The creators of the crypto analytics agency Glassnode are warning that altcoins might lose all bullish momentum following final week’s market correction.

Jan Happel and Yann Allemann, who go by the deal with Negentropic on the social media platform X, inform their 63,400 followers that “altcoin season,” which they are saying started in late November, might come to an abrupt finish after alts witnessed deep pullbacks over the past seven days.

In line with the Glassnode co-founders, merchants and traders will doubtless have a risk-off strategy on altcoins except Bitcoin recovers a key psychological value level.

“Is This the Finish of Altcoin Season?

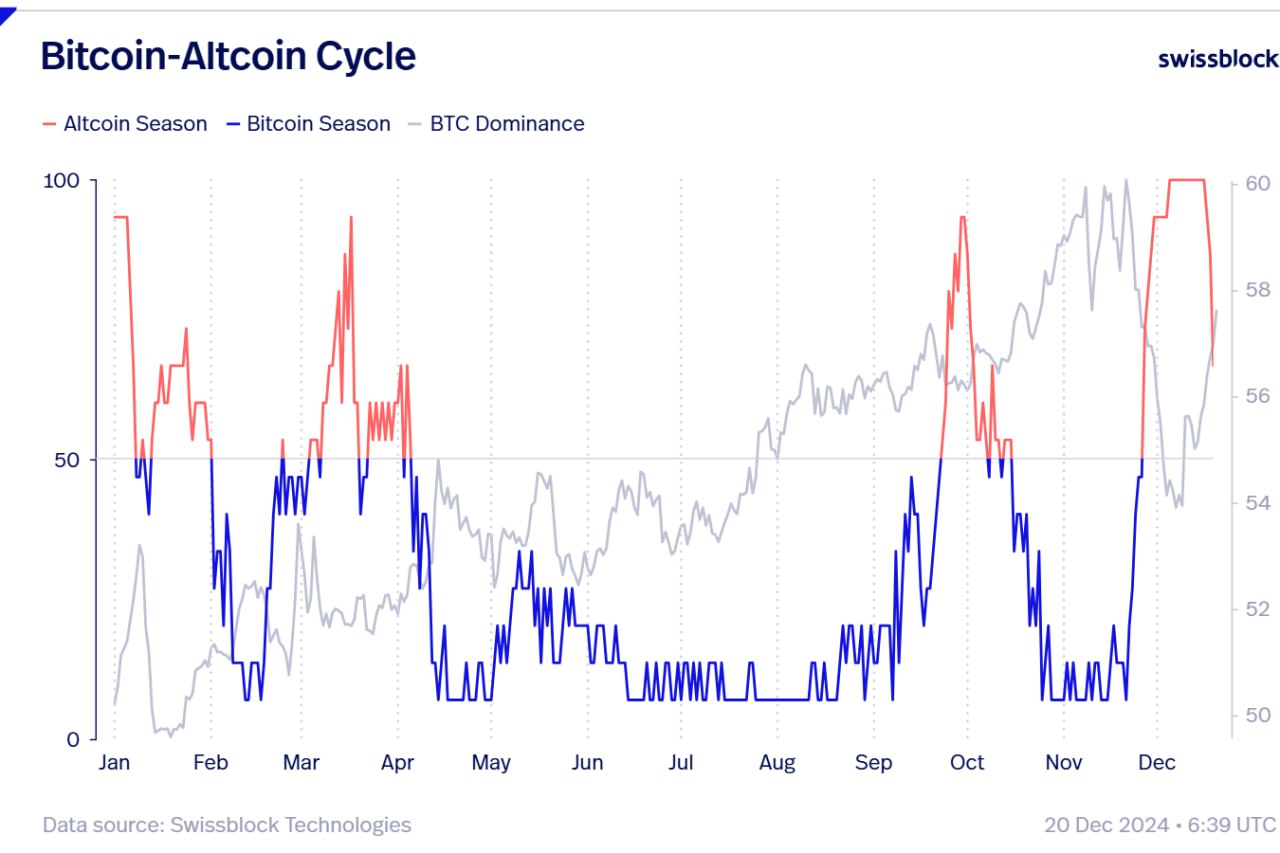

Bitcoin dominance is surging after dipping under $100,000, whereas altcoins are shedding essential helps. Dominance has risen and resumed its upward pattern, signaling a stronger BTC surroundings.

