Key Notes

- Bitcoin closed August down 6%, its first month-to-month loss since February, after briefly touching new all-time highs above $124,000.

- Ethereum outperformed with a 25% August acquire amid company accumulation, contrasting Bitcoin’s weaker momentum and declining volumes.

- Michael Saylor hinted at renewed purchases as Bitcoin consolidates round $108,800, doubtlessly signaling a worth ground close to present ranges.

Bitcoin’s worth consolidated round $108,800 on August 31, 2025, marking a 1% intraday decline and positioning the asset for a 6% month-to-month loss, its first crimson month since February.

This underwhelming efficiency comes after Bitcoin worth surged to new all-time highs round $124,500 on August 14, earlier than reversing as merchants rotated capital towards Ethereum. In stark distinction, ETH gained 25% in August, fueled by Ethereum Technique Reserve accumulation from companies equivalent to Sharplink Gaming and Tom Lee’s Bitmine.

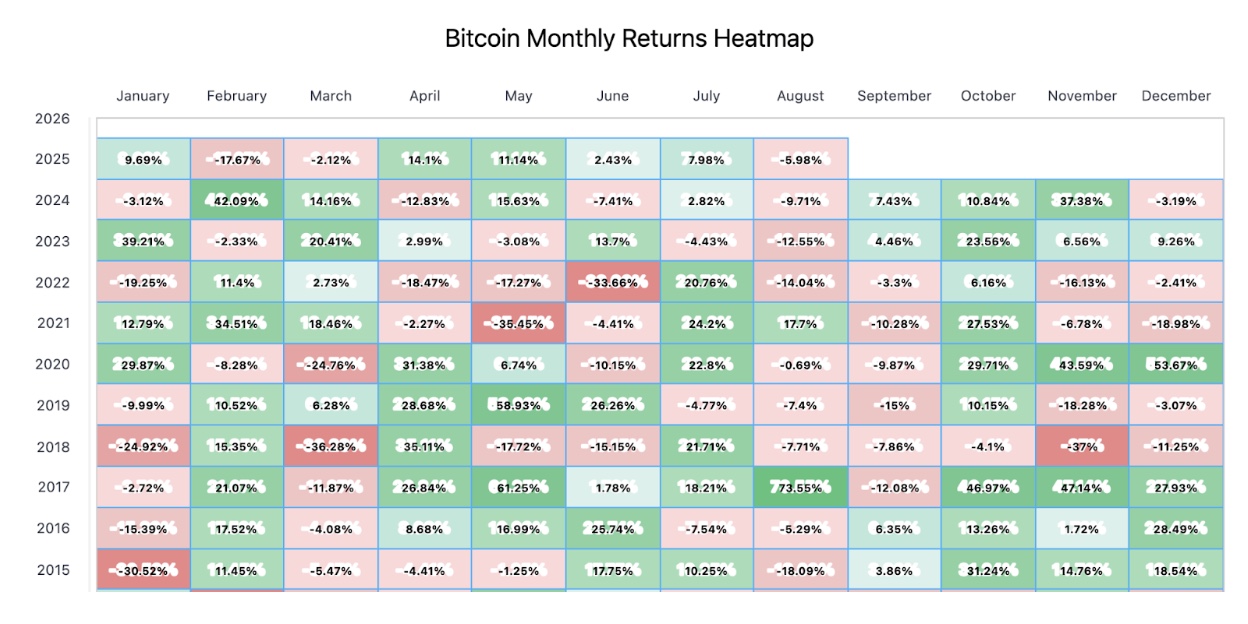

Bitcoin Month-to-month Returns Heatmap | Supply: BitcoinROI.com | August 31, 2025

Historical returns data from BitcoinROI highlights that August has been a blended month for BTC, with losses recorded 8 occasions within the final 10 years. The August rallies since 2015 have included a 73% acquire in 2017 and a 17.7% enhance in 2022.

The seasonal developments additionally present that BTC worth has posted positive aspects in September, October, and November for 2 consecutive years, elevating hopes of a repeat efficiency.

Extra so, present macroeconomic situations may additionally lean in Bitcoin’s favor. Following a number of calls from US President Donald Trump, embattled Fed Chair Jerome Powell lastly delivered hawkish hints throughout his speech at Jackson Hole in late August.

