- Bitcoin’s Futures market noticed over $10 billion in Open Curiosity worn out.

- CME Open Curiosity dropped 45% from 18th of December to 18th of March.

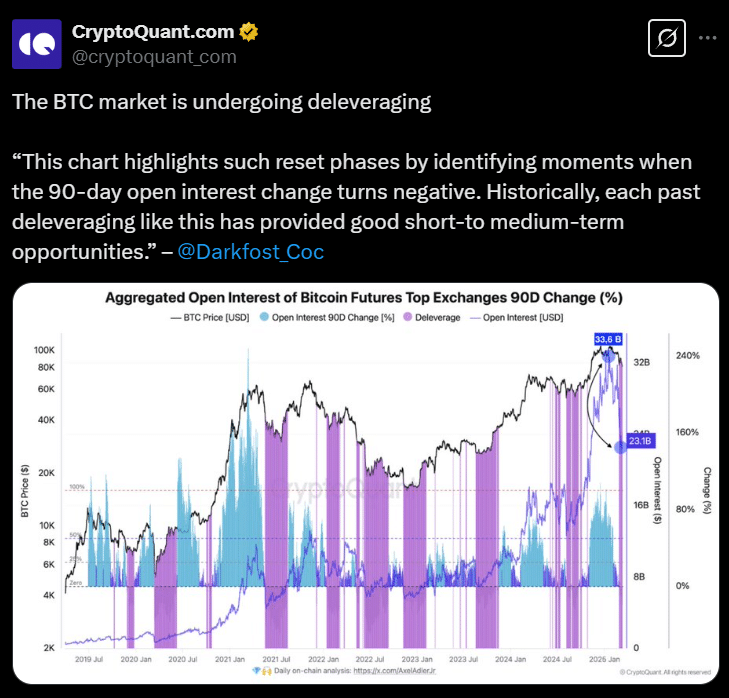

Bitcoin’s [BTC] Futures market is present process one in all its largest deleveraging occasions, with over $10 billion in Open Curiosity worn out since January 2025. The height, on the seventeenth of January, was at $33 billion.

It was an all-time excessive in market leverage, as per a CryptoQuant analyst.

Between twentieth of February and 4th of March, Open Curiosity dropped by $10 billion.

The decline was seemingly accelerated by mounting uncertainty from each home and worldwide political developments and market-wide liquidations.

CryptoQuant analysts describe this section as a pure market reset, a sample that has traditionally preceded short- to medium-term bullish tendencies.

This decline will not be the primary time extreme leverage has triggered a market reset.

Historical past repeats itself: Echoes of March 2024

An analogous occasion came about in March 2024, when Bitcoin pulled again sharply from $69,000 to $59,700. That specific occasion compelled a wave of obligatory exits from leveraged positions, totaling $1 billion.

Moreover, that correction led to a normalization of Funding Charges throughout main cryptocurrencies, paving the best way for a sustained rally later within the yr.

As historical past suggests, deleveraging cycles usually coincide with exterior financial and geopolitical developments, additional amplifying market reactions.

Reportedly, the newest deleveraging wave was influenced by exterior geopolitical tensions and ongoing macroeconomic shifts, including complexity to market dynamics.

A sequence of market reactions adopted Donald Trump’s current statements on crypto, which included claims of ending “Joe Biden’s battle on Bitcoin and crypto.”

Market-wide deleveraging doesn’t occur in isolation. Funding Fee actions supply additional perception into how merchants adjusted their danger publicity throughout this era.

From $104k to $82k — What actually occurred?

