- Bitcoin’s BTC small retail holders dominated the market at press time.

- Analysts recommend three circumstances for Bitcoin to rally to new highs.

Bitcoin [BTC], the biggest cryptocurrency by market capitalization, has been on a downward trajectory over the previous month. On its value charts, BTC has declined by 1.01% on each day charts to commerce at $56657.

Equally, over the previous 30 days, it has dropped by 2.80% suggesting elevated volatility.

Since hitting an ATH of $73737 in March 2024, the crypto has struggled to keep up an upward momentum thus even hitting a neighborhood low of $49k.

The elevated market volatility has spiked questions over the longer term prospects primarily based on holders’ behaviors. Inasmuch, Santiment’s analysts have advised three circumstances for BTC to hit new highs.

What prevailing market sentiments recommend

In line with Santiment, though market sentiment amongst retail merchants has turned constructive, it’s not adequate to spice up BTC for a rally.

Within the evaluation, wallets holding <1 BTC have now elevated their holding to the very best ranges in seven months. Which means small retail merchants are holding the bigger share of the BTC provide.

Nevertheless, in accordance with this analogy, elevated holding by small merchants shouldn’t be adequate for a rally. Primarily based on this evaluation, the primary situation for BTC to rally is small holders decreasing their holdings.

Ideally, when small holders dominate the market, it signifies elevated hypothesis or a fragile market since small holders are emotional sellers.

Thus, for a sustained rally, fewer small holders are much less preferable as a result of they’re vulnerable to panic promoting.

Secondly, mid-sized buyers with 1-100 BTC must develop their holdings steadily. A sustained development by mid-sized buyers means that extra skilled buyers and establishments are getting into the market.

The doorway of such buyers is total bullish, because it exhibits confidence in long-term prospects.

The third and closing situation for a rally is aggressive accumulation by 100+ holders. Aggressive accumulation by giant holders means that establishments and whales are bullish on the longer term prospects.

Due to this fact, whales accumulating BTC suggesting they’re assured in a longer-term value enhance by decreasing liquidity on exchanges, which often helps value appreciation.

Bitcoin holder evaluation

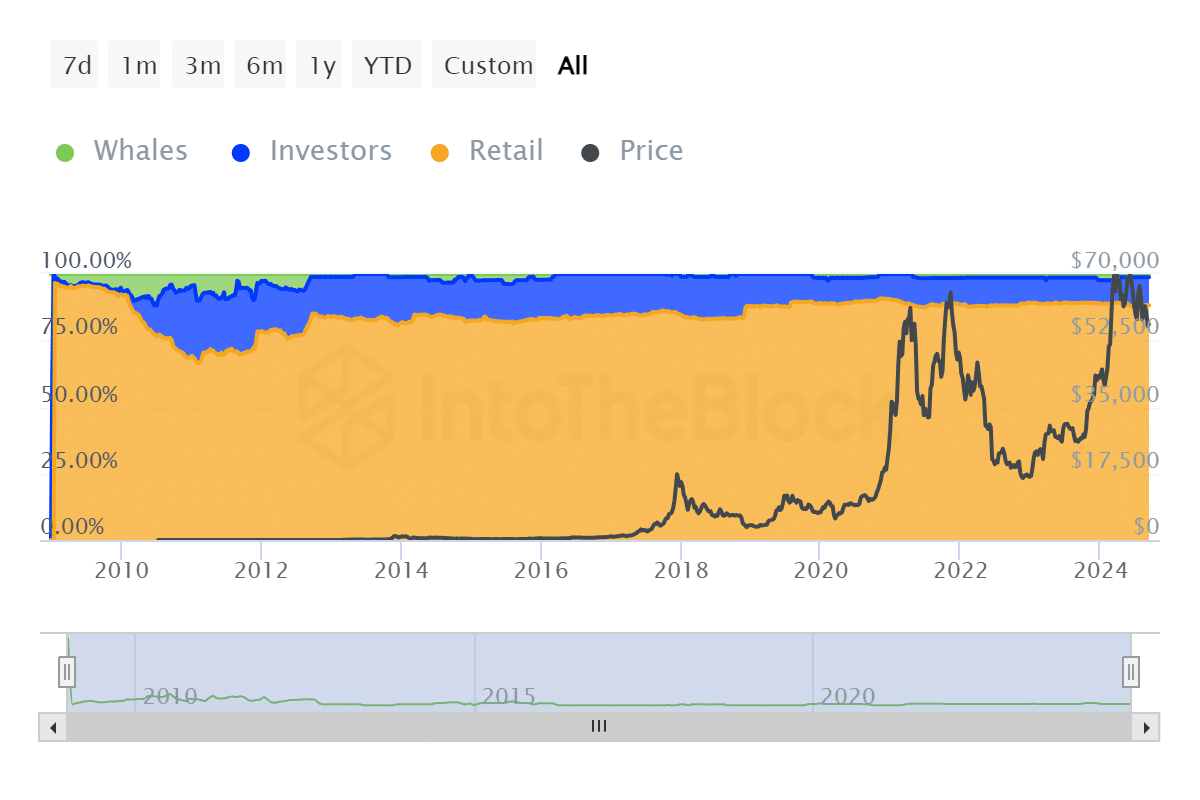

As famous by Santiment, small retail holders have continued to dominate the market within the latest previous.

