- BTC’s market construction confirmed indicators of a possible shift for the higher.

- Customers who opted for the BTC holding technique hit new highs.

Bitcoin’s [BTC] downtrend and subsequent consolidation since peaking in March may finish quickly.

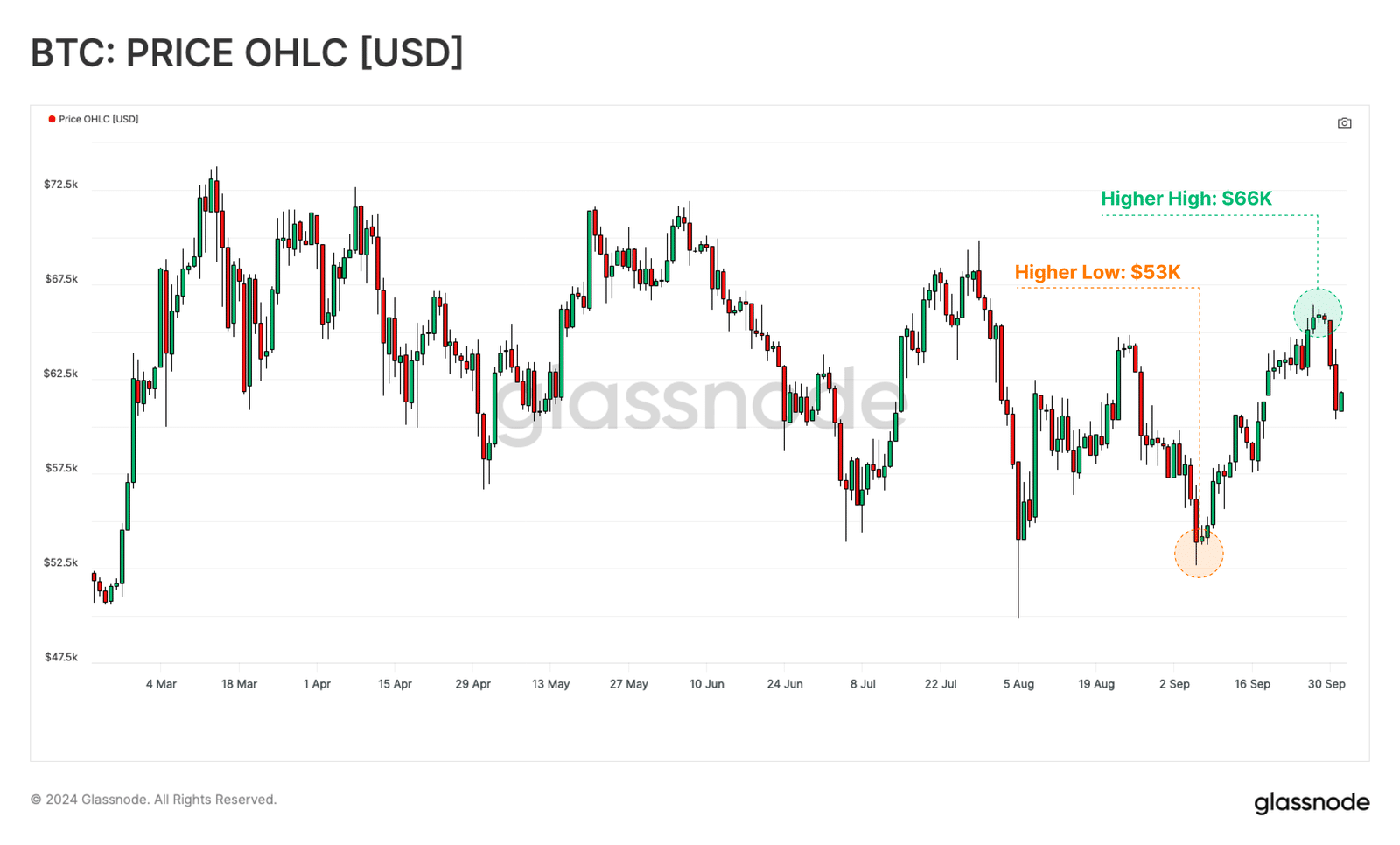

In response to blockchain analytic agency Glassnode, final week’s aid rally to $66K offered a primary larger excessive since June.

Moreover, a few on-chain metrics additionally printed new highs. The analytics agency famous that these had been growing indicators of a market construction shift, which may mark the potential finish of the continuing Bitcoin re-accumulation part seen since March.

“This worth motion gives the primary inclinations that the structured downtrend could also be approaching a part shift.”

