The worth motion of Bitcoin over the previous week was largely redemptive, because the premier cryptocurrency reclaimed its place above the psychological $100,000 mark. This latest burst of bullish momentum mirrors a healthily rising sentiment amongst buyers.

On Friday, Might 15, the Bitcoin worth reached as excessive as $103,800 — its highest stage since January. Nonetheless, the most recent on-chain information exhibits the absence of investor exercise within the derivatives market, sometimes seen when BTC’s worth hits this stage.

BTC Value Rally About To Hit A Roadblock?

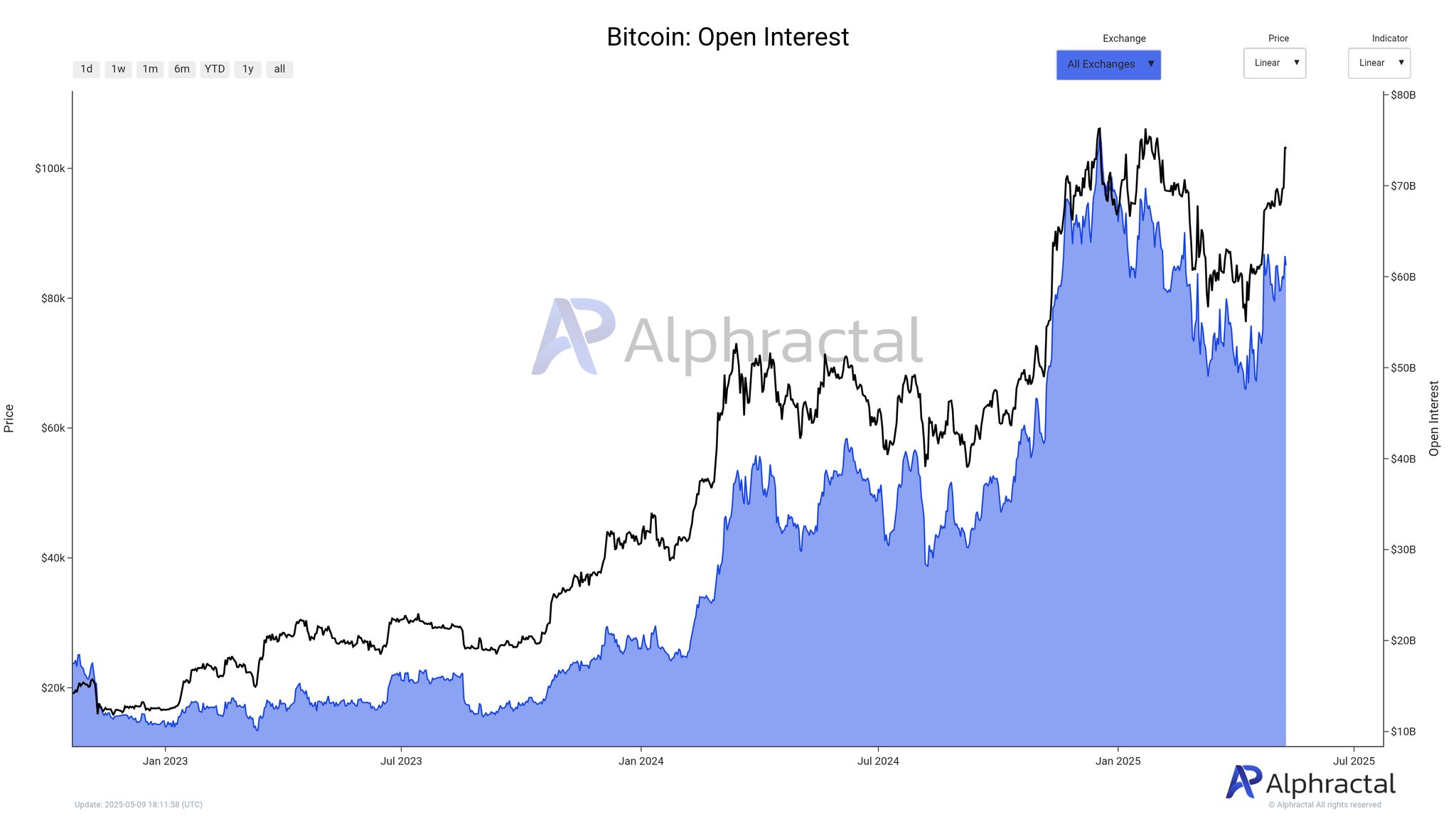

In a latest publish on the social media platform X, crypto analytics platform Alphractal shared that the open curiosity (OI) has not fairly moved in tandem with the Bitcoin worth over the previous few days. The open curiosity metric measures the entire amount of cash flowing into BTC derivatives at any given time.

Rising open curiosity is commonly thought of a bullish sign for the premier cryptocurrency, particularly because it suggests recent capital inflow into the market. Finally, this pattern suggests bettering investor sentiment and surging dealer confidence.

In accordance with information from Alphractal, the present aggregated OI for Bitcoin (valued at round $103,000) stands at an estimated $61.3 billion. The final time BTC was at this monumental worth, the open curiosity was greater than $68 billion.

Supply: @Alphractal on XWith the present Bitcoin open interest lower than the OI the final time worth was at $103,000, Alphractal famous that this pattern suggests decrease leverage and diminished exercise in crypto’s largest market. The analytics agency additional defined that this phenomenon may very well be as a consequence of both latest waves of liquidations or place closures.

Within the publish on X, Alphractal revealed different the reason why the flagship cryptocurrency’s worth may be susceptible to a short-term correctional motion. The related on-chain metric backing this bearish projection is the Whale Place Sentiment.

The Whale Place Sentiment metric tracks each the directional bias and buying and selling conduct of huge holders. It sometimes displays the online positioning of whales, their market sentiment, and likewise modifications in open positions.

Chart exhibiting a decline within the Whale Place Sentiment from 1 to round 0.7 | Supply: @Alphractal on XAlphractal concluded that the drop within the Whale Place Sentiment displays giant buyers’ curiosity in closing lengthy positions, thereby shifting market sentiment. If the metric continues to drop, the on-chain analytics agency inferred that it may result in worth stagnation, or worse, a correction.

Bitcoin Value At A Look

As of this writing, the price of BTC stands at $103,035, reflecting no vital motion within the 24 hours. Whereas the latest bullish momentum means that the premier cryptocurrency may hit a brand new all-time excessive within the coming days, buyers may wish to train warning, contemplating latest on-chain observations

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.