Key Notes

- Ethereum ETFs recorded $728.3 million in net outflows this week as market sentiment deteriorated sharply.

- BitMine, the world’s largest ETH treasury holder, appointed Chi Tsang as CEO alongside three new independent directors.

- Technical indicators show ETH faces steep resistance, with reclaiming the 50-day moving average becoming increasingly unlikely in the near term.

BitMine Immersion Technologies, the world’s largest Ethereum treasury company controlling more than 2.9% of the network’s supply, announced new leadership on Friday.

The company appointed Chi Tsang as its new Chief Executive Officer, succeeding Jonathan Bates, while simultaneously adding three independent directors, Robert Sechan, Olivia Howe, and Jason Edgeworth, to its board.

🧵

BitMine is pleased to announce management and Board appointments:– new CEO, Chi Tsang

3 independent board members:

– Rob Sechan @RobSechan , CEO of @NewEdgeWealth

– Jason Edgeworth, CIO of JPD Holdings

– Olivia Howe, Chief Legal Officer of RigUpTogether, these additions…

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 14, 2025

The reshuffle marks one of BitMine’s most significant updates since its NYSE listing and comes as the firm pushes toward its strategic goal of acquiring 5% of the total ETH supply.

In its official announcement on Friday, BitMine emphasized that the new executive team brings a combined depth of experience across technology, DeFi, banking, and legal expertise. Chairman Tom Lee said the transition was essential to position BitMine as the institutional bridge between Ethereum and traditional capital markets, likening the ongoing crypto boom to the telecom and internet revolution of the 1990s.

New CEO Chi Tsang echoed this sentiment, calling the investment strategy a generational opportunity.

Outgoing CEO Jonathan Bates also lauded the company’s rise from a small startup to the world’s largest corporate holder of ETH, expressing confidence in the incoming team’s ability to scale BitMine’s vision.

