- Over 28,000 BTC have been collected by whales and sharks within the final three months

- Bitcoin, at press time, was buying and selling above $60,000, regardless of latest declines

Bitcoin [BTC] efficiently crossed the crucial $60,000 psychological resistance, leading to a major quantity of brief liquidations over the previous 24 hours. Within the build-up to this value breakthrough, accumulation patterns from key addresses intensified over the past three months.

Moreover, BTC provide on exchanges steadily declined too, with extra Bitcoin leaving exchanges.

BTC crosses the psychological barrier

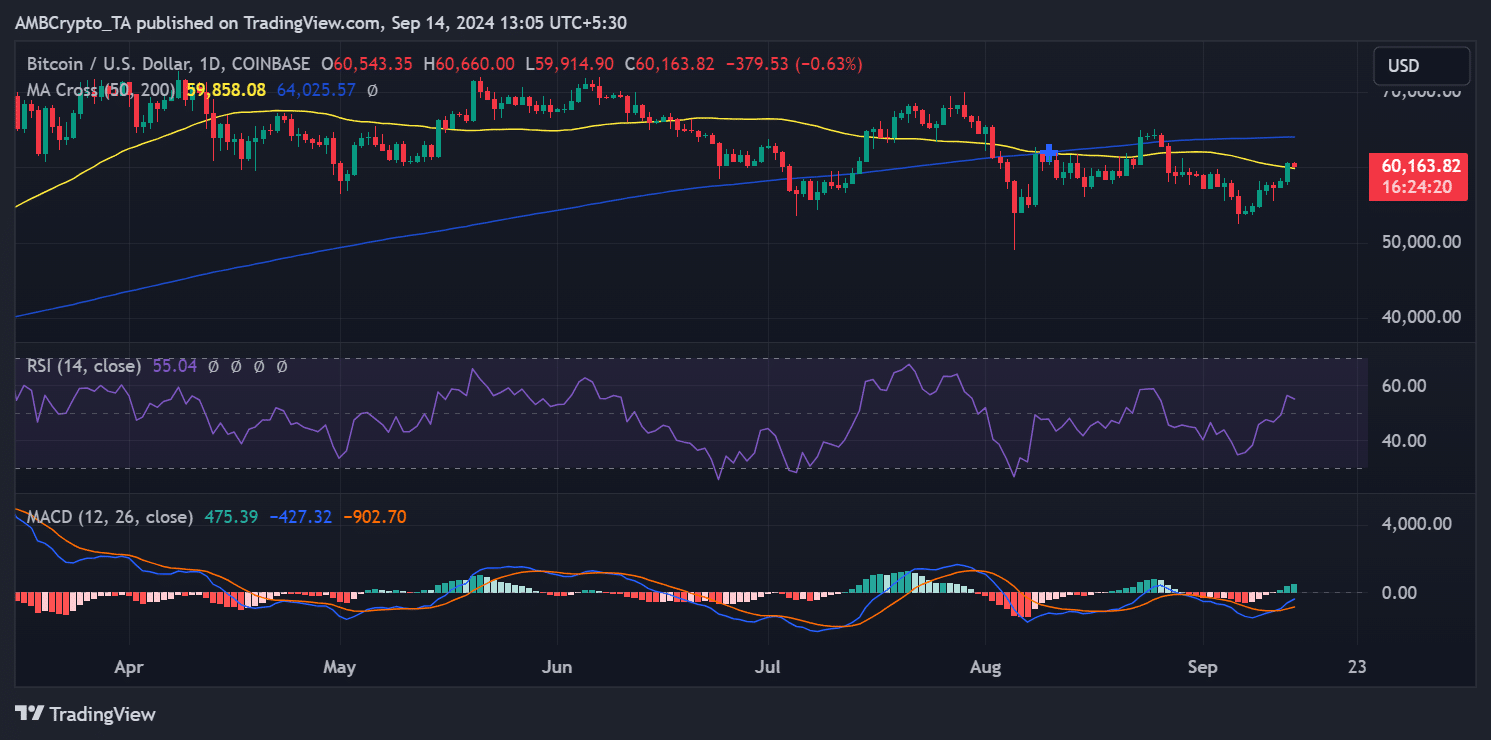

An evaluation of Bitcoin’s value motion on 13 September revealed a powerful upswing, one which pushed BTC above its psychological resistance of $60,000. In truth, at one level, it was buying and selling at $60,543, up by 4% in simply 24 hours. This surge allowed Bitcoin to interrupt above its short-moving common (yellow line), which had beforehand acted as resistance.