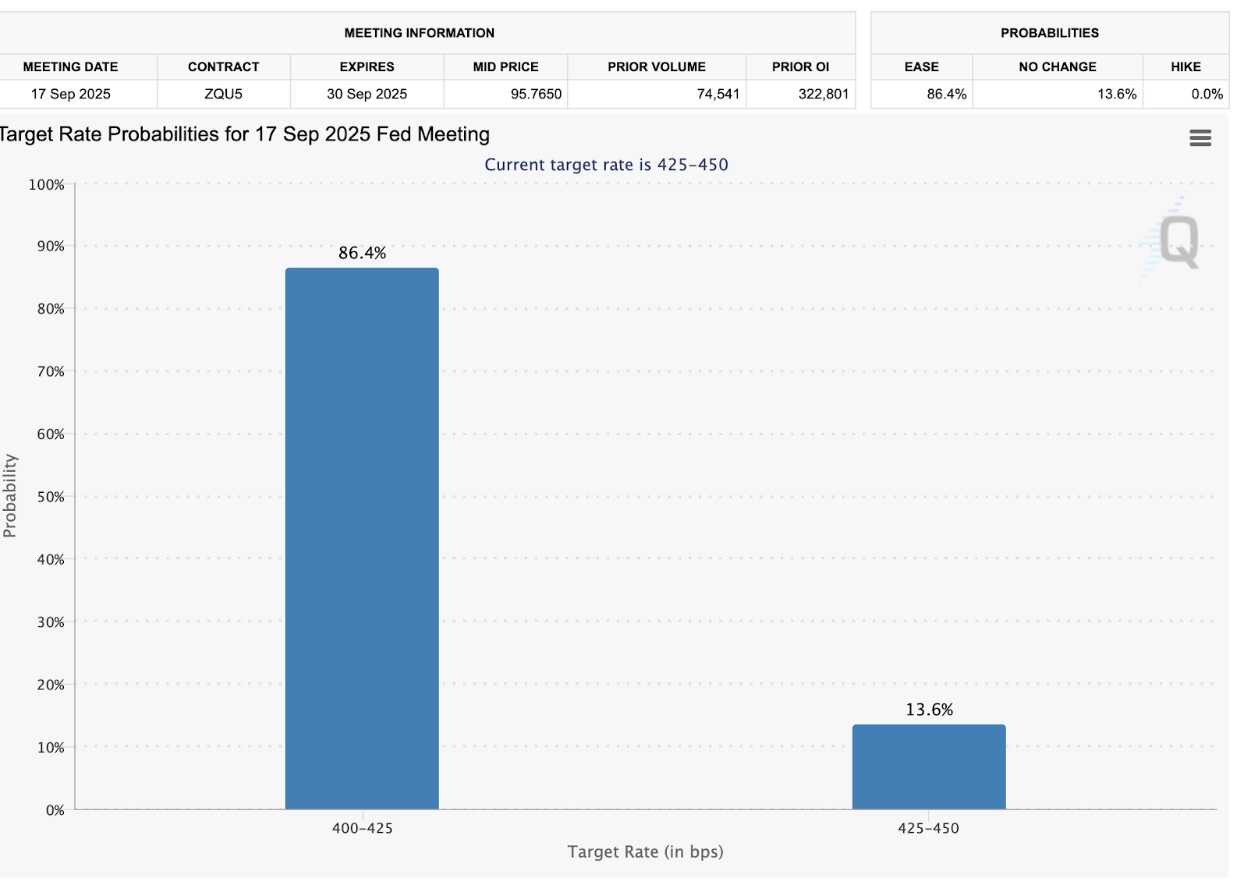

CME Group Fed WatchTool Exhibits Analysts Pricing in 86% likelihood of a charge minimize | Supply: CMEGroup, August 31, 2025

Within the aftermath of the hawkish Fedspeak, CME Group analysts have priced in an 86.4% likelihood of the US Federal Reserve’s first charge minimize in 2025, through the subsequent FOMC assembly slated for September 17. This anticipated increase in cash provide improves the outlook for danger property, doubtlessly setting Bitcoin worth motion on a path to reflect the bullish developments of 2023 and 2024, when it recorded positive aspects from September to October.

Bitcoin continues to be on Sale. pic.twitter.com/rXP6G84rbs

— Michael Saylor (@saylor) August 31, 2025

Trying forward, Bitcoin seems to have shaped an area backside close to $108,000. Technique CEO Michael Saylor fueled hypothesis with one other cryptic post on Sunday, hinting at contemporary Bitcoin purchases. On condition that volumes have fallen sharply in latest days, renewed shopping for from institutional gamers like Technique may present a much-needed near-term increase to liquidity and sentiment.

Bitcoin Value Forecast: Is $108K the Backside Earlier than a September Rebound?

At first look, Bitcoin’s technical indicators recommend consolidation close to a vital assist degree. The Bollinger Bands present BTC buying and selling simply above the decrease band at $106,529, indicating oversold situations after the latest selloff. The MACD stays in unfavorable territory, with the sign line nonetheless above, confirming ongoing bearish momentum and suggesting {that a} potential reversal may type if momentum shifts.

On the upside, the primary resistance lies on the 20-day transferring common round $114,384. A breakout above this zone may open the trail towards $118,000, with stronger bullish continuation retesting the $122,000 higher Bollinger Band.

Bitcoin (BTC) Technical Value Evaluation | Supply: TradingView

On the draw back, rapid assist sits at $108,000, the latest native backside. A sustained break decrease may expose Bitcoin to the $106,500 Bollinger Band ground. If this degree fails, merchants could eye a sharper correction towards $102,000 earlier than patrons re-emerge.

In abstract, with spot buying and selling volumes dipping 29% on Sunday and momentum indicators leaning bearish, Bitcoin worth seems poised for extra sideways motion within the near-term. If Saylor’s hinted purchases materialize and Fed charge cuts shouts develop louder, BTC may reestablish upward momentum in September.

Maxi Doge Presale Nears $1.9M Goal as Bitcoin Value Stumbles

With Bitcoin worth consolidating across the $108,000 ground and broader market sentiment subdued, some merchants are rotating into speculative tokens like Maxi Doge (MAXIDOGE), a meme-themed venture providing 1000x leverage with no stop-loss.

Maxi Doge Presale

Presently priced at $0.000253, the Maxi Doge presale has raised $1.6 million of its $1.9 million aim, with solely two days left earlier than the following worth enhance. The venture has gained traction amongst high-risk merchants, viewing it as a counter-narrative alternative whereas BTC worth faces extended consolidation.

Buyers searching for early entry can safe MAXIDOGE tokens by means of the official Maxi Doge site.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.