- Bitcoin mining has skilled a shift, with two nations now controlling 95% of the mining hash fee.

- This focus of energy might displease miners, prompting mass capitulation.

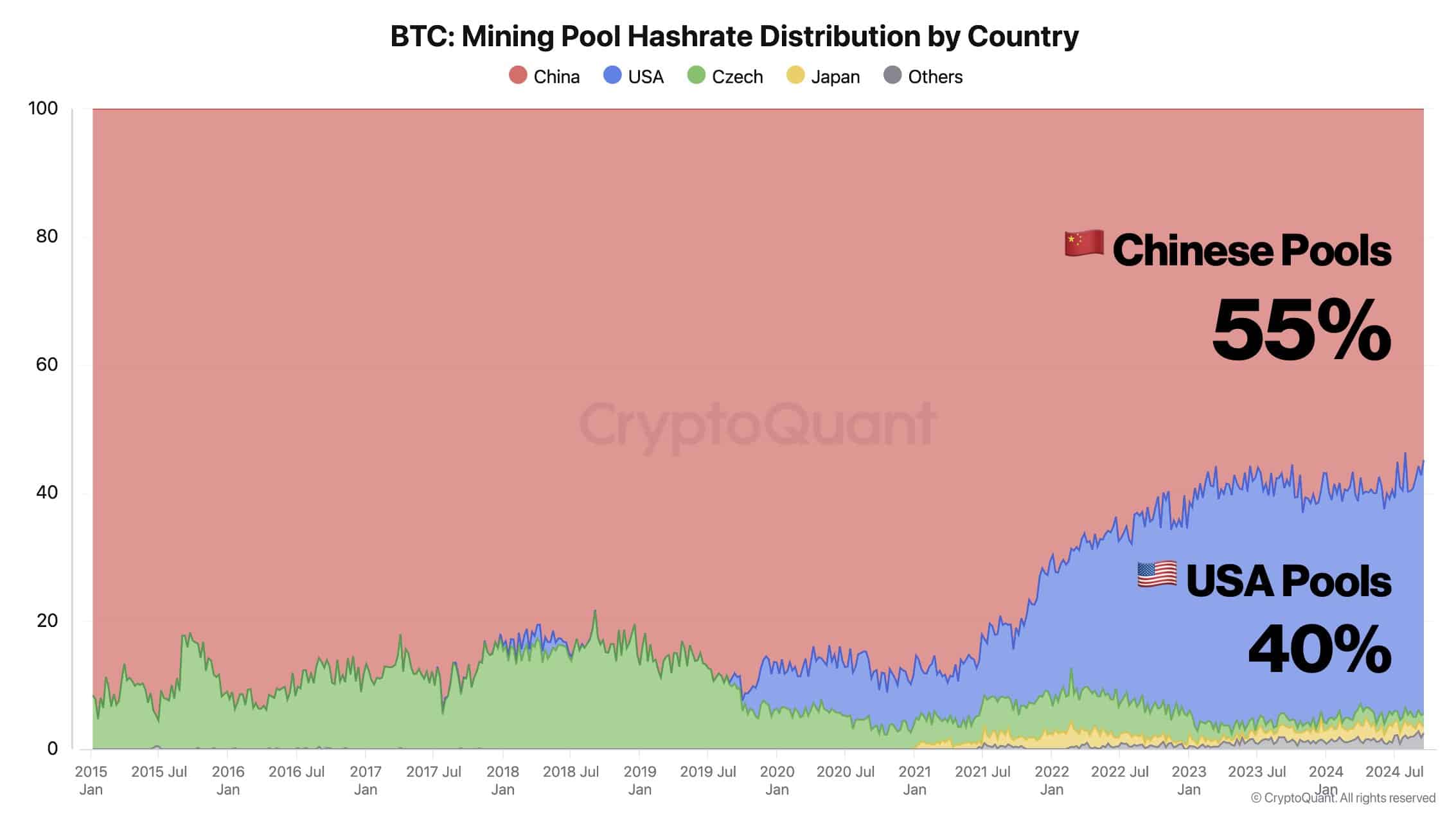

The Bitcoin [BTC] mining panorama is shifting, with U.S. swimming pools now controlling 40% of the hashrate, whereas Chinese language swimming pools maintain 55%.

As soon as dominant attributable to low cost {hardware}, Chinese language miners are dropping their edge as the main focus shifts to low cost vitality sources. This shift, pushed by China’s regulatory crackdown, is pushing mining operations to relocate to areas with extra favorable vitality – Its impression? AMBCrypto investigates.

Hashrate distribution is just too centralized

Beforehand, China held a big affect over the mining trade, controlling about 55% of the entire BTC hashrate. This meant that the majority Bitcoin mining energy was concentrated in China.

This dominance allowed Chinese language miners to realize an edge in staking rewards, resulting in a larger accumulation of BTC within the nation.