Bitcoin cycle aligns with previous developments

Regardless of the extended consolidation, BTC was on the identical stage as in previous market cycles after cycle lows. It was up over 300% from its cycle lows, additional reinforcing that BTC worth nonetheless had extra room for growth.

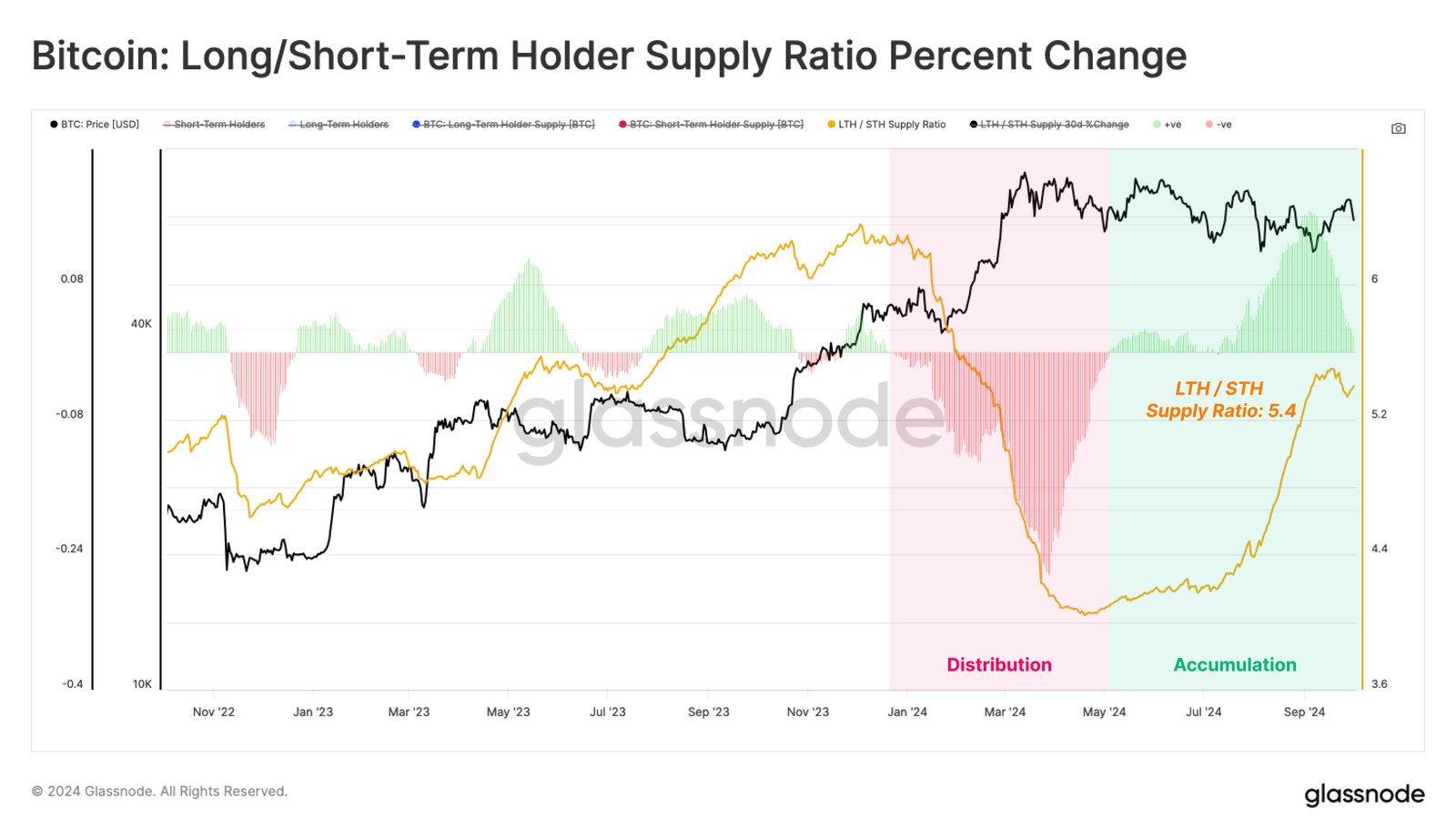

The bullish prospect was additionally illustrated by the rising variety of customers and whales adopting the BTC holding technique. Since Might, the Lengthy/Quick-Time period Holder Provide Ratio has elevated to five.4, underscoring that customers held slightly than bought their BTC.

“This means that HODLing persists because the dominant behaviour of Bitcoin buyers.”