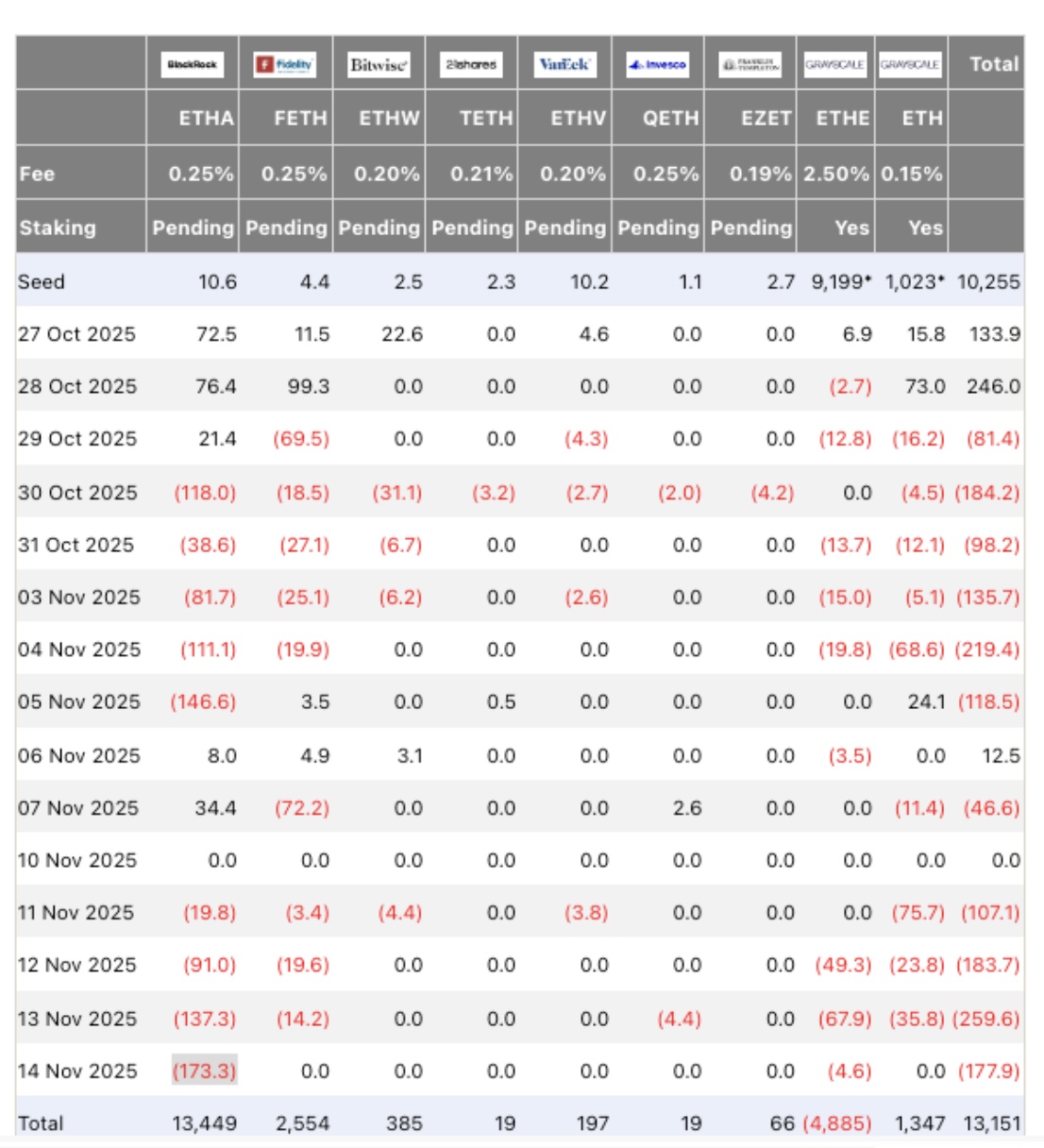

Ethereum ETF Flows, Saturday, Nov 15, 2025 | Source: FarsideInvestors

The appointments arrive after a bruising week for ETH-linked funds. FarsideInvestors data shows U.S. Ethereum ETFs posted $728.3 million in net outflows over four trading days following the Monday market holiday. BlackRock’s Ethereum ETF registered a single-day withdrawal of $173.3 million on Friday, the largest for the month.

ETH fell 5% intraday, hovering just above $3,200 as traders reacted to another session of heavy ETF withdrawals flooding the market. Bitmine’s current 3,505,723 ETH haul, now accounts for 2.9% of total circulation supply and is valued at $11.2 billion at current prices.

Ethereum Price Forecast: Can ETH Hold $3,200 as Momentum Weakens Into December?

Ethereum’s price action has deteriorated as ETF outflows coincided with technical rejection near key moving averages. On the daily chart, ETH price has plunged below the 50-day and 100-day moving averages, and is now attempting to stabilize along the 200-day line near $3,200.

Persistent ETF sell-offs after the failure to reclaim the 50-day average near $3,912 earlier in the month have weakened Ethereum rebound prospects.

Ethereum (ETH) Price Forecast | TradingView

The Breakout probability ratio shows successive days of heavy sell-offs flooding the market in the past week. ETH price now has a 29% of reclaiming the $3,250 mark, favoring a 54% probability of a retrace to $3,000. The distance from current prices to the 50-day MA implies that buyers would need a strong catalyst and volume surge to initiate a clean breakout.

Meanwhile, Ethereum’s RSI remains depressed at 36, hovering just above oversold conditions with no clear bullish divergence. The RSI’s failure to rise sustainably above 40 suggests weak demand and ongoing vulnerability to further retracement. Meanwhile, the BBP indicator shows persistent negative readings, reflecting contracting buy-side pressure and subdued volatility expansion that usually accompanies trend reversals.

A breakdown below the 200-day average could expose ETH to $3,050 and potentially $2,850, levels where stronger historical bid clusters exist.

Conversely, if ETF outflows stabilize and ETH holds the $3,200 support convincingly, a recovery toward $3,450 is possible; however, reclaiming the 50-day MA remains a low-probability outcome unless institutional flows shift positive.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

I’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.