The price of Bitcoin is step by step retaining its upward pattern because the flagship asset eyes the $100,000 pivotal mark after a slight rebound on Monday. Throughout the waning worth performances over the previous few days, current information exhibits that BTC’s funding charges have persistently maintained a bullish sentiment.

BTC’s Funding Charges Defies Market Dip

Bitcoin has confronted bearish strain over the previous few days, inflicting its worth to retest the $94,000 vary. Regardless of the notable worth drop, funding charges throughout a number of crypto exchanges stay optimistic.

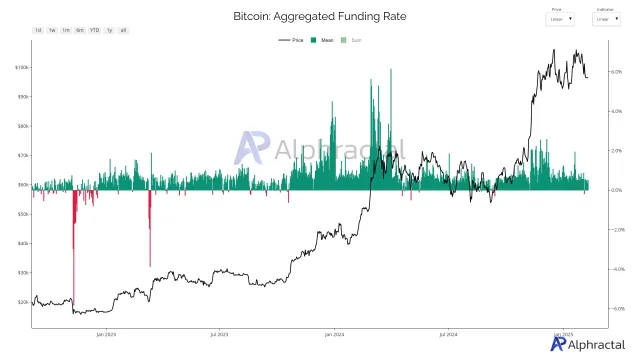

Alphratcal, a complicated funding and information analytics agency reported the event in an X submit. Information from the platform exhibits that Bitcoin’s aggregated funding charges have sustained a bullish pattern amongst 11 crypto exchanges, signaling that merchants are sustaining an optimistic sentiment.

Merely put, extra merchants are inserting leveraged long-term bets on BTC than short-term bets as they anticipate a worth restoration. This suggests that long-term investors are masking the funding charges, that are assessed each 8 hours, whereas short-term traders are being paid.

A rise in long-term positions showcases traders’ sturdy confidence in BTC’s long-term potential. Ought to this optimistic pattern proceed, the event may spur renewed momentum in the upcoming days, permitting the asset to reclaim key resistance ranges.

In accordance with Alphractal, Bitfinex (BTC-USDT) has the best funding charge in the mean time, whereas BitMEX (XBTUSD) and OKX (BTC-USD-SWAP) are the one two crypto exchanges with unfavorable funding rates. The hole means that merchants have completely different opinions concerning the market throughout completely different platforms.

Addressing what the event might imply for Bitcoin, Alphractal said that if the funding charge stays optimistic, it may be an indication of overconfidence and the opportunity of liquidation ought to BTC’s price proceed to fall. Nevertheless, it might point out a extra bearish marketplace for BTC the place brief positions dominate if the speed turns unfavorable throughout the board.

Within the meantime, Alphractal highlighted that almost all exchanges nonetheless show optimistic funding charges as they preserve an general common above zero. Particularly, sustaining an general common above zero means that the market is just not but typically bearish although it has declined.

Coinbase Premium Index Turns Inexperienced

One other metric that has turned optimistic amid waning worth actions is the Coinbase Premium Index. An increase within the metric demonstrates renewed confidence and demand in BTC amongst US institutional traders.

Associated Studying: Bitcoin Coinbase Premium Index Flips Positive As Market Euphoria Increases, A Rally Imminent?

For the reason that index turned optimistic, it has impacted BTC positively, inflicting a rebound from the $94,000 mark to the $97,000 stage. Nevertheless, the flagship asset should recover above $100,000 in an effort to set up extended upward momentum.

On the time of writing, Bitcoin has fallen by over 2%, bringing its worth to the $97,400 stage. With traders’ sentiment rising as evidenced by a virtually 84% enhance, the drop could shift towards the upside shortly.

Featured picture from Unsplash, chart from Tradingview.com