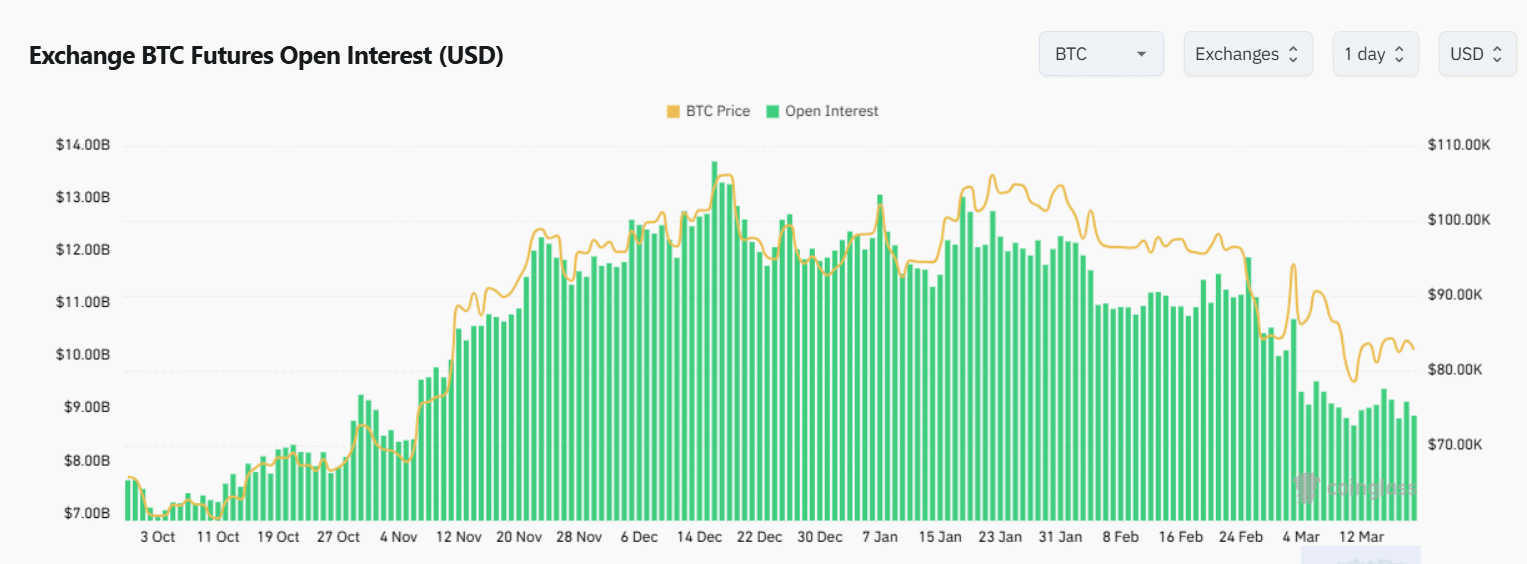

By late February, Open Curiosity on Bitcoin Futures contracts had fallen beneath $60 billion, down from $70 billion in January, in line with Coinglass information.

Bitcoin’s Futures Open Curiosity on Coinglass highlighted the connection between leverage discount and value actions.

Between December 2024 and March 2025, Bitcoin’s Open Curiosity fell from $13.70 billion to $8.86 billion. The information confirms a 35% decline in OI throughout this era, alongside a 20% drop in Bitcoin’s value.

This implies that the December rally was fueled by extreme leverage, which was later unwound as sentiment shifted.

