Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Kevin (@Kev_Capital_TA) has shared a chart that overlays the World Liquidity Index (yellow, plotted above) on prime of Dogecoin’s worth motion (candlesticks in purple, plotted beneath). The visible comparability highlights quite a lot of parallel channels and key pattern strains which have beforehand aligned with turning factors in Dogecoin’s trajectory.

Explosive Dogecoin Setup Amid Liquidity Shift

Whereas the World Liquidity Index has traded inside a downward sloping channel – its decrease boundary repeatedly capturing native lows marked by orange circles – the worth of Dogecoin itself has damaged out and retested a long-term sloping pattern line that stretches again to its explosive worth run in early 2021.

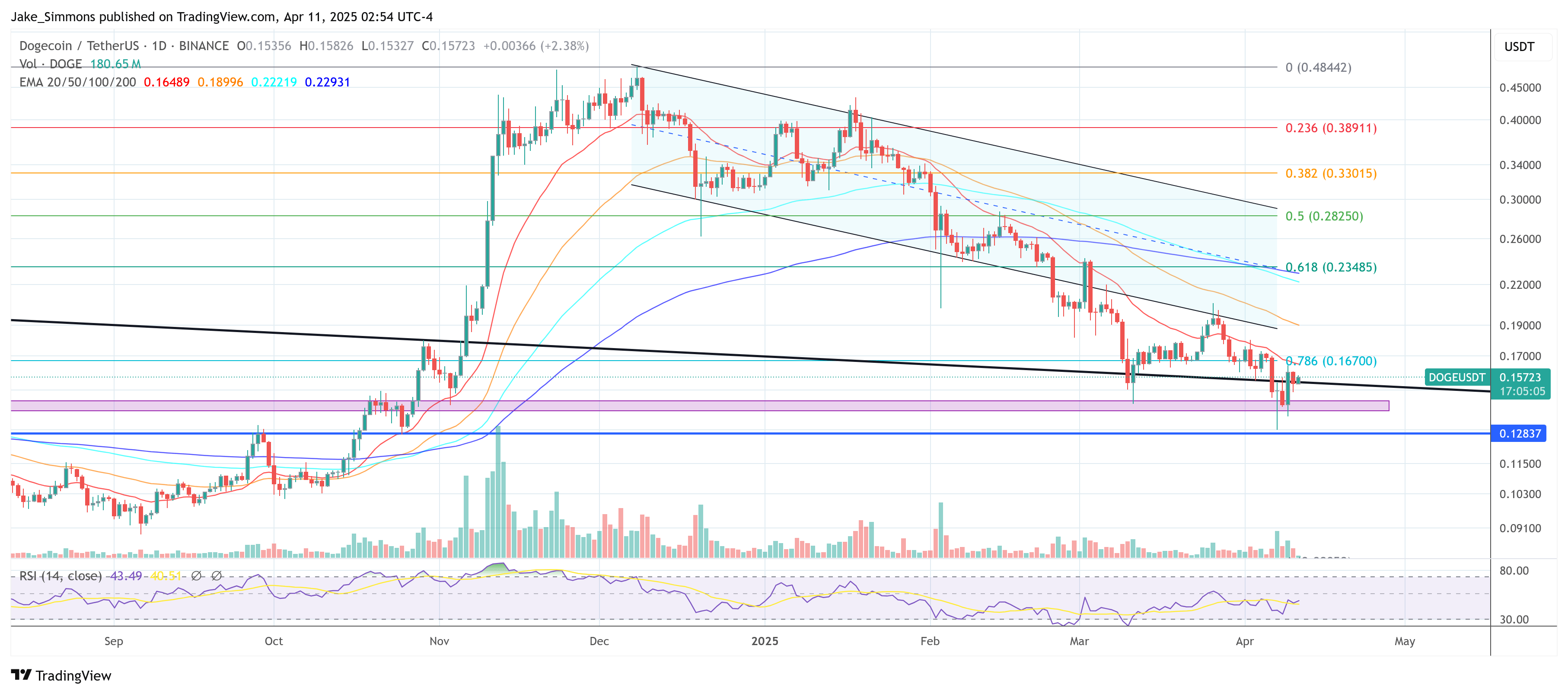

The chart exhibits Dogecoin’s dramatic rise from lower than a cent in 2020 to its all-time excessive of round $0.74 in 2021, earlier than retreating to what seems to be vital assist round $0.15. The analyst’s Fib retracement overlay exhibits the 0.382 stage at round $0.14225, an space of technical significance that has attracted renewed consideration. The present worth motion is depicted as settling round a zone the place the multi-year descending trend line (yellow) retest meets the 0.382 Fib stage, circled on the chart as a possible turning level.

Associated Studying

In the meantime, the World Liquidity Index on the prime of the picture has shifted inside a downward worth channel of its personal, suggesting a broader contraction in obtainable market liquidity over the previous yr. As will be seen, every contact with the decrease boundary of the channel has coincided with a notable turning level in Dogecoin’s worth motion.

The repeated round markers emphasize moments the place the liquidity curve dipped and Dogecoin subsequently carved out native or macro bottoms. This synchronization, argues Kevin, ought to immediate merchants to concentrate as a result of it might herald a rebound if liquidity inflows stabilize or start to rise once more.

Associated Studying

Why does the World Liquidity Index matter for Dogecoin? Normally, high liquidity levels can sign larger capital flowing into risk-on belongings, particularly memecoins like DOGE. When the World Liquidity Index traits decrease, it usually displays tighter monetary situations worldwide.

Traditionally, Dogecoin’s most explosive strikes—such because the meteoric rally of 2021—emerged when broader liquidity was on the rise, fostering an setting that helped speed up buying and selling volumes throughout the crypto panorama.

Kevin’s chart provides no ensures, however it does underscore an space the place Dogecoin’s historic assist strains, fib retracement ranges, and a bottoming world liquidity channel all converge. Whether or not this confluence will function a catalyst for the subsequent Dogecoin rally stays to be seen, however the chart makes a compelling case to watch how the World Liquidity Index evolves—and what it would imply for the ever-popular meme-inspired cryptocurrency.

At press time, DOGE traded at $0.15723.

Featured picture created with DALL.E, chart from TradingView.com