- Whales have withdrawn 110,000 BTC in 30 days, signaling aggressive accumulation and attainable upside momentum.

- Merchants are closely positioned at key ranges, with $496M in longs close to $102.8K and $319M in shorts at $104.8K.

Bitcoin [BTC], the world’s largest cryptocurrency, has shifted the general cryptocurrency market with its spectacular restoration over the previous few days.

The surge appeared largely pushed by whale exercise, which has ramped up throughout each spot and by-product markets.

Whales withdrew 110,000 BTC, time to purchase?

Because the day Bitcoin started bleeding, whales and business giants have seized the chance to purchase the dip.

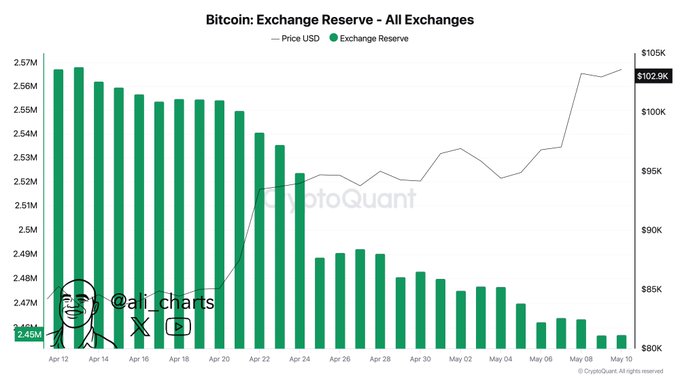

Not too long ago, a distinguished crypto expert shared knowledge on Bitcoin trade reserves over the previous 30 days, revealing that whales have withdrawn over 110,000 BTC throughout this era.

This substantial withdrawal of BTC signifies potential accumulation and will create shopping for stress, resulting in an additional upside rally, which explains Bitcoin’s latest surge.

In the meantime, whales haven’t stopped but, they’ve been repeatedly accumulating BTC.

In simply 48 hours, whales added one other 20,000 BTC to their wallets.

This steady accumulation of BTC displays the whales’ curiosity and confidence within the asset for the long run.

Retailers least participation

Alternatively, retail traders have been largely absent throughout this era and have been seen offloading their holdings attributable to panic.

Based on on-chain analysts, retail sometimes returns close to market tops, not throughout recoveries or corrections.

Regardless of BTC buying and selling simply 5% beneath its earlier peak, retail participation stayed muted, presumably limiting frothy hypothesis—for now.

$500 million price of bullish bets

Apart from all this, merchants look like aligning with the present market sentiment, as revealed by the on-chain analytics software Coinglass.

Information reveals that merchants are at the moment overleveraged on the $102,819 stage on the decrease aspect (help) and $104,871 on the higher aspect (resistance).

At these ranges, merchants have constructed $496.55 million price of lengthy positions and $319.26 million price of brief positions.

This metric signifies that bulls are at the moment dominating the market, hoping that the BTC worth received’t fall beneath the $102,819 help stage anytime quickly.

At press time, BTC traded round $104,300—up 0.75% in 24 hours. Nevertheless, buying and selling quantity dipped 7%, hinting at decrease engagement.

Bitcoin worth motion & technical evaluation

Based on AMBCrypto’s technical evaluation, BTC seems bullish and is poised for a brand new excessive. The day by day chart reveals that the asset is heading towards the important thing resistance stage of $106,800.

If this upward momentum continues and the worth breaks by this resistance, there’s a sturdy risk that BTC might expertise a notable surge and doubtlessly attain a brand new all-time excessive.

BTC’s Relative Energy Index (RSI) stood at 74, indicating that the asset is in overbought territory.

There’s a sturdy risk that it might expertise a worth correction till the RSI strikes out of the overbought zone.