If BTC stabilizes above $100,00, we’d see a pump in altcoins now in accumulation zones. Till then, Bitcoin seems poised to guide, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how a lot of the overall crypto market cap belongs to BTC. Within the present state of the market, a surging BTC.D means that altcoins are shedding worth sooner than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

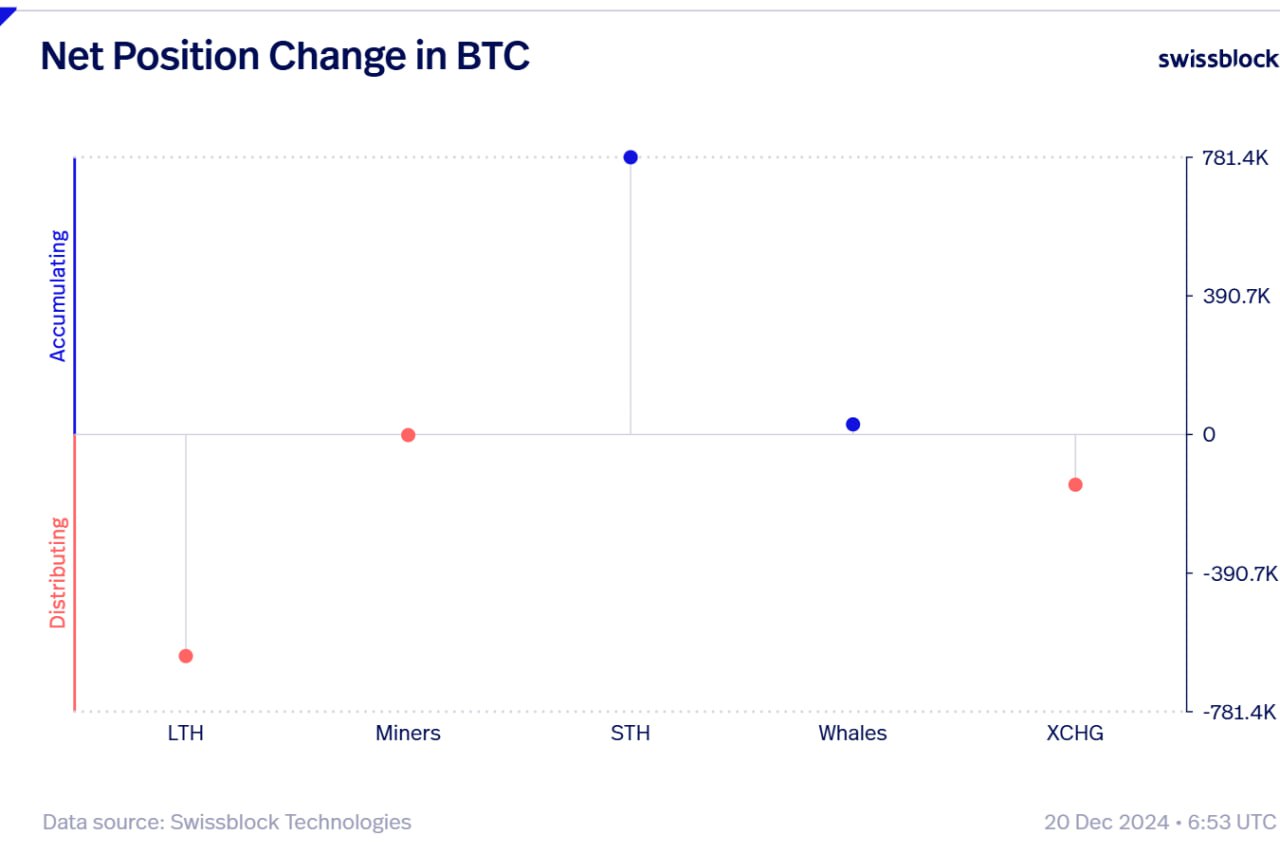

Taking a look at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as different investor cohorts choose up the slack.

“The Board Retains Shifting.

As BTC continues flowing out of exchanges throughout this dip, long-term holders are exiting forcefully, whereas short-term holders step in with out hesitation.

Whales quietly accumulate, miners stay impartial, and promoting strain has merely reshuffled the board.

New fingers are absorbing the gross sales.”

At time of writing, Bitcoin is price $97,246.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Price Action

Comply with us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in online marketing.

Generated Picture: DALLE3