Now, the U.S. is closing the hole, controlling 40% of the hash pool. The main target is shifting, with U.S. primarily based Bitcoin mining firms reaping essentially the most advantages, significantly these catering to institutional traders.

Nevertheless, this mass exodus might problem U.S. miners as elevated competitors might skinny earnings. It’s essential to observe particular person miners intently, if operational prices outweigh profitability, they could shut their positions.

Worry is clearly seen

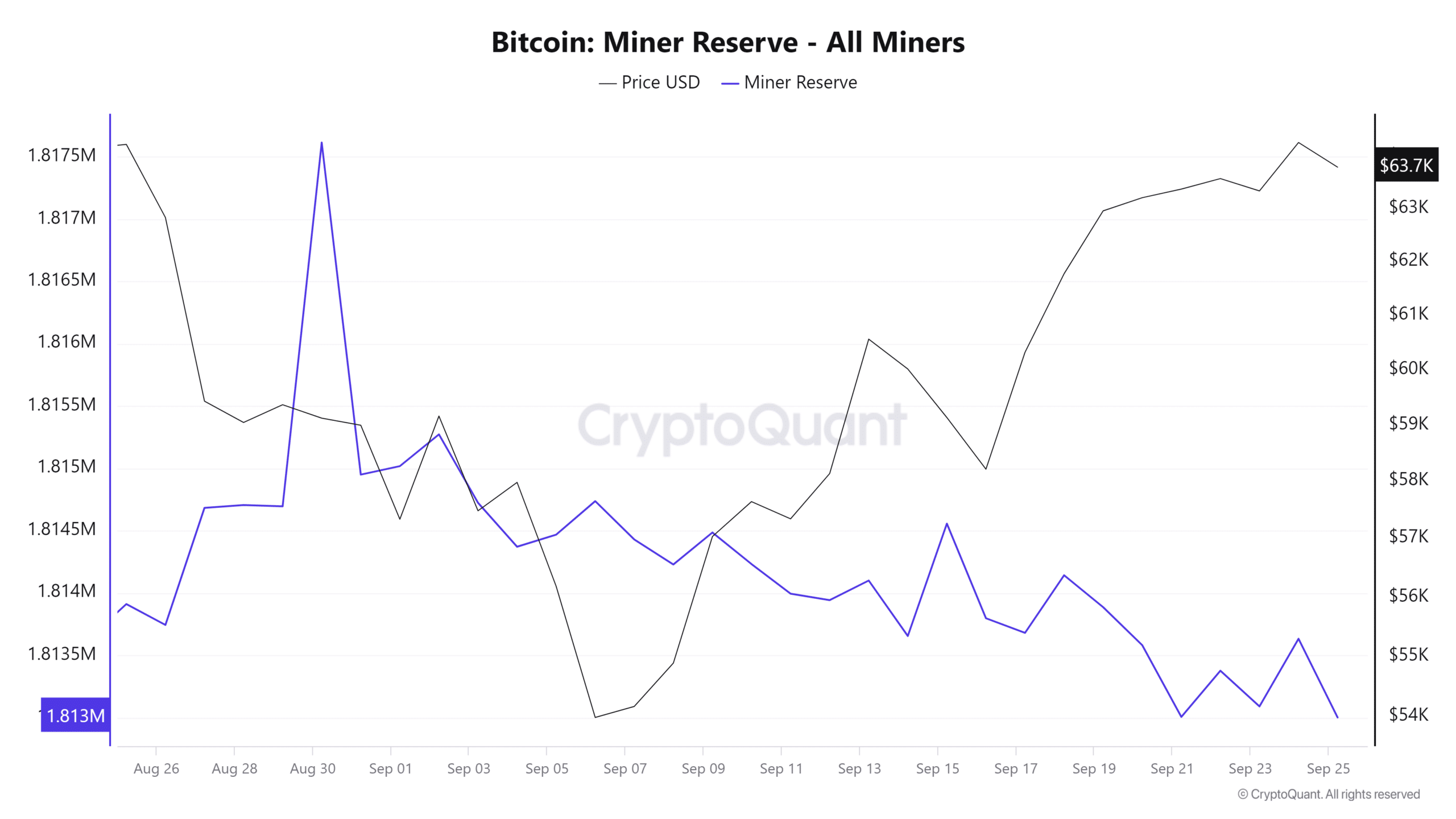

Benefiting from the current surge, Bitcoin miners have probably capitalized on earnings whereas BTC consolidated above $63K and peaked close to $64K, as evidenced by miner reserves hitting all-time lows.

With Bitcoin mining problem reaching new month-to-month highs, it has develop into important for miners to grab any alternative for beneficial properties every time they come up.

Furthermore, the inflow of miners within the U.S. raises considerations, as elevated competitors is anticipated to drive problem to new data, finally decreasing rewards.