Funding Charges flip

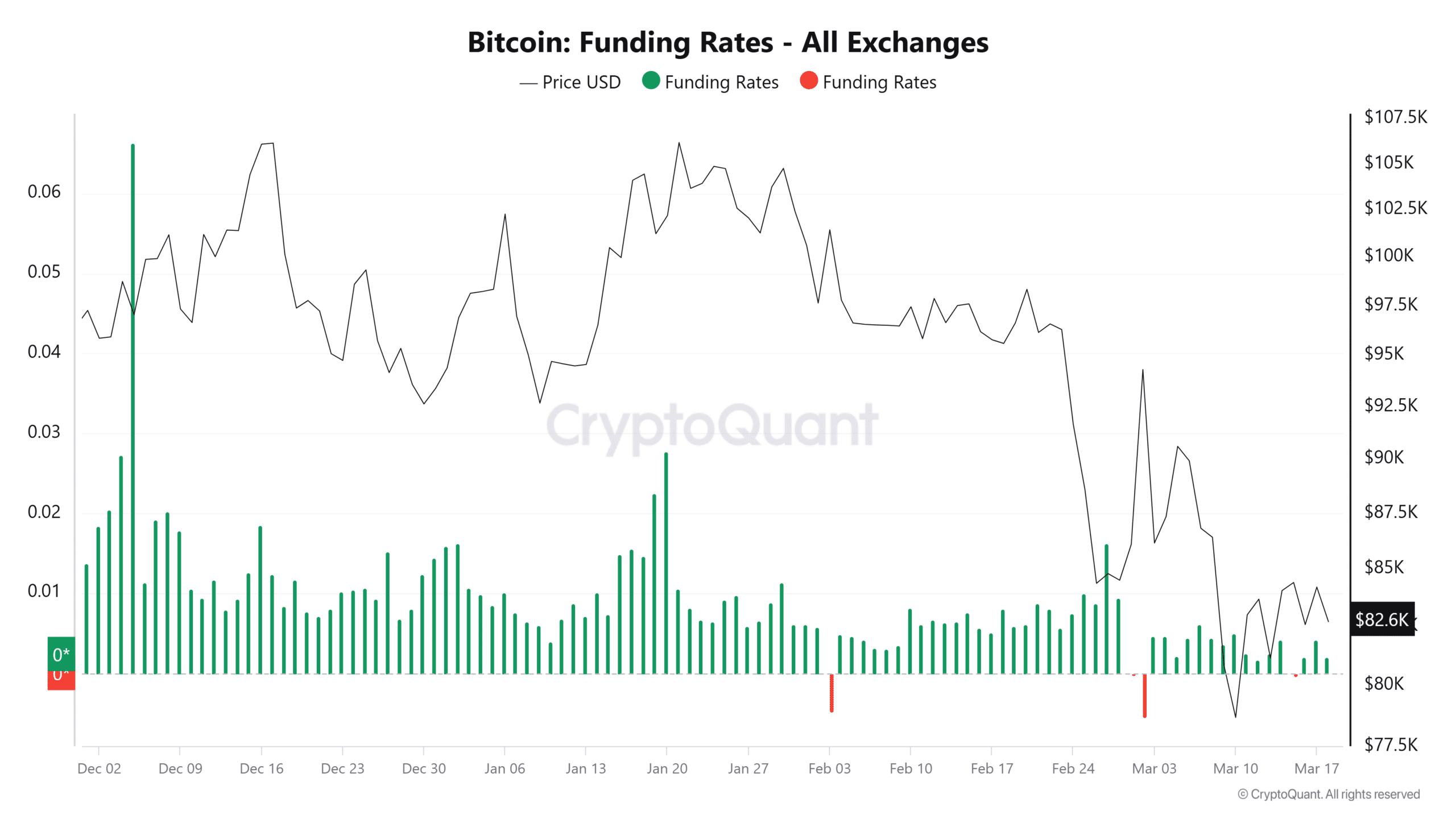

Funding Fee tendencies provide extra affirmation of Bitcoin’s ongoing deleveraging.

Between December 2024 and March 2025, Funding Charges shifted from strongly constructive to unfavorable. That was signaling a transition from bullish to bearish sentiment.

All through December and early January, Funding Charges had been persistently constructive, reflecting excessive demand for leveraged lengthy positions.

On the third of February, Funding Charges turned unfavorable (-0.00479) for the primary time in months, coinciding with Bitcoin’s value peak of $101,440.

By the 2nd of March, Funding Charges had dropped additional to -0.00554. This confirmed that merchants had been closing leveraged positions or dealing with compelled liquidations.

This decline mirrors the March 2024 Funding Fee reset, when charges collapsed from triple-digit figures to beneath 20%, signaling the tip of an overheated futures market.

As Funding Charges reset, Open Curiosity information gives one other layer of perception into how capital exited leveraged positions.

How institutional merchants responded

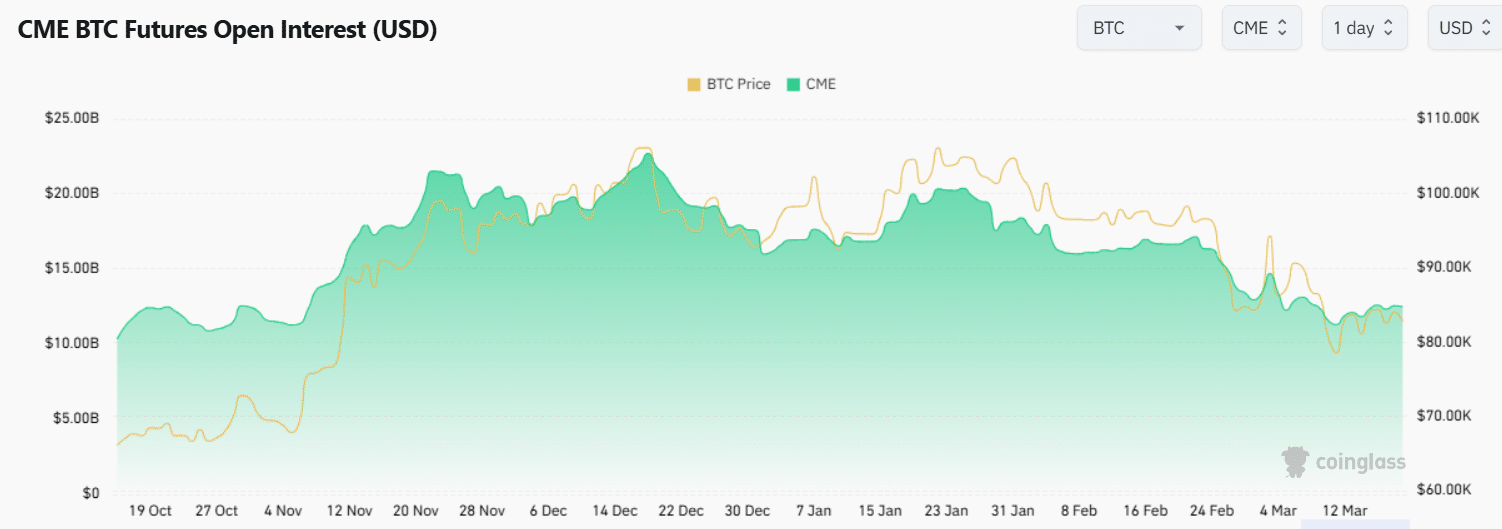

Institutional merchants adopted the same sample, with CME Bitcoin Futures displaying a comparable discount in leveraged publicity.

