- Bitcoin has declined by over 7% during the last 7 days.

- Analysts consider a big correction could possibly be due if BTC drops beneath $56k

Bitcoin [BTC], the world’s largest cryptocurrency by market capitalization, has seen appreciable depreciation over the previous week. In truth, on the time of writing, BTC was down by over 7% to commerce at a price of $59,129 on the charts.

August, typically, has been pretty unstable for the cryptocurrency. As an illustration, BTC dropped to as little as $49,500 on the charts earlier within the month, earlier than recovering quickly after. In truth, it later hit an area excessive of over $65k too, earlier than shedding its beneficial properties once more to drop beneath $60k.

That’s the explanation why many are nonetheless unsure in regards to the scale of the following wave of corrections.

Based on Cryptoquant analyst Julio Moreno, nonetheless, Bitcoin might register a robust decline if the value declines beneath $56k.

What does the market sentiment say?

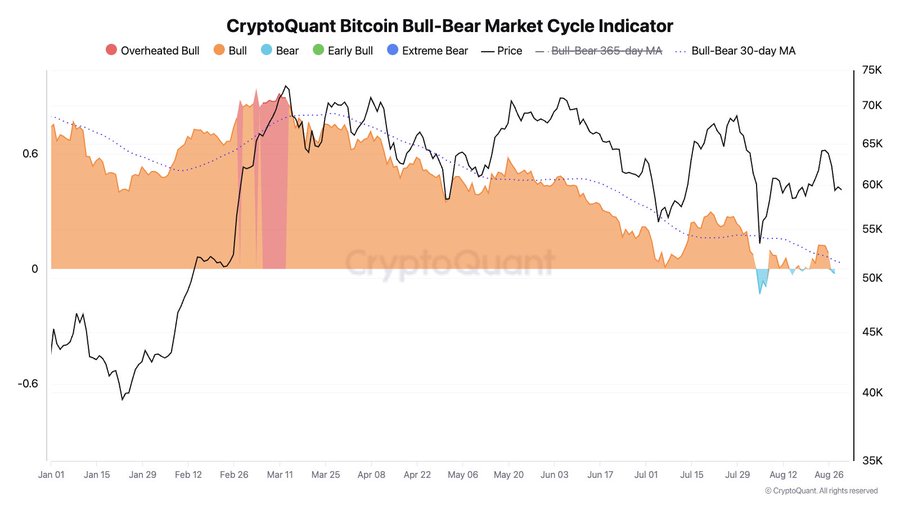

In his evaluation, Moreno cited the market cycle indicator suggesting that $56k is essentially the most essential help degree. Based on the analysts, if the value falls beneath this degree, the crypto will seen important weak spot. Because the Bitcoin market cycle indicator has turned bearish once more, the crypto dangers additional correction beneath the demand zone.

The analyst shared the evaluation on X, noting that,

“#Bitcoin market cycle indicator is once more in BEAR part (gentle blue space). From a valuation perspective, if the value pierces $56K to the draw back, dangers of a bigger correction enhance.”

Based mostly on this evaluation, the Bear part is properly positioned to persist if the bulls don’t reclaim the market.

What do BTC’s charts say?

Whereas these metrics highlighted by Moreno present potential future value actions, it’s important to see what different market indicators recommend.

