- Bitcoin faces key resistance on the $63.9k degree.

- Revenue-taking exercise is pure throughout worth appreciation and doesn’t essentially mark cycle tops.

Bitcoin [BTC] has been trending downward since April on the upper timeframe worth charts such because the weekly.

The every day timeframes confirmed extra volatility, such because the 22% worth surge in July from $56k to $68k or the more moderen pump from $55k to $64k, a 17.5% transfer up to now two weeks.

Is the Bitcoin bull run over?

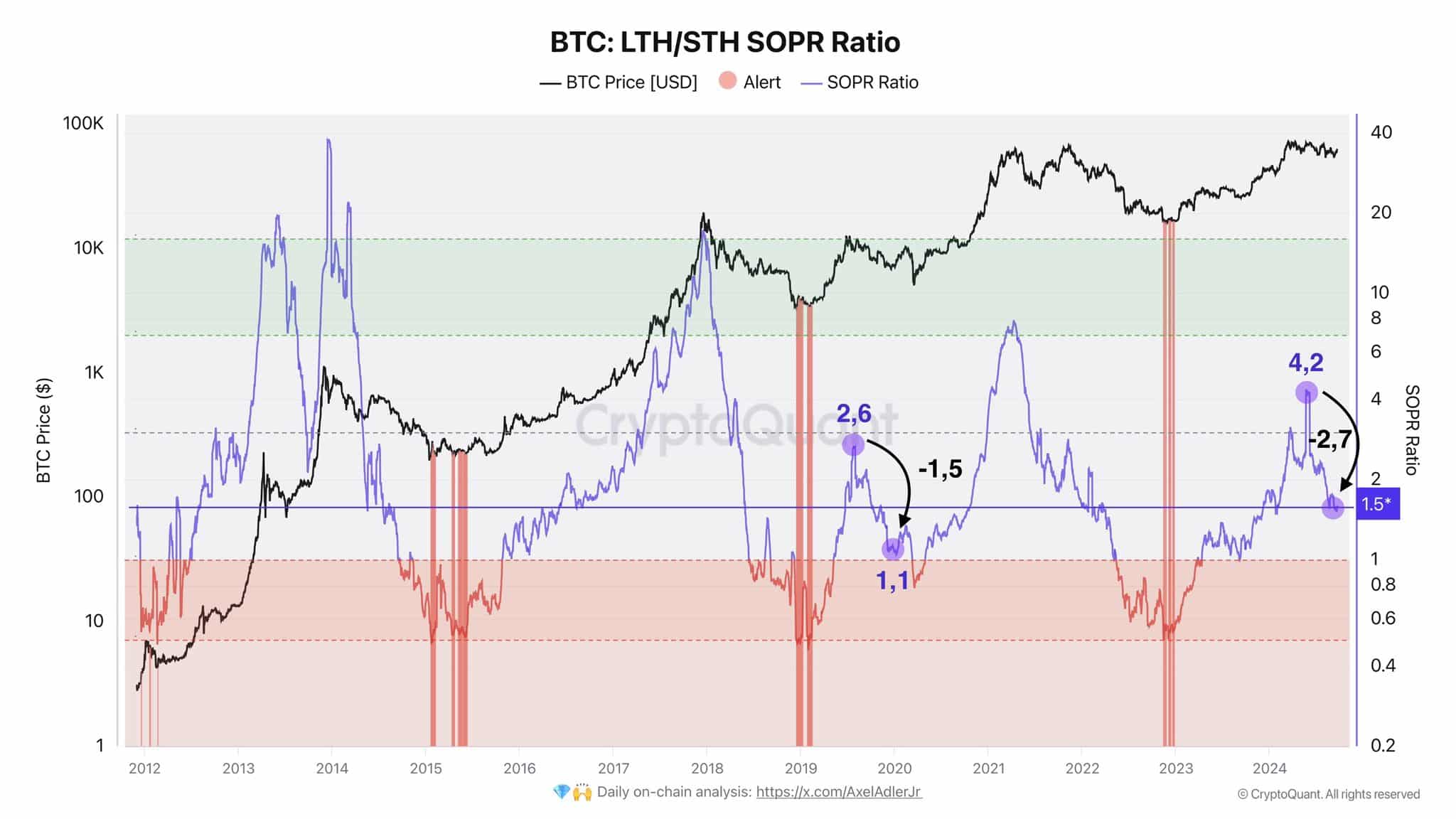

Supply: Axel Adler on X

As crypto analyst Axel Adler famous in a post on X, the formal transition to a bull market just isn’t distant. The 200-day shifting common at $63.9k must be breached and flipped into help.

Many market members have been satisfied that the rally to $73.7k in March marked the top of the bull run and that the Bitcoin halving won’t usher in one other run for the reason that cycle dynamics have modified.

The chart above reveals that the October 2023-June 2024 was a bullish development, however was this the true bull run? For instance, within the earlier cycle, the interval from the Covid crash to the 2020 halving in Might noticed Bitcoin acquire 157% in 10 weeks.