Consequently, miner capitulation might considerably threaten BTC’s skill to succeed in the $68K resistance.

On the flip facet, this situation might spotlight the dominance of massive mining firms, offering them with a bonus as smaller miners exit the market, which might additional centralize the community.

Bitcoin mining homes may take cost

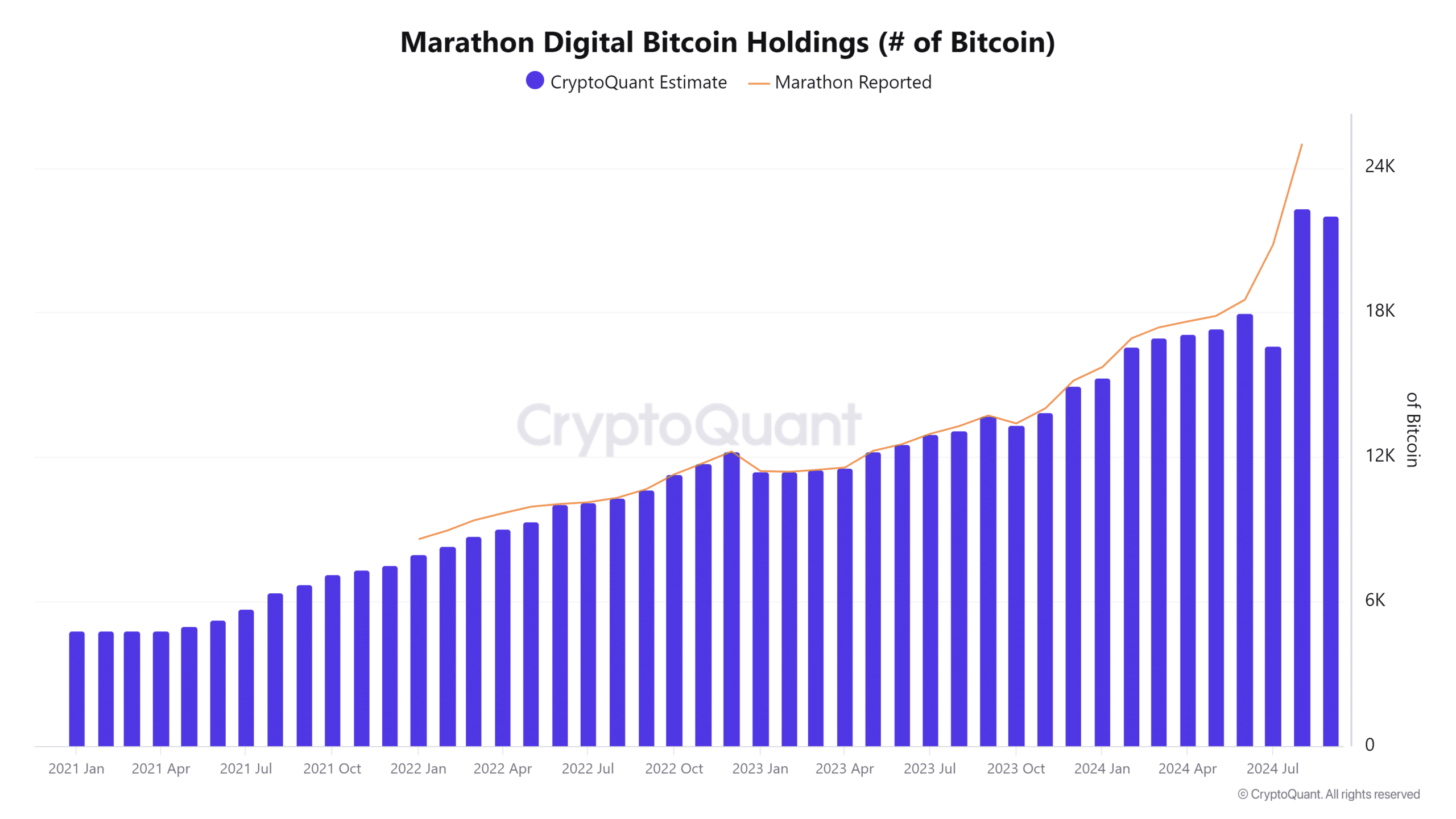

Bitcoin mining homes with substantial holdings might search to leverage their sources and take cost as many miners exit attributable to growing problem.

As an example, the most important Bitcoin mining firm within the U.S. has strategically amassed holdings, peaking at an estimated $22,022.4, though reported figures could also be even increased.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Moreover, their substantial holdings might additionally present a bonus throughout miner capitulation, enabling them to soak up strain when BTC hits market prime.

Nevertheless, elevated centralization might spell bother for the Bitcoin mining trade, maintaining BTC from breaking by way of the essential $64K resistance.