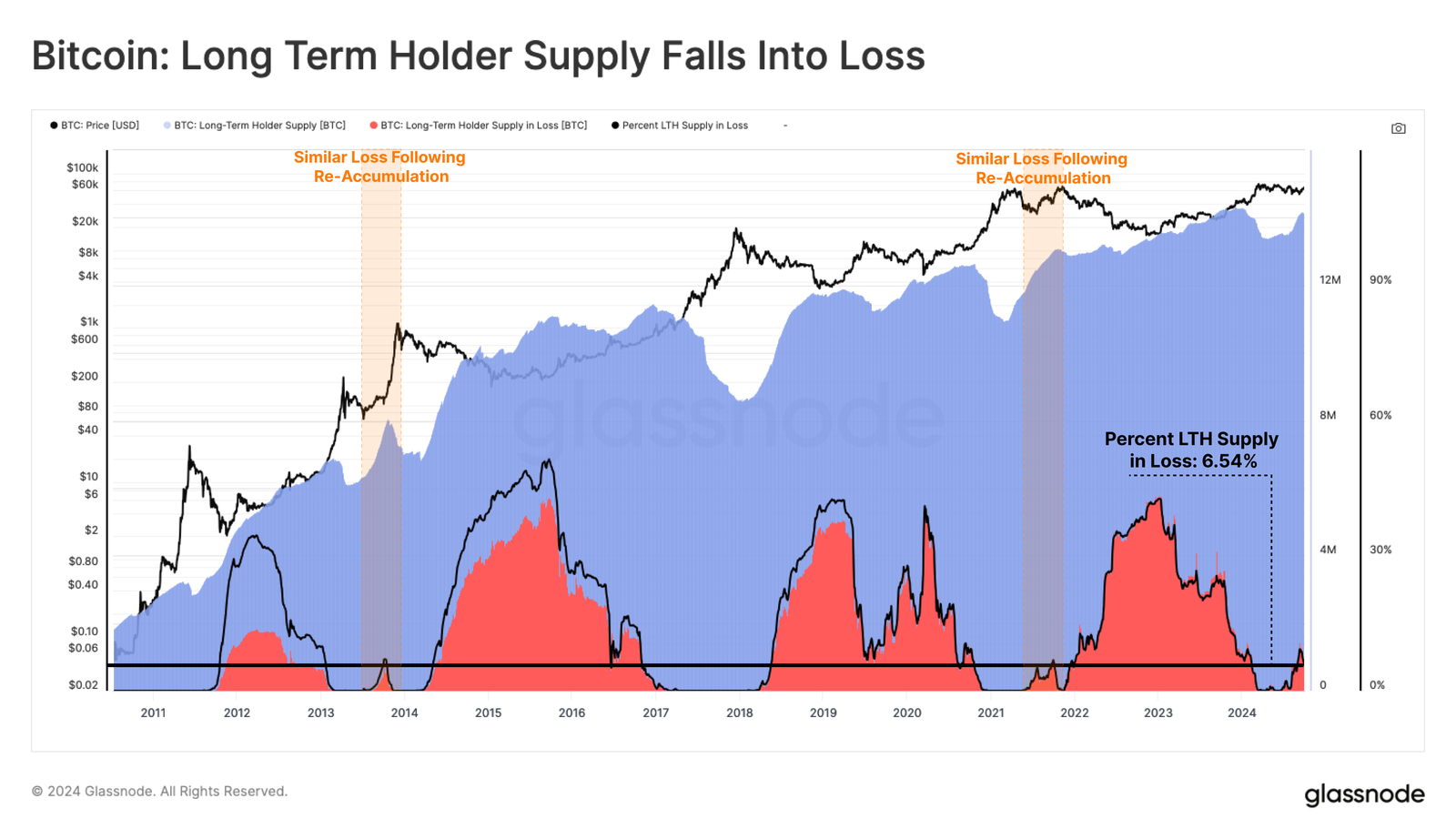

That being mentioned, about 6.5% of Lengthy-Time period Holders (LTH) had been in loss as of the first of October.

Nevertheless, Glassnode acknowledged that the unrealized losses throughout the LTH cohort had been comparatively small however had been in step with previous re-accumulation phases.

The analytics agency added that the current aid rally boosted STH into earnings, a special situation from the last few weeks.

Collectively, these bolstered the thought of a possible market construction shift to increase the re-accumulation interval.

Nevertheless, Peter Brandt believed the market construction shift may solely occur if BTC surged above $71K.

At press time, BTC weakly held the psychological stage of $60K after a current sell-off.