- BTC sees a shift in market sentiment, with vote up or down turning inexperienced for the primary time in 4 months.

- Bitcoin whales are again available in the market, with whale addresses hitting a 2025 excessive of 2106.

Over the previous months, Bitcoin [BTC] has skilled excessive volatility, struggling to maintain an upward momentum. These struggles are primarily related to rising pessimism over macroeconomic circumstances.

Nevertheless, after 4 months of pessimism and bearish sentiment, the market confirmed its first signal of a returning bull market simply a few days in the past.

In line with Axel Adler, the Bitcoin Sentiment Vote-Up or Down metric turned inexperienced for the primary time.

When this turns inexperienced, it suggests that almost all of contributors are optimistic and count on Bitcoin costs to rise. Thus, social sentiment is leaning bullish with crowd psychology shifting.

Whales lead the cost

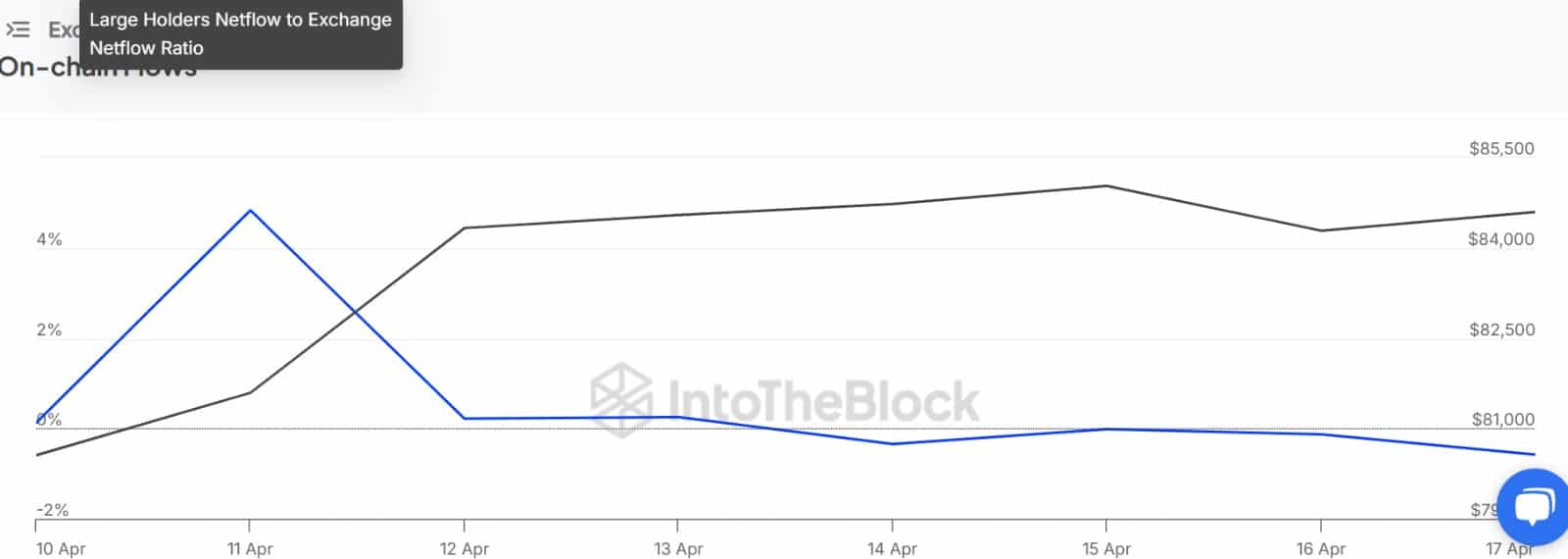

Curiously, this transformation was most pronounced amongst massive holders.

Firstly of 2025, there have been 2,054 wallets holding over 1,000 BTC. That quantity dipped to 2,038 amid rising uncertainty.

Nevertheless, over the previous few days, whales are again available in the market and are aggressively accumulating.

The return has pushed the Variety of Addresses greater, with the variety of these addresses reaching 2106, which is a 2025 excessive.

The surge within the variety of whale addresses means that whales are actually much more optimistic in comparison with the market contributors.

After all, the uptick steered rising confidence. On-chain information confirmed it—whales recorded a sustained damaging Change Ratio for 5 consecutive days.

In addition to whales, even different market contributors have turned optimistic.

For the primary time in 17 days, U.S. institutional buyers have turned bullish. Wanting on the Coinbase Premium Index, it has turned optimistic for the primary time in additional than two weeks.

Such a shift means that even U.S. buyers are actually anticipating Bitcoin’s costs to rise.

What it means for BTC

The shift in market sentiment displays rising confidence in Bitcoin.

As such, most contributors now count on costs to reclaim a better resistance. When whales, establishments, and retailers shift their sentiment, it signifies that Bitcoin is now secure sufficient to see one other leg up.

If optimism holds, BTC may reclaim $86,190. A sustained transfer may open the door to $88,500. Nevertheless, if consolidation dragged and whales flipped risk-off, BTC risked slipping towards $81,616.

Both means, the market stood at a turning level. Momentum now hinged on sentiment follow-through and whale conviction.