- BTC’s value moved marginally within the final 24 hours.

- Market indicators regarded bearish on the coin.

Bitcoin’s [BTC] value has been in a consolidation section for the previous few days, because it was sticking close to the $70k mark. In truth, there have been possibilities of BTC falling close to the $60k zone within the brief time period. If that occurs, then it will be the appropriate alternative for traders to stockpile.

Is Bitcoin beneath risk?

AMBCrypto reported earlier that BTC’s value was in a consolidation section and was transferring in between $60k and its ATH. Our evaluation of IntoTheBlock’s data revealed that greater than 97% of BTC holders had been in revenue. At first look, this would possibly look optimistic, however in actuality, it might probably trigger hassle.

When such a excessive variety of traders are in revenue, they usually promote their holdings to take an exit with the money, which will increase promoting stress. After we checked CryptoQuant’s data, it was discovered that BTC’s aSORP was pink.

This meant that extra traders are promoting at a revenue. In the midst of a bull market, it might probably point out a market high, hinting at a value decline.

In keeping with CoinMarketCap, BTC’s value moved marginally within the final 24 hours and, at press time, was buying and selling at $70,446.45.

Buyers are nonetheless shopping for BTC

It was attention-grabbing to notice that regardless of these aforementioned pink flags, BTC traders confirmed immense confidence within the coin as they continued to build up.

Ali, a well-liked crypto analyst, not too long ago posted a tweet highlighting that BTC confirmed a powerful accumulation rating whereas consolidating round all-time highs.

An evaluation of BTC’s metrics additionally recommended that purchasing stress remained excessive. For example, BTC’s change reserve was inexperienced. As per CryptoQuat’s information, BTC’s Coinbase Premium was additionally inexperienced, that means that purchasing sentiment was dominant amongst US traders.

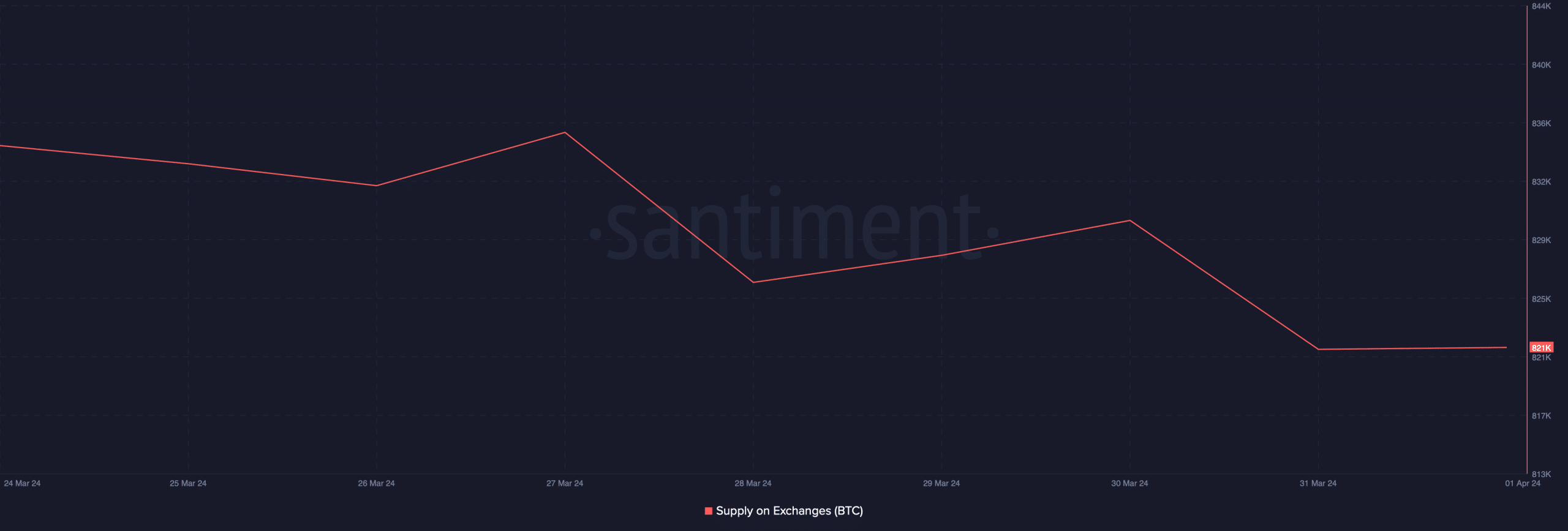

On high of that, BTC’s provide on exchanges dropped during the last week, additional establishing the truth that traders had been shopping for BTC whereas the coin was in a consolidation section.

