Enterprise capitalist Chris Burniske says that the present dip in digital property is typical of any bull market cycle.

In a post on the social media platform X, Burniske, the previous head of crypto at Cathie Wooden’s ARK Make investments and present accomplice at Placeholder, factors out different corrections within the 2021 bull market cycle that finally preceded new highs.

“In the course of 2021:

BTC drew down 56%

ETH drew down 61%

SOL drew down 67%

Many others 70-80%+

You possibly can give you all the explanations for why this cycle is totally different, however the mid-bull reset we’re going by isn’t unprecedented. These calling for a full-blown bear are misguided.”

At time of writing, Bitcoin (BTC) is down 20% from its all-time excessive, Ethereum (ETH) is down 50% from its all-time excessive whereas Solana (SOL) is down 51%.

Earlier this month, Burniske said that BTC’s lackluster value efficiency seemed like a “mid-cycle high” harking back to April, Might, June of 2021, when “many stated it was over, top-callers gloated, after which we ripped in 2H ’21.”

Former Goldman Sachs government and present Actual Imaginative and prescient CEO Raoul Pal echoes Burniske’s sentiments. Pal, who has been vocally bullish on crypto, additionally believes the present correction is a pace bump on the way in which to new highs.

“You guys all have to be taught persistence…

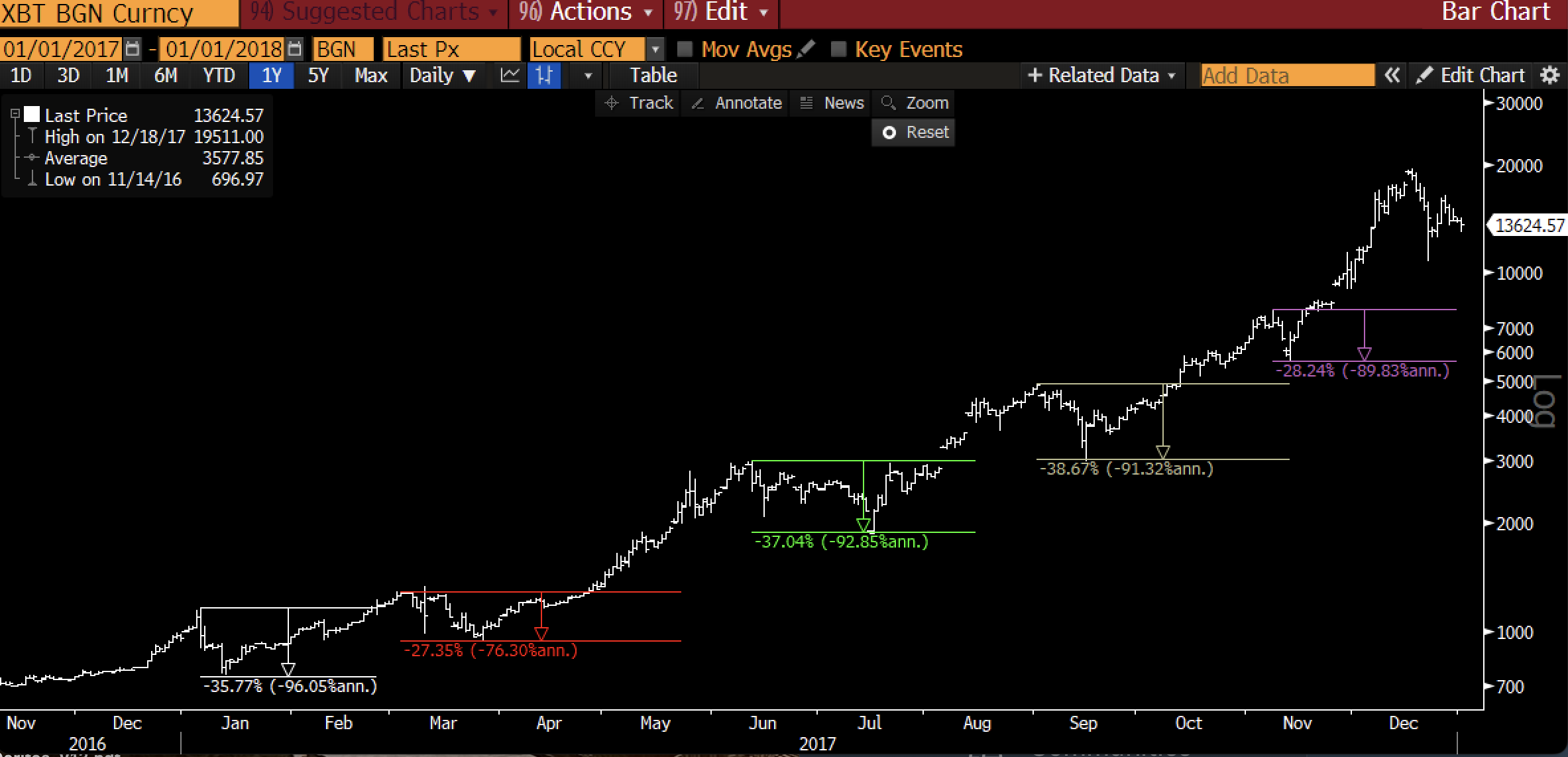

This was 2017. Very related macro construction:

5 x 28%+ pullbacks in BTC

Most lasted 2 to three months earlier than a brand new excessive

Alts noticed 65% corrections.

All have been noise.

Go do one thing else extra constructive than stare on the display.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/dTosh/Roman3dArt