- Retail merchants piled into Bitcoin longs, however whales pulled again, signaling the potential for a correction.

- Rising retail optimism and overleveraging might result in a pointy Bitcoin correction, as whales scale back publicity.

Bitcoin [BTC] is at a crossroads, with market sentiment sharply divided between retail merchants and whales. Retail buyers are more and more piling into lengthy positions, fueling optimism a couple of worth restoration.

In the meantime, whales are presently exhibiting warning by closing lengthy positions and even initiating brief positions. Traditionally, aggressive lengthy accumulation by retail merchants typically precedes a market correction and a possible liquidation wave.

With the rising stress between retail optimism and whale warning, the important query is whether or not retail merchants will drive the market greater or if whales will steer it towards a downturn.

Retail merchants double down whereas whales pull again

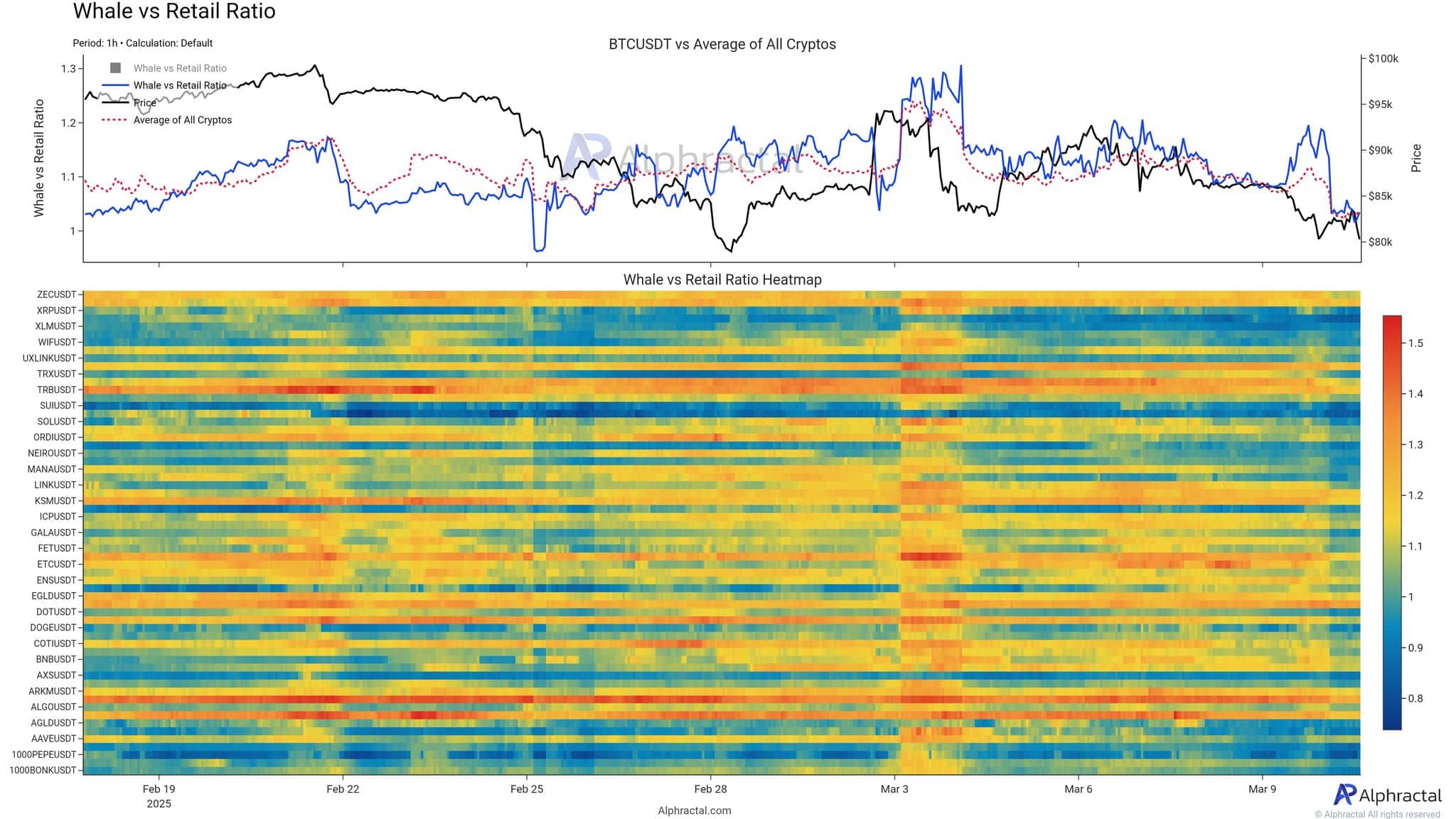

From the third to the ninth of March, retail exercise has surged, as mirrored by the broader blue-to-yellow spectrum – significantly whereas Bitcoin’s worth remained underneath stress.

In distinction, whales seem like adopting a extra cautious stance, as indicated by fewer crimson bands. Traditionally, important will increase in retail dominance with out affirmation from whales have typically been adopted by market corrections.

This divergence resembles earlier bull traps, the place retail euphoria clashed with whale-driven reversals. The present disparity means that whales could also be getting ready for a downturn, at the same time as retail merchants stay optimistic about additional good points.

Bitcoin: Retail merchants are all in, however at what value?

The retail lengthy/brief ratio heatmap reveals a pointy rise in lengthy positioning amongst retail merchants throughout numerous altcoins from March 3 onward.

But Bitcoin’s worth motion, proven within the high panel, diverges from this optimism – highlighting a rising disconnect between sentiment and market route.

Traditionally, such spikes in lengthy bias have preceded sharp corrections, as overleveraged retail positions are susceptible to fast downturns.

The heatmap’s depth reveals elevated retail conviction – bullish on the floor, however probably laying the groundwork for a liquidation-driven drop. If historical past is any information, this imbalance could possibly be nearing a reset, marking the present part as a precarious second of overconfidence.

The divergence between Bitcoin’s retail and whale sentiment

The information highlights a transparent divide: retail merchants are aggressively including lengthy positions, whereas whales are quietly lowering their publicity. Traditionally, such gaps have typically led to swift corrections, with overleveraged retail merchants dealing with liquidation as whales anticipate and capitalize on the decline.

Present developments recommend that whereas retail merchants are chasing momentum, whales are getting ready for potential volatility. With out assist from whales, a retail-driven rally might battle to maintain itself, leaving Bitcoin uncovered to a pointy reversal.

Historic context and looming dangers

Bitcoin’s historic cycles typically present a recurring sample: retail merchants enter lengthy positions in periods of peak optimism, simply as whales start to scale back their publicity. These phases steadily end in abrupt reversals and liquidation cascades.

This dynamic has performed out repeatedly, marked by surges in retail confidence adopted by sharp worth declines. The present setup bears a putting resemblance, with retail sentiment changing into more and more one-sided and leverage build up. This raises the danger of a sudden draw back transfer.