Excessive shopping for stress may not be sufficient to cease the bears, as moist market indicators recommended a value correction, rising the possibilities of BTC hitting $60k.

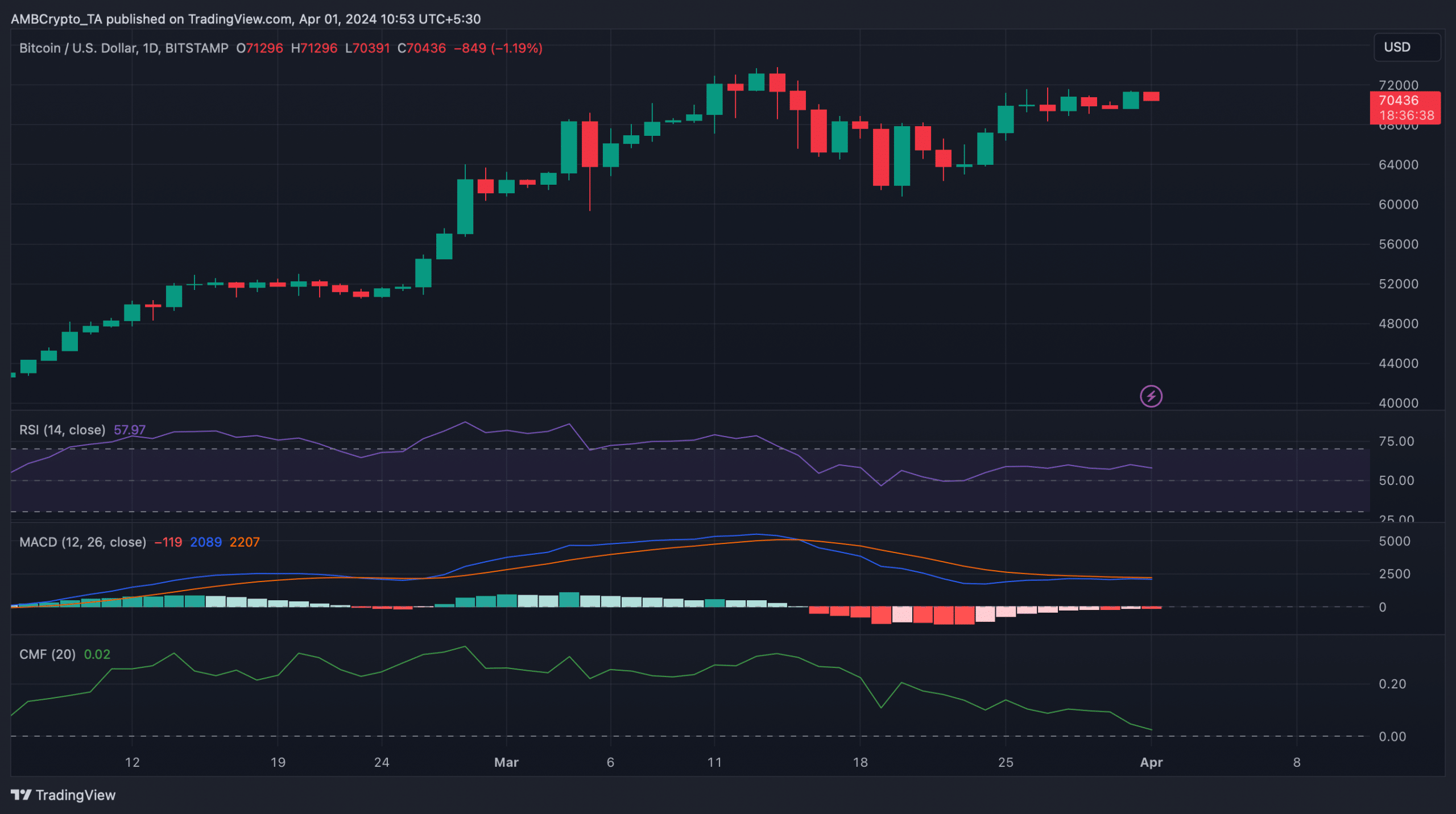

For instance, the MACD displayed a bearish crossover. The Relative Power Index (RSI) registered a downtick after days of sideways motion.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Furthermore, Bitcoin’s Chaikin Cash Move (CMF) went down sharply and was headed in direction of the neural mark. These indicators hinted that BTC would possibly quickly witness a value correction.

Due to this fact, traders would possibly take into account ready longer earlier than rising their accumulation.