- 2024 was a pivotal yr for Bitcoin, with the identical setting the stage to sort out the volatility of 2025

- Stablecoins are rising as the brand new gold, main a monetary revolution because the anti-dollar coalition grows

2024 was a wild journey for cryptos. Inflation skyrocketed, conventional markets obtained rocked by international drama, and extra folks began taking a look at crypto as their monetary “Plan B.”

The so-called “Trump pump” gave Bitcoin an opportunity to show itself as digital gold, and it didn’t disappoint. Now, as we sit up for 2025, the crypto world is holding its breath, questioning what’s subsequent. Hypothesis is excessive, however the stakes are even larger.

Crypto market stays tangled within the financial thread

It’s no coincidence – Bitcoin surged due to a triple-digit YTD development, climbing as excessive as $108k on the charts, earlier than retracing to $98,334 at press time. In reality, it’d simply be closing the yr 4 occasions stronger than gold.

Why? Each fourth yr is famously bullish for Bitcoin, setting off momentum that carries into the years forward, fueled by a mixture of inside and exterior elements. True to type, BTC as soon as once more lived as much as its fame.

Nevertheless, the crypto market stays tightly linked to exterior forces. Investor sentiment remains to be largely formed by macroeconomic traits, which dictate their ‘danger urge for food’– A actuality that grew to become much more obvious because the yr got here to an in depth.

When the FOMC adopted a cautious stance on financial knowledge and hinted at rising volatility, the crypto market took successful. In simply three days, the market cap dropped from an ATH of $3.77 trillion to $3.13 trillion – A steep 17% decline.

In the meantime, the U.S Greenback surged to a three-year excessive. The affect wasn’t confined to Bitcoin alone – Main currencies just like the Japanese Yen additionally struggled, hitting a five-month low on the charts.

Clearly, the Fed’s single announcement triggered ripple results throughout international markets, immediately or not directly influencing crypto demand. A deeper take a look at the metrics, nonetheless, revealed an enormous shift in market conduct.

Bitcoin bucks its standard development

June 2022 noticed a post-pandemic inflation spike of over 9%, with the the Fed elevating rates of interest and pushing Bitcoin into its hardest cycle. On the time, the crypto was caught between $20k and $25k on the charts.

Nevertheless, the response this yr has been totally different.