A pointy decline in CME Bitcoin Futures Open Curiosity confirms that institutional merchants additionally decreased leveraged publicity.

CME Bitcoin Futures Open Curiosity fell 45% from $22.71 billion on the 18th of December to $12.50 billion by the 18th of March, as Bitcoin dropped to $82,785.

To additional validate the extent of the market reset, Funding Fee shifts on a broader scale supply a further perspective.

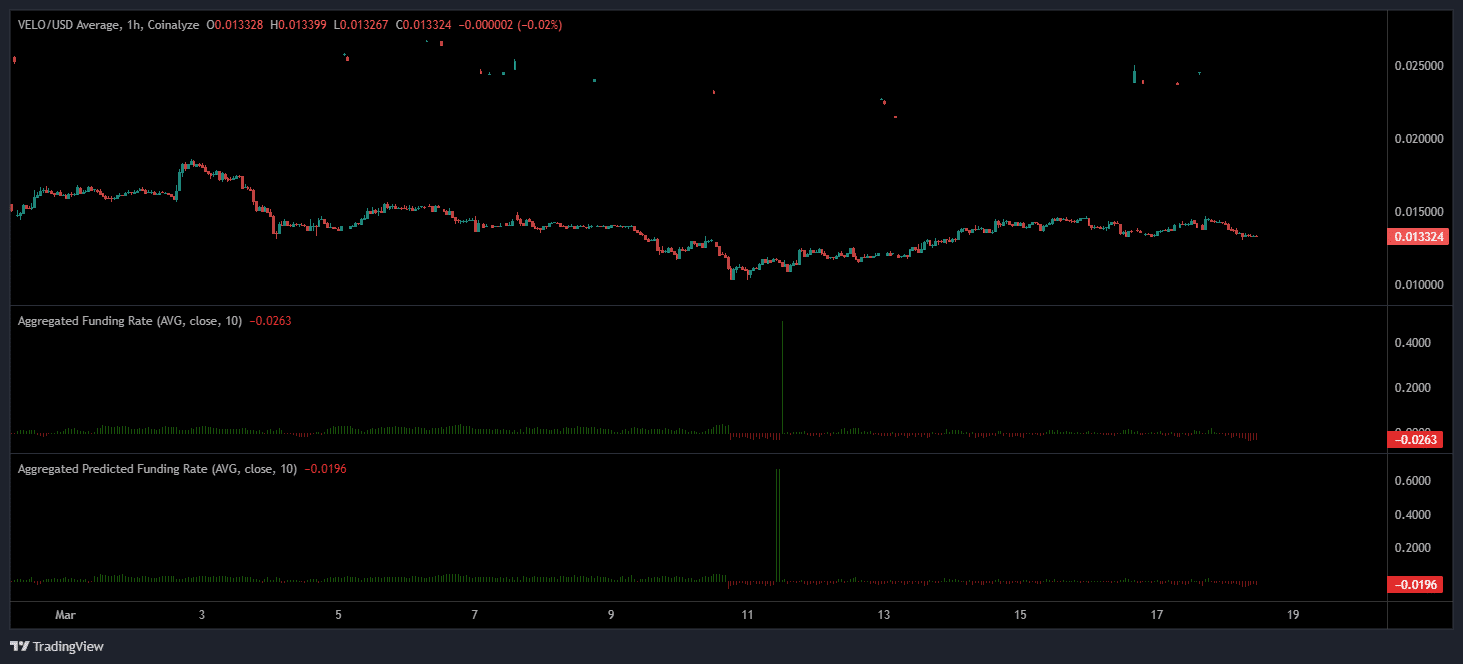

An evaluation of aggregated Funding Charges additional helps the deleveraging thesis.

On the eleventh of March, aggregated Funding Charges surged to +0.4984, reflecting an overheated market. Nonetheless, a speedy reversal adopted, with charges turning unfavorable by the 18th of March (-0.0263).

Bitcoin’s value decline from $101,440 in February to $82,800 in March means that merchants aggressively unwound lengthy positions, amplifying downward strain.

A reset or a reversal?

Regardless of the current downturn, analysts see potential for a bullish restoration.

Bitcoin’s $10 billion deleveraging is without doubt one of the largest resets in over a yr.

With Funding Charges normalizing and Open Curiosity stabilizing, merchants are looking ahead to accumulation indicators which will drive a bullish development in Q2 2025.

Whereas uncertainties persist, historic patterns point out that such resets usually pave the best way for long-term recoveries.