Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

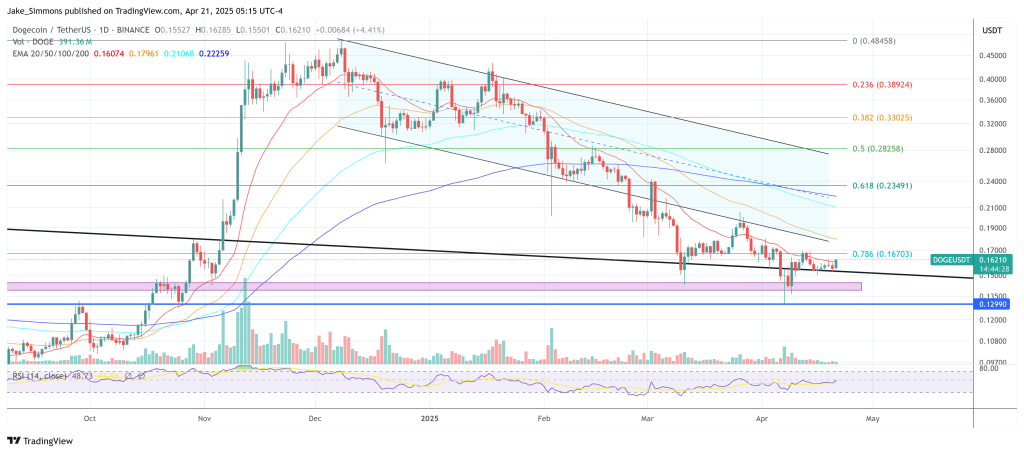

Dogecoin’s chart has changed into what impartial market analyst Kevin calls “actually doing nothing” for nearly a month and a half. In a broadcast on X, the veteran technician recounted that the memecoin’s final decisive transfer was a pointy promote‑off greater than six weeks in the past; since then value has compressed right into a slender band, threatening to lose the structural help it reclaimed on the finish of March.

Dogecoin Momentum Nonetheless Weak

Kevin has been monitoring the identical horizontal ranges for “weeks.” The higher certain of the vary is the submit‑bear‑market breakout retest round $0.156, whereas the important thing Fibonacci retracement “macro 0.382” sits decrease at $0.138 — a zone he has repeatedly described as his “line within the sand.” Solely a weekly candle shut beneath that stage would persuade him that the rally that started in late 2023 has totally damaged down. “If Dogecoin breaks $0.138 on weekly closes, then it’s most likely over,” he cautioned.

Momentum indicators are failing to offer early affirmation both method. Commenting on the a lot‑watched 3-day MACD, Kevin pushed again in opposition to social‑media claims {that a} bullish cross is already in play. “Individuals don’t know learn how to learn this indicator correctly,” he mentioned. “Technically, sure, by definition it’s a cross, nevertheless it’s actually not a cross […] It’s a must to have growth of the shifting averages in an effort to have a confirmed cross.” With out that growth, he warned, the fledgling uptick within the histogram may “simply simply roll proper over.”

With spot value inertia now stretching to 42 days, threat‑reward has compressed as nicely. Kevin frames the choice tree in stark phrases: maintain the $0.156–$0.138 congestion and Dogecoin retains its constructive medium‑time period construction; lose it and merchants should look all the way down to the psychological $0.10 shelf. Even there, he sees solely the potential for a counter‑development bounce towards $0.25–0.26.

Associated Studying

The broader-market backdrop presents little instant aid. Utilizing Bitcoin as a number one indicator, Kevin reminds viewers that your complete advanced stays in what he calls a “main correctional section,” triggered when the three‑day MACD crossed down in January 2025. Historic research of Bitcoin’s macro pullbacks suggests they persist “wherever from 114 to 174 days,” he famous.

“They function the identical method it doesn’t matter what the financial circumstances are. They final wherever from 114 to 174 [days]. Each single time whether or not it’s a bear market [or] bull market. Dangerous information, excellent news doesn’t matter. They all the time final the identical period of time. 174 days being the longest in historical past, 114 days being the typical of each right main correctional interval in historical past,” Kevin defined.

Associated Studying

Ought to Bitcoin fail to defend $70,000, he argues, odds of a recent all‑time excessive within the quick run can be fairly low. “If Bitcoin breaks $70,000 and goes into the $60,000’s, we’re gonna get an enormous bounce out of there. You get an enormous countertrend rally. All the things will look rosy once more, however the likelihood is that it makes a brand new excessive very slim. Identical goes for Dogecoin. If dogecoin comes all the way down to this $0.10 stage and it will get a bounce, perhaps it comes like a giant counter development rally again as much as like $0.25 or $0.26 after which it simply rolls over and that’s the top,” Kevin acknowledged.

For Dogecoin, due to this fact, the following decisive signal is more likely to be a tough break of the $0.156–$0.138 hall or a confirmed momentum resurgence on the upper‑time‑body MACD — whichever comes first. Till then, the asset stays trapped in Kevin’s phrases: “We’ve finished nothing… there’s not a lot to speak about.”

At press time, DOGE traded at $0.1621.

Featured picture created with DALL.E, chart from TradingView.com