

Ethereum’s Netflows remained firmly destructive, with -248.83K ETH recorded over the past seven days and -60.9K ETH over 30 days.

Whereas this usually suggests accumulation or investor withdrawal to chilly storage, the flat value motion implies these withdrawals comply with heavy prior promote exercise.

The 24-hour Netflow additionally confirmed a smaller decline of -4K ETH, reinforcing that capital outflows are regular, not accelerating.

Due to this fact, though the worth holds above $2,600, this development exposes underlying hesitation. With out renewed inflows or purchaser confidence, the worth might fail to maintain present ranges.

Dealer warning and liquidation boundaries weigh closely

Over the previous 24 hours, Open Curiosity dropped sharply by 8.99% to $18.14 billion, as merchants backed away from either side of the market.

Decrease OI usually indicators a scarcity of conviction, and with out aggressive positioning, volatility tends to compress earlier than a breakout or breakdown.

Nevertheless, what’s extra regarding is Binance’s ETH/USDT Liquidation Heatmap, which reveals dense liquidation partitions stacked between $2,700 and $2,830.

These clusters have repeatedly triggered promoting stress, creating resistance zones that take up bullish momentum. Every failed try and breach this area has led to sharp reversals, as seen on the 24-hour chart.

Until ETH surges with substantial quantity to clear these boundaries, bulls might stay trapped beneath them. These liquidation zones act as a ceiling till market conviction shifts strongly in favor of patrons.

Ethereum’s sideways motion conceals deeper market weak point.

Declining OI, destructive Netflows, and powerful liquidation zones recommend that promote stress is capping positive aspects.

If bulls can not reclaim $2,700 convincingly, the $2,480 help might come below stress subsequent. For now, warning stays warranted as ETH navigates a decent vary with restricted momentum.