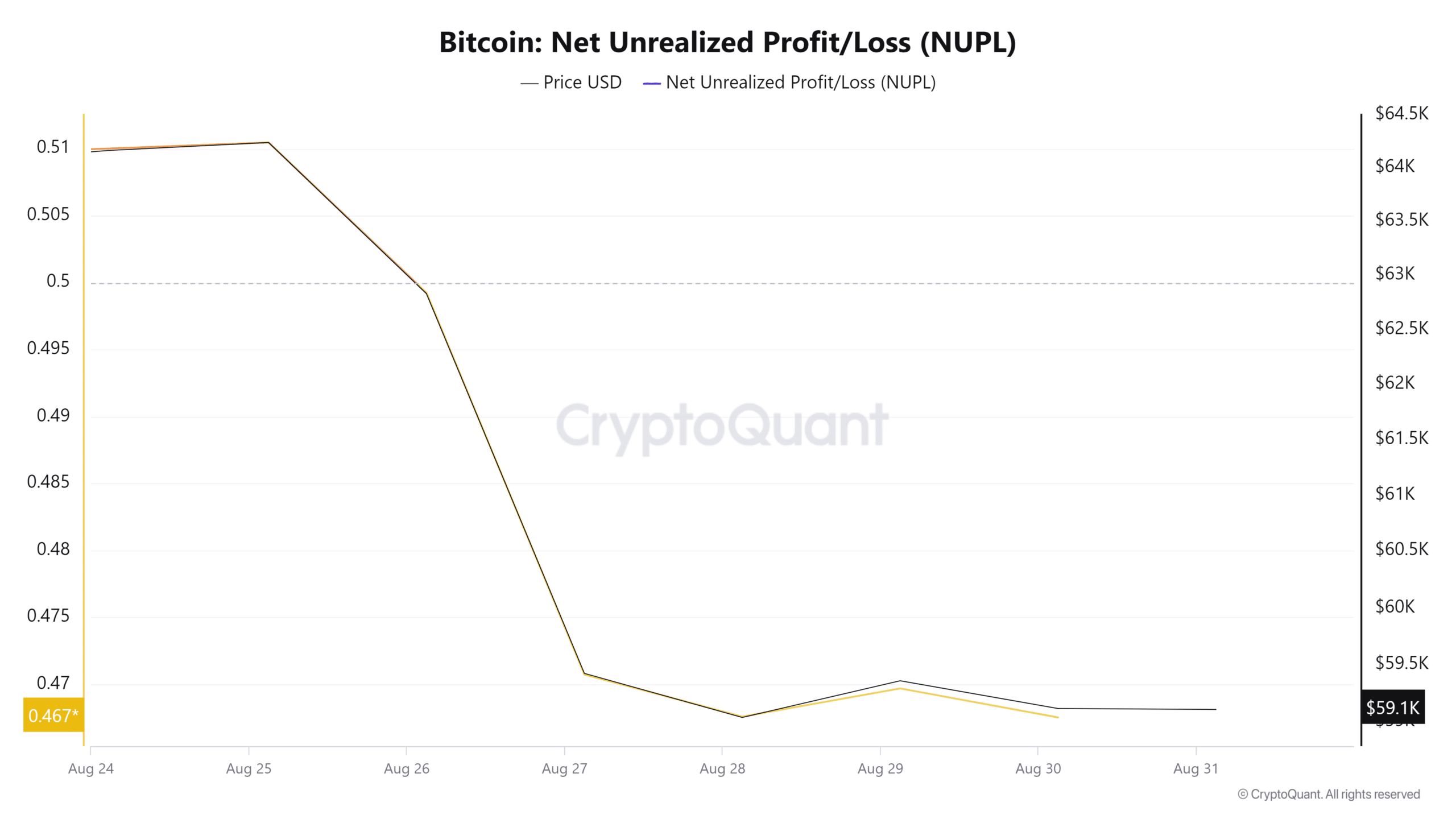

For starters, Bitcoin’s NUPL has declined over the previous 7 days. Internet unrealized revenue/loss declined from 0.5 to 0.4, suggesting that traders are shifting from unrealized revenue to unrealized loss.

It is a signal that the market could also be leaning bearish. By extension, this implies traders are worrying in regards to the sustainability of the present costs, which can lead to promoting strain.

Moreover, BTC is reporting a unfavourable adjusted value DAA divergence of -44.31.

This means a decline in on-chain exercise primarily based on present costs. Such market circumstances lead to correction as costs modify to the decrease degree of on-chain exercise.

