Though merchants are on edge as a result of value habits of Bitcoin, some analysts assume a breakout is simply across the nook.

Associated Studying

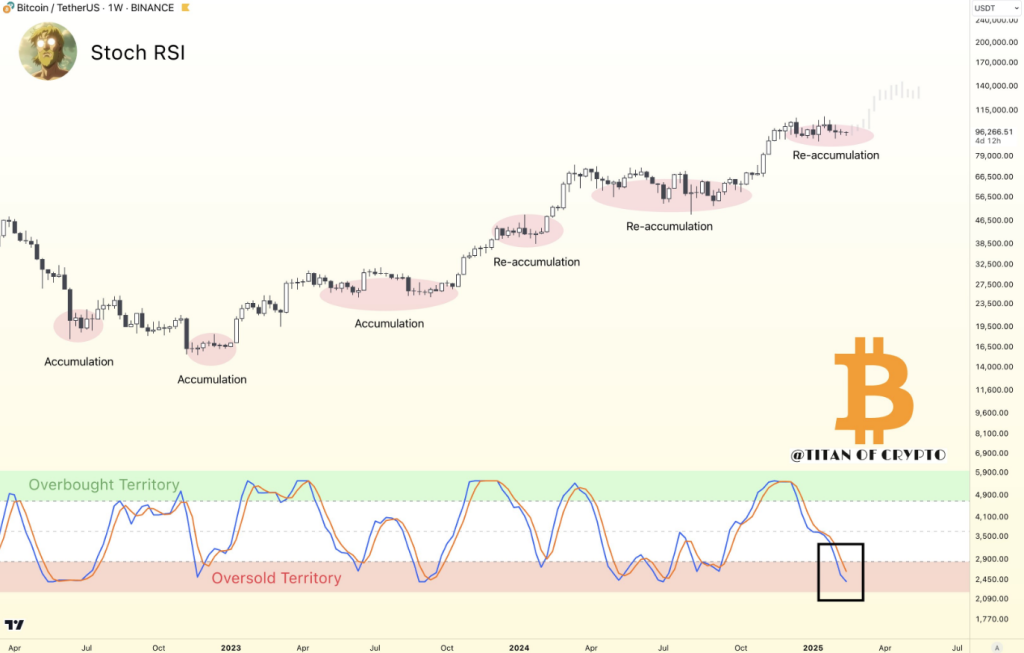

One of many vocal supporters of Bitcoin is “Titan of Crypto,” who means that Bitcoin’s stochastic relative energy index (StochRSI) is about to sign a serious transfer. Might BTC be about to begin a contemporary climb as institutional curiosity grows and technical indicators line up?

Bitcoin: Sturdy Reversal From StochRSI Alerts

Titan of Crypto claims that the weekly StochRSI of Bitcoin is in oversold zone, a state of affairs that has at all times preceded notable constructive reversals. Measuring momentum, this indicator factors to BTC perhaps getting ready for a push greater. The analyst stated:

“Bitcoin may very well be ‘about to take off.’”

The highest crypto is at present buying and selling round $96,910, marking a 1.36% improve from the earlier session. Exhibiting indications of accelerating volatility, the intraday vary has various from $95,400 to $97,300. Ought to the StochRSI pattern comply with, BTC may bounce again to greater ranges.

#Bitcoin About to Take Off? ????#BTC has entered oversold territory on the weekly Stoch RSI, a sign typically marking accumulation or re-accumulation. pic.twitter.com/DHyEKXT31E

— Titan of Crypto (@Washigorira) February 19, 2025

Institutional Demand Nonetheless Stays Sturdy

Institutional engagement is among the primary components exhibiting nice promise for Bitcoin. Effectively-known for its aggressive acquisition of the crypto, Strategy (beforehand MicroStrategy) has revealed intentions to buy extra Bitcoin by way of $2 billion raised through convertible notes. This motion underscores mounting perception within the long-term worth proposition of Bitcoin.

Bitcoin ETFs, with whole belongings amounting to $120 billion, have garnered substantial inflows. Because of the reputation of those funding merchandise, which has strengthened their standing within the monetary markets, organisations now have simpler entry to essentially the most broadly utilized digital asset globally.

BTCUSD buying and selling at $96,980 on the 24-hour chart: TradingView.com

Market Contradictions Increase Questions

Regardless of hopeful indicators, not everybody thinks Bitcoin will growth quickly. Crypto shares underperform typical shares, say some specialists. BTC stays under its January peak, suggesting market uncertainty regardless of the S&P 500’s highs.

Latest Bitcoin value swings point out investor uncertainty. Regardless of constructive macro indications, bitcoin has stalled, sparking some reservations relating to its subsequent trajectory.

Associated Studying

Bitcoin’s Subsequent Transfer: Breakout Or Consolidation?

Bitcoin’s future continues to be hotly debated given institutional traders’ ongoing curiosity and technical indicators pointing to a possible breakout. Ought to earlier developments maintain, the market is perhaps about to expertise a rare climb. Macroeconomic occasions and investor temper will finally, nonetheless, determine whether or not BTC can preserve a breakout or maintain buying and selling sideways.

Proper now, everybody’s targeted on the subsequent technical affirmation for Bitcoin. Will the bulls take over, or will doubt assist to manage costs? For the largest cryptocurrency on the planet, the subsequent weeks may very well be essential.

Featured picture from Gemini Imagen, chart from TradingView