- Bitcoin, at press time, was testing its higher channel boundary as inflation cooled down and Trump paused tariff hikes

- Whale exercise and rising giant transactions strengthened a possible breakout above key resistance

Bitcoin [BTC] is regaining investor consideration once more after Trump’s tariff pause and cooling inflation eased macroeconomic stress, probably creating the right set-up for a bullish breakout. These two developments have sparked renewed optimism throughout international markets, lowering the necessity for aggressive financial tightening and inspiring a shift in the direction of threat property.

Due to this fact, Bitcoin—typically favored as each a hedge and a development asset—stands to learn from the enhancing backdrop. As institutional urge for food progressively returns, the value construction and on-chain habits are starting to mirror this renewed momentum.

Is Bitcoin prepared to flee the descending channel?

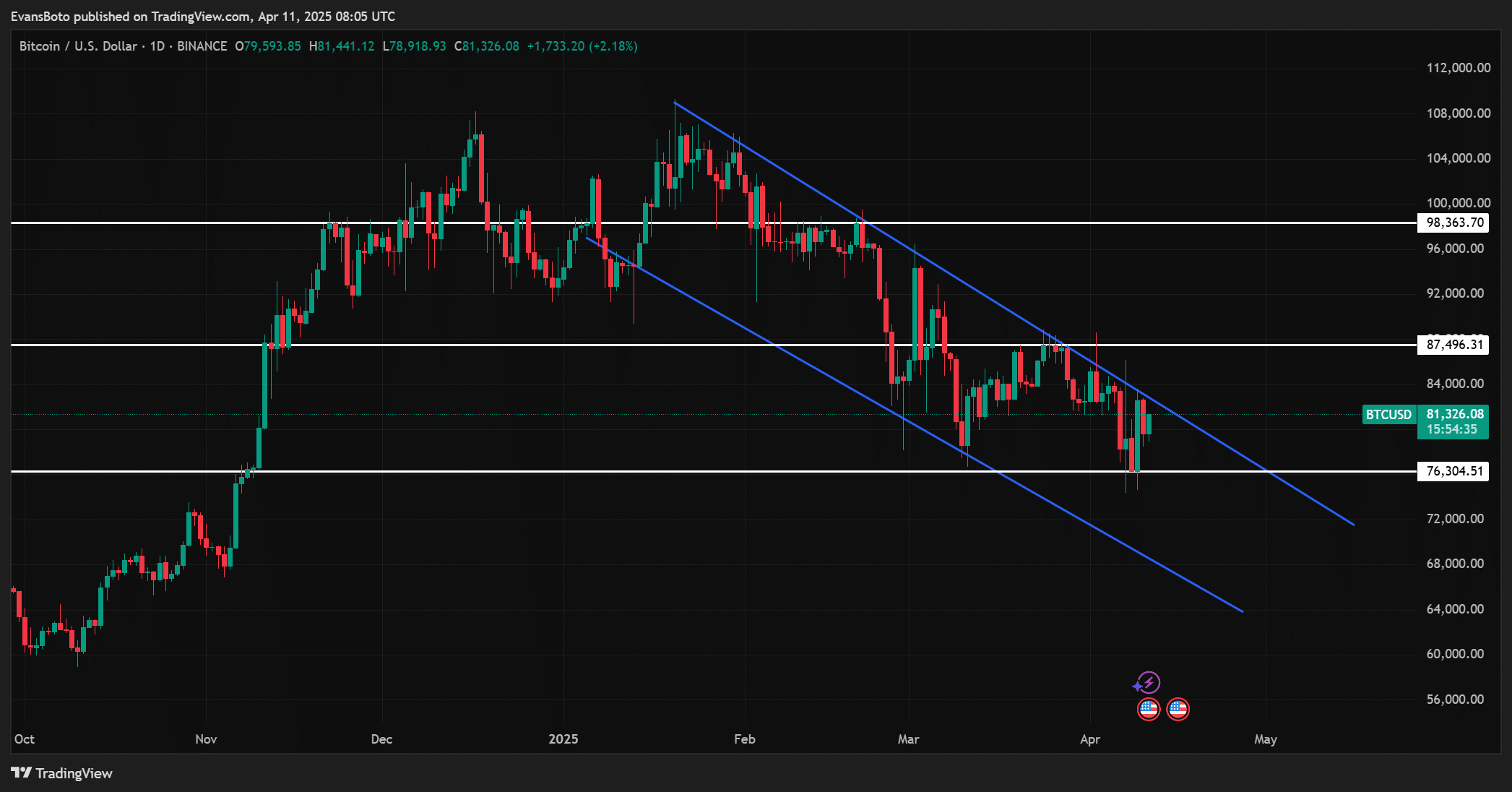

On the time of writing, Bitcoin was buying and selling at $81,614.11, down 0.15% within the final 24 hours. Nonetheless, this slight dip masks an essential growth on the chart. BTC gave the impression to be testing the higher boundary of a descending channel after bouncing off the $76,304 assist.

A every day shut above $87,496 might affirm a breakout, probably pushing the value in the direction of the $98,363 resistance.

Due to this fact, the technical setup would possibly lean bullish, however provided that consumers keep stress. If BTC fails to clear the channel, the danger of a pullback in the direction of its decrease assist ranges will increase. Momentum has been constructing, however affirmation stays key.

What’s the stablecoin provide ratio signaling?