For starter’s, Bitcoin’s possession by historic focus indicated that retail merchants holders held 88.24%, that are 17.44 million Bitcoins, whereas buyers maintain 10.5% and whales 1.26%.

This exhibits retailers have a significant say out there, which leads to speculative promoting, ensuing within the not too long ago witnessed volatility and fluctuations.

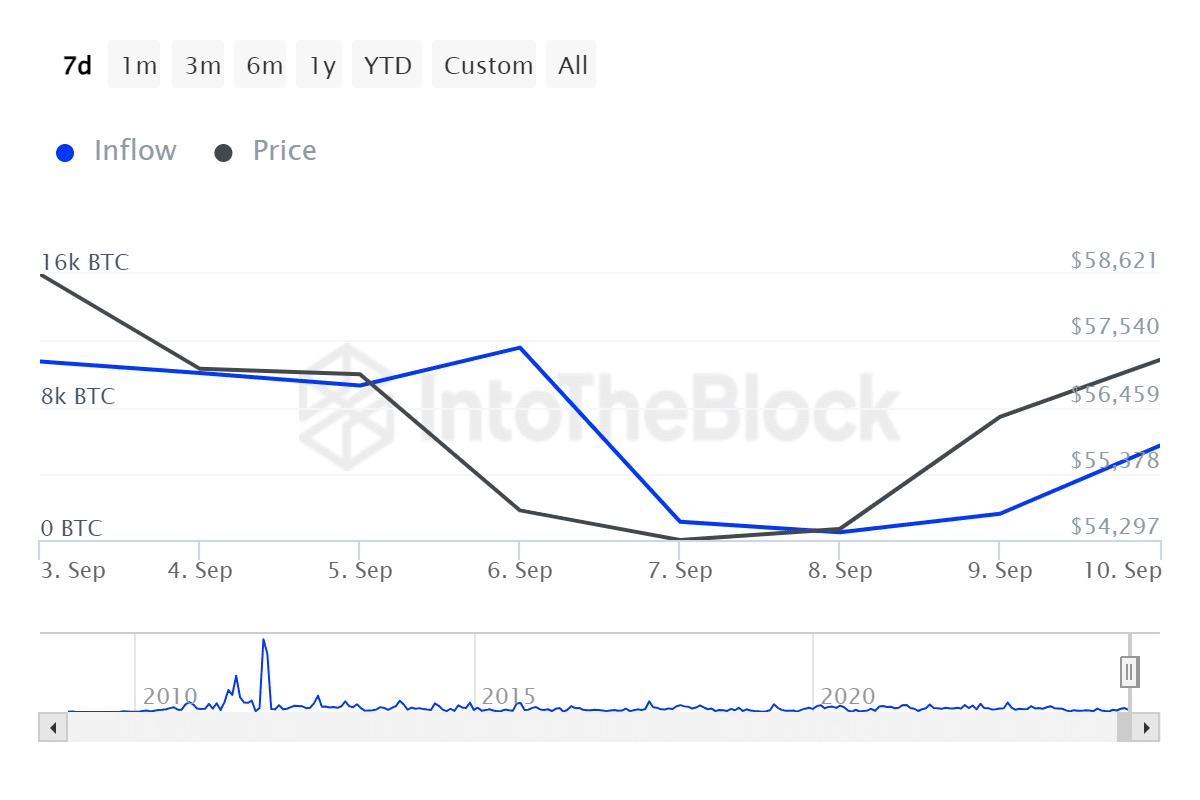

Moreover, giant holders’ influx has declined from 11.57k to a low of 1.58k over the previous seven days.

This implies diminished demand by whales as they’ve turned to closing their positions in the course of the market downturn. A discount in whale holding exhibits confidence sooner or later prospects.

Due to this fact, the rise in small retail merchants holding displays the present market fluctuations.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Throughout downturns, retail merchants have a tendency to shut their positions as they’re speculative sellers, which additional drives costs down.

Thus, a rise in giant and mid-sized holders would stabilize the market and push costs up. Thus, if the retail merchants proceed to dominate the markets, BTC will decline to $54587.