Subsequently, a sizeable worth rally into the halving occasion just isn’t unprecedented. The size of the bullish interval was fairly lengthy, prolonged by the Bitcoin spot ETF approval. Every cycle has its variations.

Holders’ habits confirmed a market prime was seemingly not but in

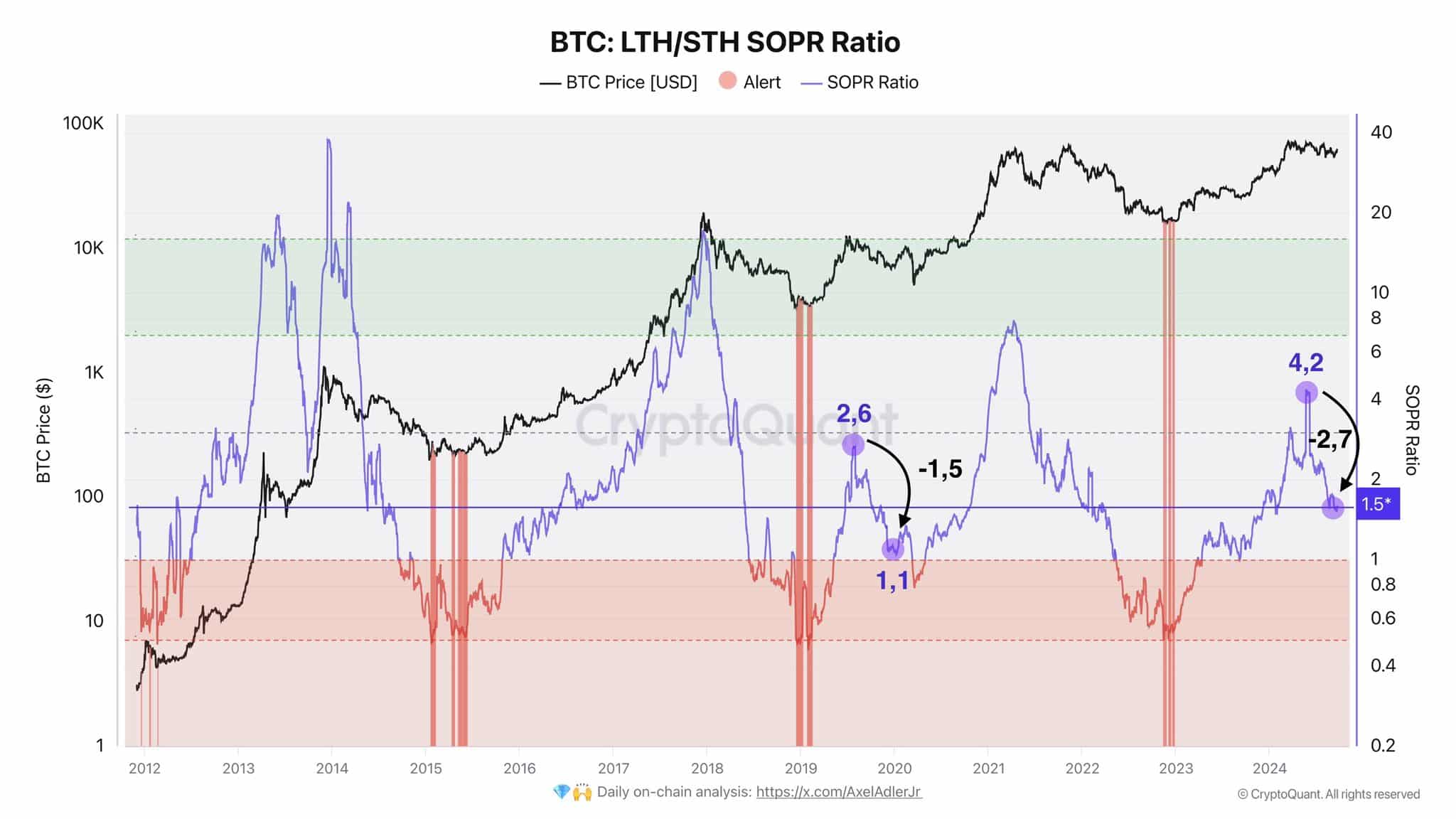

Supply: Axel Adler on X

One other chart from the identical analyst confirmed that worth appreciation durations are naturally accompanied by holders taking earnings. This by itself doesn’t imply the bull run is over.

Moreover, the long-term holder/short-term holder spent output revenue ratio (LTH/STH SOPR) was but to push previous the 7. This was a development that marked the tops of the earlier two cycles.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The interval earlier than the earlier bull run noticed a big worth appreciation in 2019. This transfer was used to take earnings. This took the SOPR from 2.6 to 1.1. Equally the promoting strain of the previous 5 months noticed the metric go from 4.2 to 1.5.

Total, the metrics nonetheless supported the thought of additional worth growth for Bitcoin within the coming months.