- ETH dangers additional correction as Futures quantity bubble sign an overheated state.

- Ethereum fundamentals counsel that the altcoin is extremely undervalued.

Since rallying to hit $2.7k per week in the past, Ethereum [ETH] has struggled to keep up its uptrend. After reaching these ranges, the altcoin retraced, hitting a low of $2.3k.

Over the previous three days, ETH has remained caught between $2.5 and $2.3k.

The failure to interrupt out of this vary has left strategists speculating over Ethereum’s future trajectory.

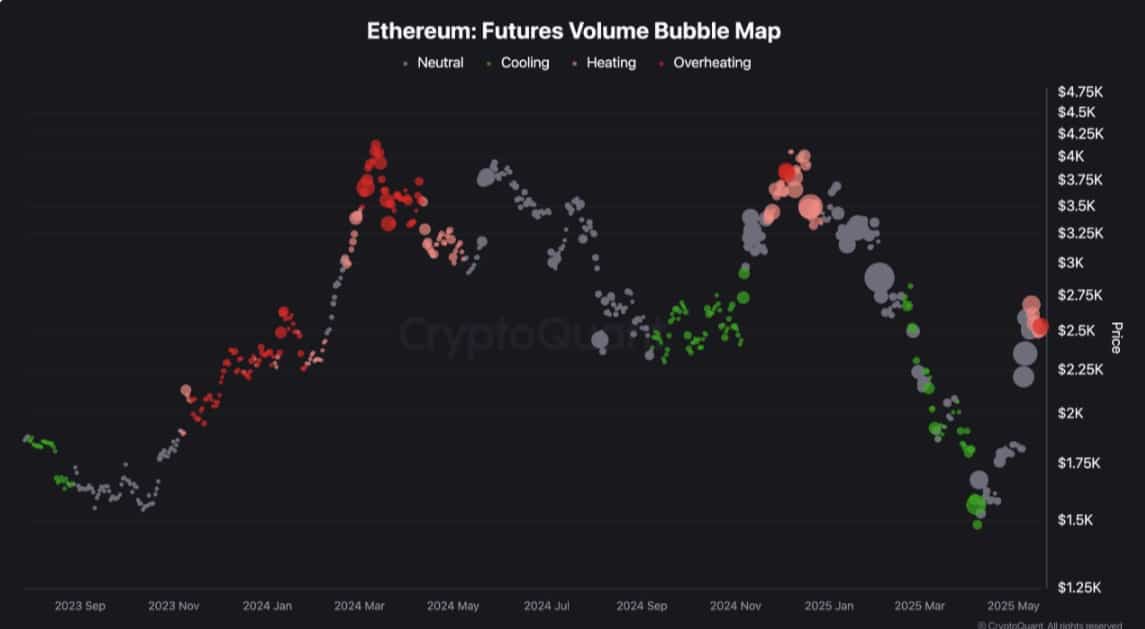

In keeping with CryptoQuant analyst Shayan, the Ethereum market has been overheating close to $2.5k, signaling a possible short-term correction.

In his evaluation, Shayan noticed that Ethereum’s method to the crucial $2.5K resistance stage has led to an overheating state, characterised by a big surge in buying and selling quantity.

The rise in buying and selling quantity is generally pushed by profit-taking exercise and the presence of resting provide at this important zone.

Such circumstances sign a possible market correction, though within the brief time period, because the market cools down. A calm down is paving and constructing a basis for renewed accumulation.

This renewed accumulation is evidenced by a sustained interval of detrimental trade netflow. As such, Ethereum’s trade netflow has remained inside detrimental territory for 4 consecutive days.

This conduct on the exchanges displays sturdy accumulation, as withdrawals outpace inflows.

Is ETH set for correction?

In keeping with AMBCrypto’s evaluation, though quantity has surged to sign overheated ranges, different metrics present a unique story.

Actually, the altcoin overly undervalued, and the latest pullback is a wholesome retrace.

Quite the opposite, Ethereum is extremely undervalued. Taking a look at Ethereum’s MVRV Z rating, this metric has remained inside detrimental territory for 4 consecutive days.

Over the previous week, ETH’s MVRV Z rating has solely hit a optimistic worth for 2 days.

Traditionally, a detrimental MVRV Z rating for Ethereum has coincided with macro bottoms. As an example, these occurred in December 2018, March 2020 and June to December 2022.

In earlier cycles, the altcoin held inside this territory for a quick interval, providing a purchase alternative.

The identical may be stated after we take a look at Ethereum’s long-term holders and short-term holders’ MVRV distinction. Similar to the MVRV, the altcoin MVRV lengthy/brief distinction has held inside detrimental territory.

Though it has signaled restoration, it’s but to maneuver exterior the detrimental zone.

Over the previous week, Ethereum’s lengthy/brief MVRV distinction has moved from -41% to -31%. With the metric holding inside the detrimental zone, it means that LTH are poorly performing relative to STH.

Thus, short-term holders at the moment are incomes greater than LTH. With long-term holders largely at a loss, they’re unlikely to promote. The present market circumstances usually are not incentivizing LTHs to shut their positions.

With out large offloading from LTH, the market correction predicted above is unlikely.

What subsequent?

Merely put, though quantity has surged, the Ethereum market continues to be not overheated. Quite the opposite, the market is extremely undervalued, with traders taking this chance to build up.

At present circumstances, solely short-term holders are promoting.

Nevertheless, accumulating addresses are absorbing the promoting stress from STH.

Subsequently, Ethereum is predicted to proceed its consolidation part till contemporary demand emerges to drive a breakout above the $1.5k resistance vary within the mid-term.

A breakout from the consolidation will strengthen the altcoin to leap in direction of $1.8k.