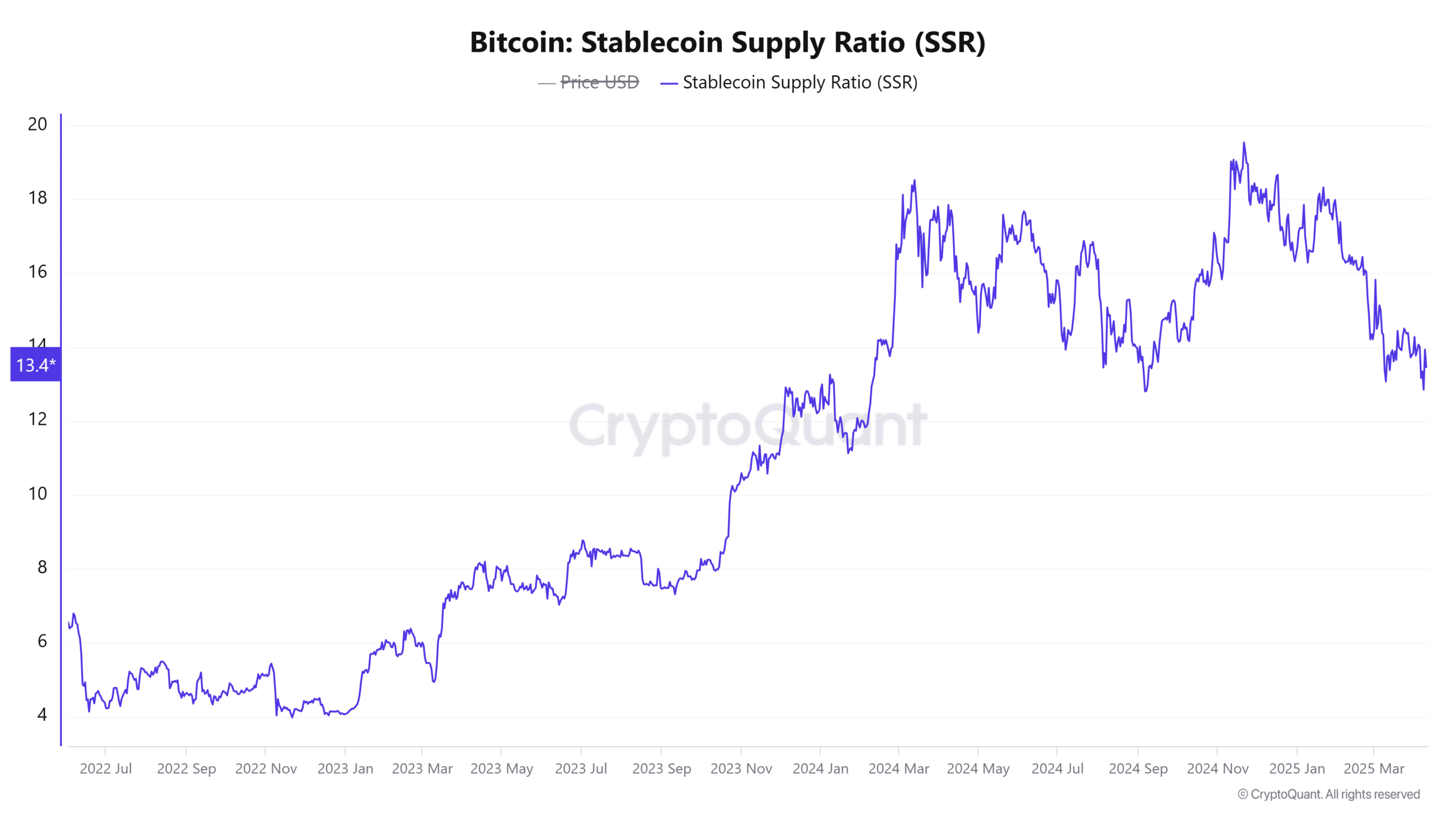

The Stablecoin Provide Ratio (SSR) rose by 0.97% to 13.40, suggesting barely lowered shopping for energy from stablecoins relative to Bitcoin’s market cap. Nonetheless, this hike has been average and doesn’t point out important promote stress.

As an alternative, it underlined that capital could also be ready for a directional sign.

Moreover, a steady SSR throughout a possible breakout situation helps a more healthy rally. Due to this fact, this metric solely appeared to bolster the concept buyers could also be poised to deploy funds. Particularly as soon as the technical breakout is confirmed.

What are Bitcoin whales and establishments signaling?

Massive BTC transactions had been up 1.28%, suggesting accumulation by whales or establishments. These entities usually act forward of main value shifts, and the hike in exercise typically precedes rallies.

Due to this fact, this metric gave the impression to be in step with the bullish stress forming on Bitcoin’s charts.

Furthermore, sensible cash tends to re-enter throughout consolidation phases. Such an uptick in high-value transactions additional validated the potential of a near-term breakout.

That’s not all although as Lookonchain reported {that a} whale lately deposited 1,500 BTC ($120.29M) to Binance. Nonetheless, the whale nonetheless holds 1,486 BTC, signaling retained publicity. This motion displays profit-taking—not a full exit—after beforehand accumulating BTC at $80,449 and promoting some at $87,812.

Due to this fact, the whale’s habits is an indication of confidence in Bitcoin’s longer-term energy, regardless of trimming holdings close to its resistance. Strategic exits are regular in sturdy setups.

Conclusion

Bitcoin may be well-positioned for a rebound. The mixture of a tariff pause, cooling inflation, hike in whale exercise, and institutional positioning could have created a supportive atmosphere for the crypto.

Whereas the breakout should nonetheless be confirmed on the chart, all indicators appeared to trace at upside potential. Due to this fact, if BTC clears its resistance, a pointy rally can be more and more probably.