- Bitcoin whales’ unrealized earnings surged to $150 billion, signaling potential short-term market shifts

- MVRV ratio indicated overvaluation, suggesting a potential correction if earnings are realized

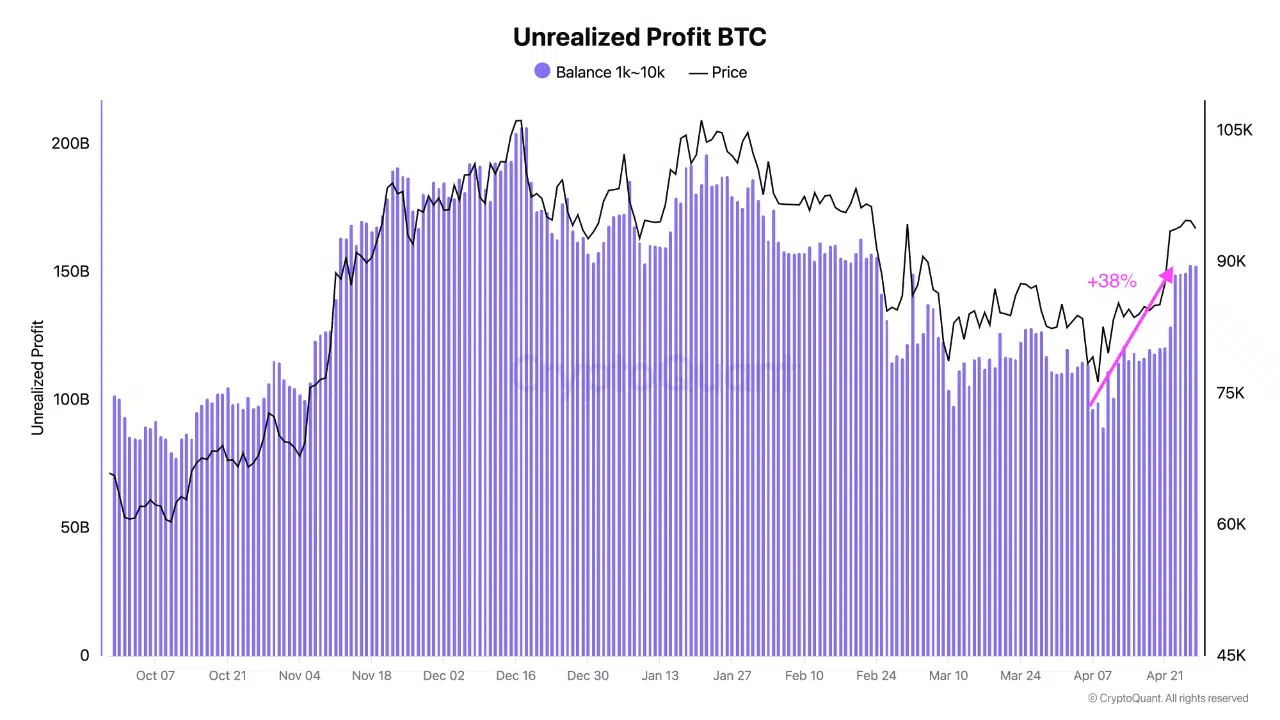

Bitcoin [BTC] whales, holding between 1K to 10K BTC, have seen their unrealized earnings surge by roughly 38% because the begin of April – Hitting $150 billion.

Traditionally, when these earnings close to $200 billion, whales are inclined to take earnings, probably slowing Bitcoin’s upward momentum.

Such a hike in whale earnings usually alludes to potential shifts in market sentiment, elevating questions on whether or not BTC can proceed its upward trajectory or face a value correction. At press time, Bitcoin was buying and selling at $94,811.68, following a modest 0.16% uptick over the past 24 hours.

Each day energetic addresses, transactions point out wholesome community development

Bitcoin’s community exercise has been sturdy, with 808.82k each day energetic addresses and 392.47k transactions recorded at press time. These numbers hinted at a rising stage of adoption and transactional exercise, supporting the bullish narrative for Bitcoin.

Now, whereas these metrics alone don’t assure sustained value development, robust community exercise is commonly correlated with higher investor demand, which may additional gas Bitcoin’s rally.

Because the variety of energetic addresses continues to rise, the demand for BTC could climb too. This might probably push the value increased within the coming weeks.

Excessive MVRV ratio – What does it imply?

At press time, Bitcoin’s MVRV ratio stood at 2.37 – A excessive worth that indicated potential overvaluation. This additionally recommended that BTC could also be buying and selling above its “honest” worth, as measured by the common value at which cash had been final moved on the blockchain.

Traditionally, when the MVRV ratio is excessive, it has usually hinted at the start of a market correction.

The Inventory-to-Stream ratio for BTC surged to 725.39 too, signaling growing shortage. This metric displays Bitcoin’s diminishing provide over time – Historically, a long-term bullish indicator.

As BTC turns into extra scarce, its worth may rise, offered demand stays robust. The spike within the Inventory-to-Stream ratio recommended that whereas Bitcoin faces short-term volatility, its long-term worth proposition as a scarce asset may proceed to draw traders.

Bitcoin battles key resistance – Can it break $95K?

Bitcoin has been testing important value ranges, together with a resistance zone at $95k recently. On the time of writing, the RSI sat at 66.98, indicating that Bitcoin could also be approaching overbought situations. If BTC can break by means of the $95k resistance, it may goal the subsequent stage round $105k.

Nevertheless, if it faces rejection, it could check assist at $85k. The Bollinger Bands underlined that BTC was close to the higher vary, additional supporting the concept the asset may face a pullback if momentum stalls.

Will BTC proceed to rise or face a value correction?

Bitcoin’s market situations have been flashing combined alerts. Whereas whales are growing their unrealized earnings and community exercise has been robust, the excessive MVRV ratio is an indication that Bitcoin could also be overvalued.

The surge within the Inventory-to-Stream ratio highlighted long-term shortage – A bullish sign. Nevertheless, Bitcoin’s press time value ranges and technical indicators recommended {that a} potential value correction may very well be subsequent if the resistance at $95k proves too robust.