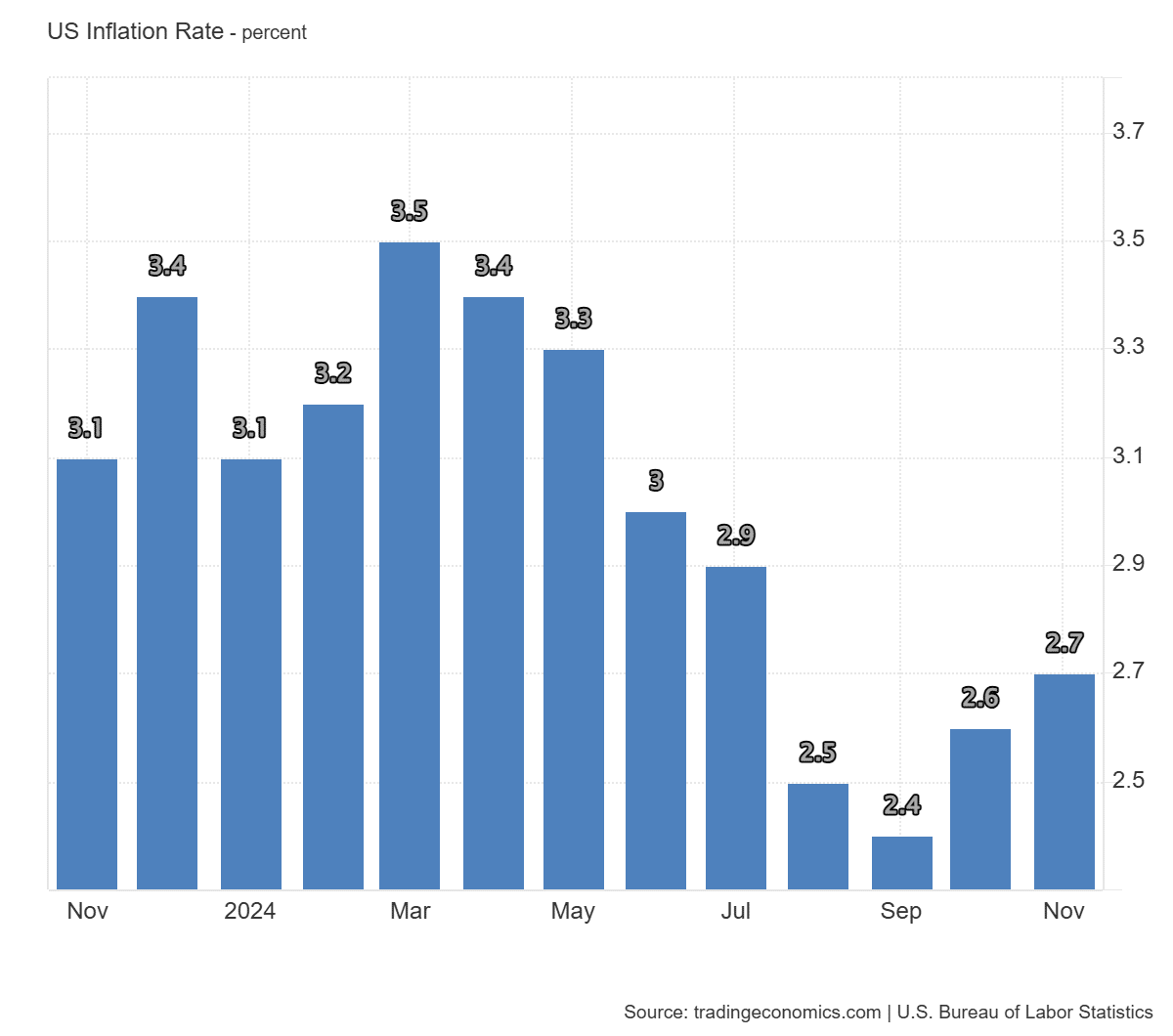

Whilst inflation reached a yearly excessive of three.5% in March, pushed by hovering oil costs, Bitcoin didn’t flinch. As a substitute, it soared, posting a brand new all-time excessive of $73k.

What’s much more spectacular is how Bitcoin has far outpaced conventional belongings. With a YTD development of almost 140%, BTC has left different main indexes like Gold (+27%), the S&P 500 (+33%), and NASDAQ (+33%) within the mud.

In a yr marked by skyrocketing battle provide prices, fractured provide chains, political chaos, and escalating commerce sanctions, Bitcoin remained unwavering.

However, why does this matter? In occasions of financial strain, traders often retreat from “dangerous” belongings. Capital floods into banks as folks search security in financial savings and better borrowing prices tighten liquidity, pushing traders into conventional belongings with assured returns.

And but, regardless of tightening family budgets and total market uncertainty, Bitcoin emerged as a “protected haven,” – dwelling as much as its fame as “digital gold.” This marks a pivotal shift for BTC and implies that 2025 might be a game-changer.

So, is that this the start of one thing new?

Undoubtedly, Bitcoin’s dominance over conventional belongings, notably gold – the age-old protected haven – has set the stage for a brand new period in international funding.

With a pro-crypto administration on the helm and Bitcoin reserves gaining mainstream consideration, BTC’s power appears set to endure. Nevertheless, the street forward is much from clean.

Renewed China tariffs, tax cuts, and tighter authorities spending might push the Federal Reserve to maintain rates of interest excessive, difficult markets – and Bitcoin – alike.

The driving issue? Inflation. Whereas these insurance policies intention to spice up home reliance, they carry financial dangers that would ripple throughout international markets.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

As these challenges unfold, Bitcoin’s resilience will face renewed scrutiny, and the U.S greenback’s dominance will dangle within the steadiness. Clearly, the shifts we’ve seen this yr are removed from atypical. They’ve been groundbreaking, setting the stage for Bitcoin to sort out the volatility that lies forward.

In the meantime, stablecoins are carving out their very own area of interest. Tether (USDT), the most important dollar-pegged stablecoin, hit an all-time excessive market cap of $140 billion.

With sensible use circumstances, additionally it is difficult conventional fiat currencies. Case in point – In October 2024, Tether enabled the $45 million transportation of 670,000 barrels of Center Jap crude oil.

So, with stablecoins gaining traction as inflation hedges and options to conventional fiat, the anti-dollar movement is rising stronger. This might mark the daybreak of a brand new monetary period – One the place Bitcoin and stablecoins lead the cost.