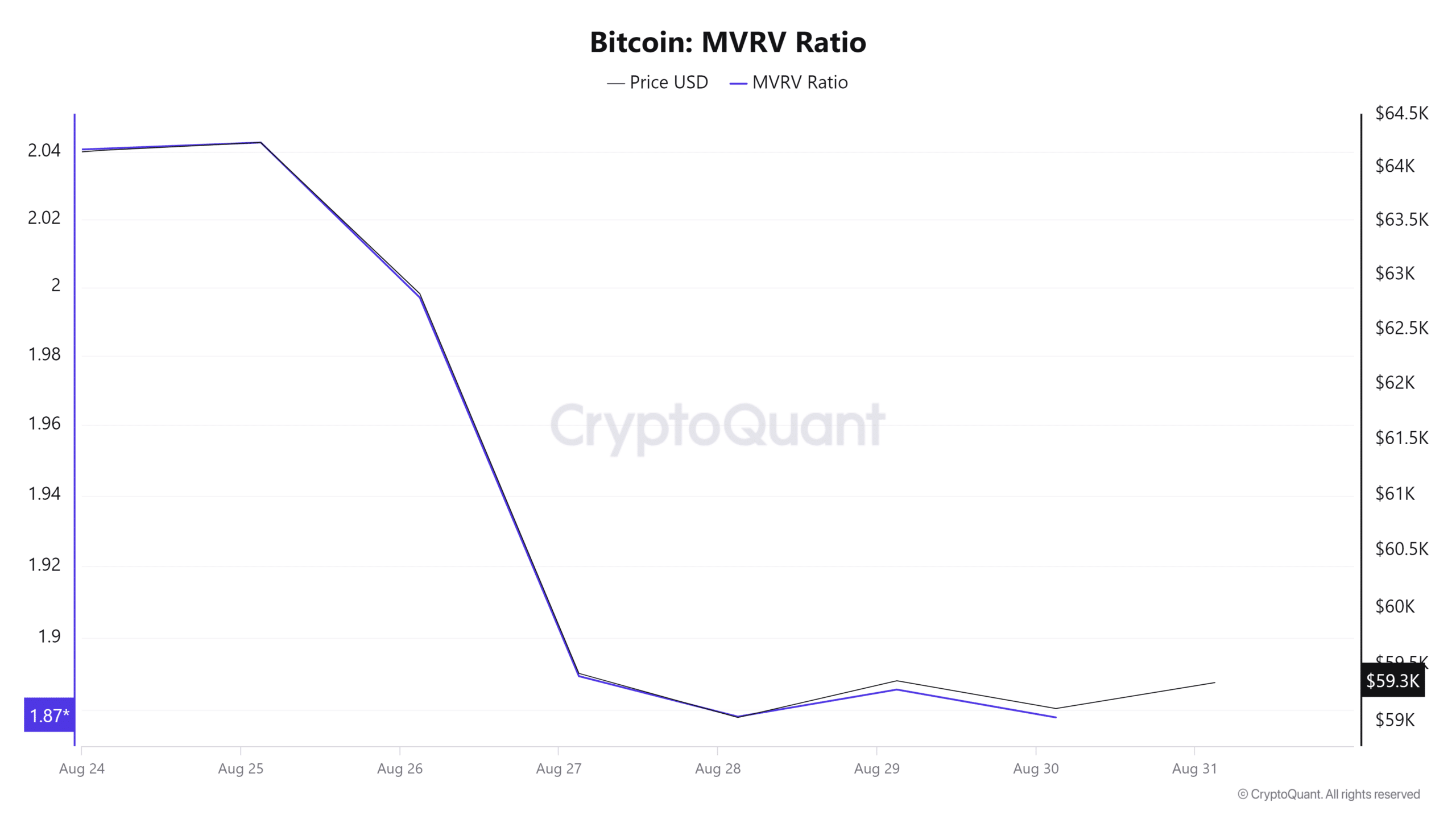

Equally, the MVRV ratio for BTC has remained at 1.8 over the previous week. This reveals that contributors are in revenue, which might result in promoting strain as they intention to appreciate these beneficial properties. Due to this fact, if BTC holders determine to promote at this price to appreciate their income, it could result in additional value correction.

If promoting strain will increase, the market will expertise a pullback.

Due to this fact, as Cryptoquant analyst Julio suggests, BTC is within the bear part. If the present market circumstances maintain, Bitcoin could also be positioned for a much bigger correction. A pullback beneath the $56 degree will see BTC fall beneath $50k to the essential help of $49k.