Now, whereas the cryptocurrency declined quickly after to $60,177, BTC stays bullish. The identical was confirmed by its Relative Power Index (RSI), with the identical hovering at round 55 – An indication of constructive market momentum.

The motion above the short-term shifting common and the sustained bullish RSI urged that Bitcoin should still be on an upward trajectory. The slight pullback could also be non permanent, with the potential for additional features if shopping for stress continues to construct.

Bitcoin’s sustained accumulation and withdrawal

Current information additionally highlighted that Bitcoin accumulation and alternate withdrawals have been vital over the previous few months – A bullish pattern.

In accordance with information from Santiment, addresses holding 10 BTC or extra have collected over 28,000 BTC within the final three months. These giant holders now management greater than 16 million BTC, exhibiting elevated confidence within the asset.

Moreover, Bitcoin dropped beneath $60,000 on 29 August, which means these addresses have collected BTC at varied value ranges. This strategic accumulation throughout value fluctuations means that these holders are making ready for potential future features.

The availability of BTC on exchanges decreased considerably too, with 75,000 BTC withdrawn over the previous three months. This has left roughly 1.8 million BTC remaining on exchanges. The lowered alternate provide is a transparent bullish sign because it implies that holders are choosing long-term storage, moderately than promoting. Consequently, this tightens the obtainable provide for buying and selling.

If Bitcoin’s value maintains its present stage or strikes increased, the mix of accumulation and provide discount on exchanges may additional strengthen the bullish momentum. It will drive the value increased on the charts.

Brief positions take a large loss

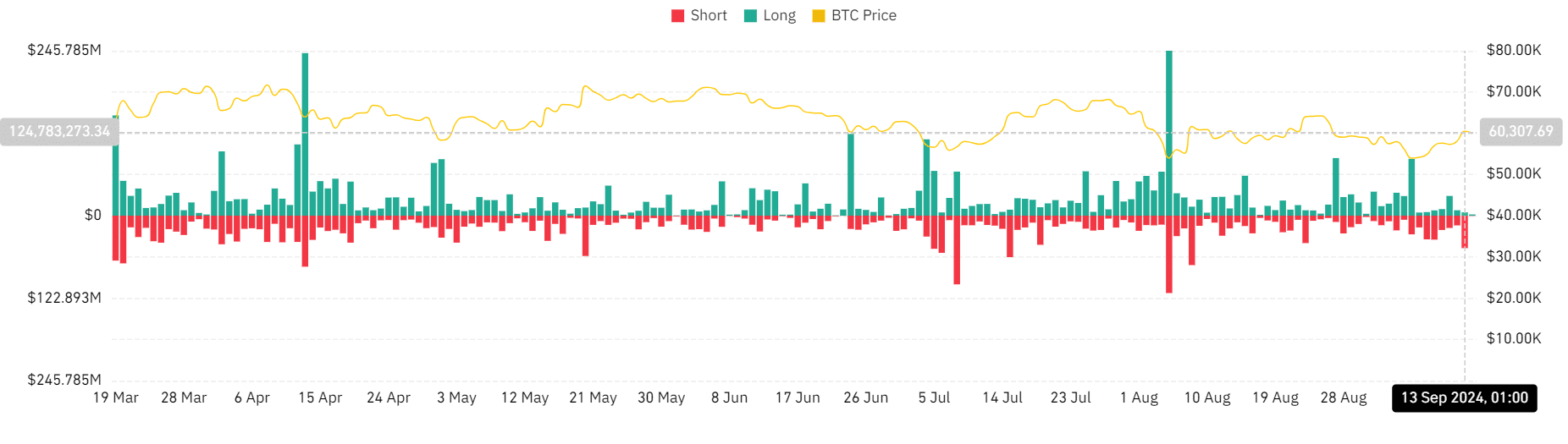

The 4% hike in Bitcoin’s value over the last buying and selling session led to a serious liquidation of brief positions.

In accordance with the Coinglass liquidation chart evaluation, brief positions confronted greater than $48 million in liquidations by the tip of buying and selling on 13 September. Quite the opposite, lengthy positions noticed solely $5 million in liquidations.

– Learn Bitcoin (BTC) Price Prediction 2024-25

This mirrored an identical occasion on 8 August, when Bitcoin’s value jumped from $55,000 to over $61,000, resulting in a comparable spike briefly liquidations.

This liquidation occasion and broader bullish indicators may gasoline additional upward momentum within the brief time period.