- Bitcoin short-term holders confronted steep losses, surpassing FTX ranges, however with out triggering full panic.

- Quick-term BTC traders had been experiencing extended losses, with market uncertainty fueling warning as an alternative of capitulation.

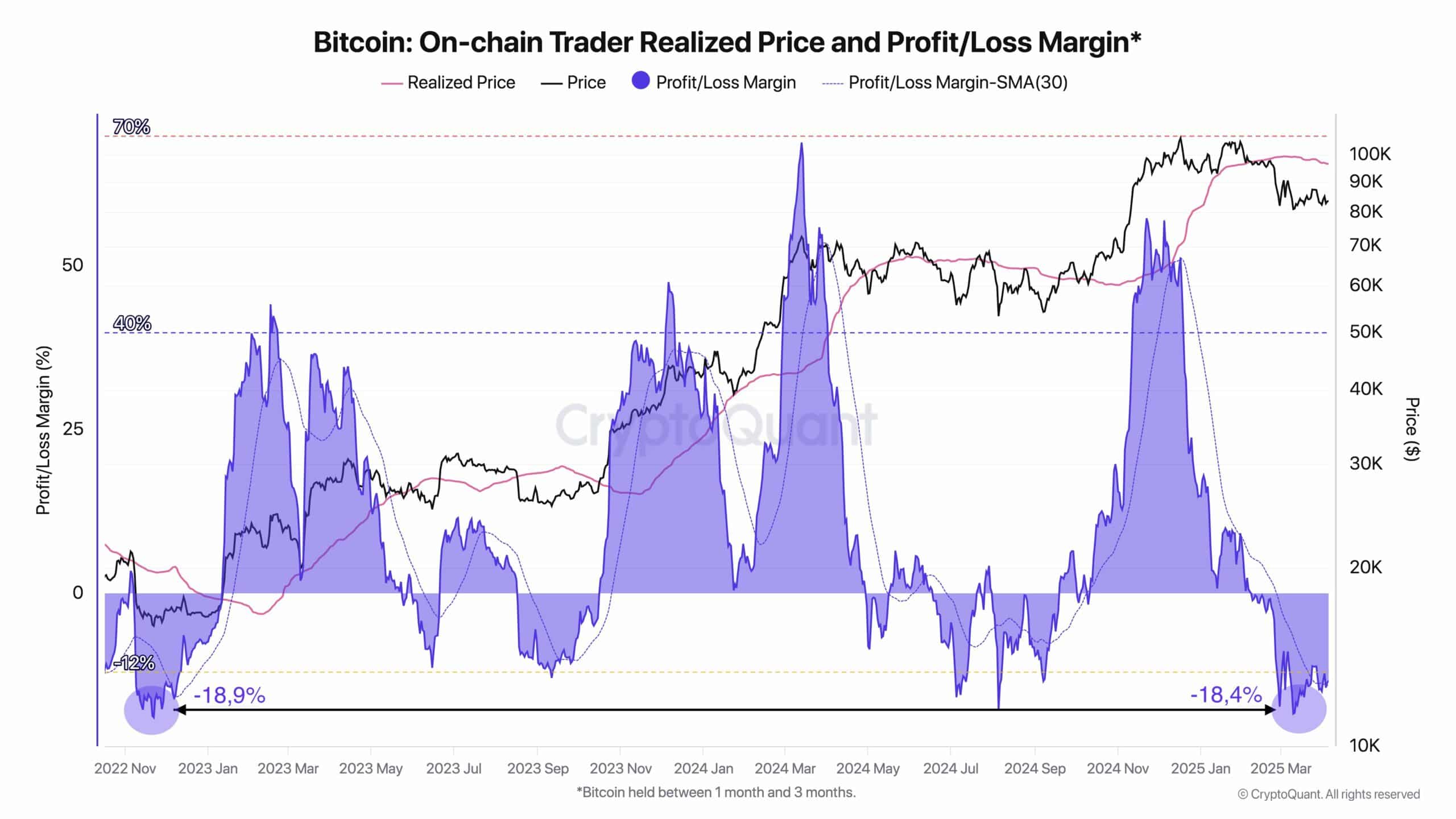

Since early February, Bitcoin [BTC] merchants have been quietly nursing losses, with the present figures now surpassing even the chaos seen through the FTX crash and the 2024 market correction.

The ache is hitting short-term traders the toughest, significantly these holding BTC for simply 1 to three months.

As market uncertainty continues to linger, this pattern of rising short-term investor losses might point out a deeper shift in sentiment, leaving many questioning if the worst is but to return or if we’re merely caught ready for a breakout.

Ache, however not capitulation

Bitcoin’s short-term holders are deep within the purple, with them now sitting on realized losses worse than something seen for the reason that FTX implosion.

The chart reveals the profit/loss margin plunging to -18.4%, eerily near the -18.9% ranges of late 2022.

But apparently, this isn’t triggering full-blown panic. Whereas the market’s bleeding, there’s little signal of a mass exodus – simply merchants biting their lips and ready it out.

The temper? Much less “get out now,” extra “this higher be value it.”

Bitcoin: Why this time feels worse for short-term holders

Not like long-term hodlers who’ve weathered bear cycles earlier than, STHs are inclined to enter close to native tops — proper when hype is peaking.

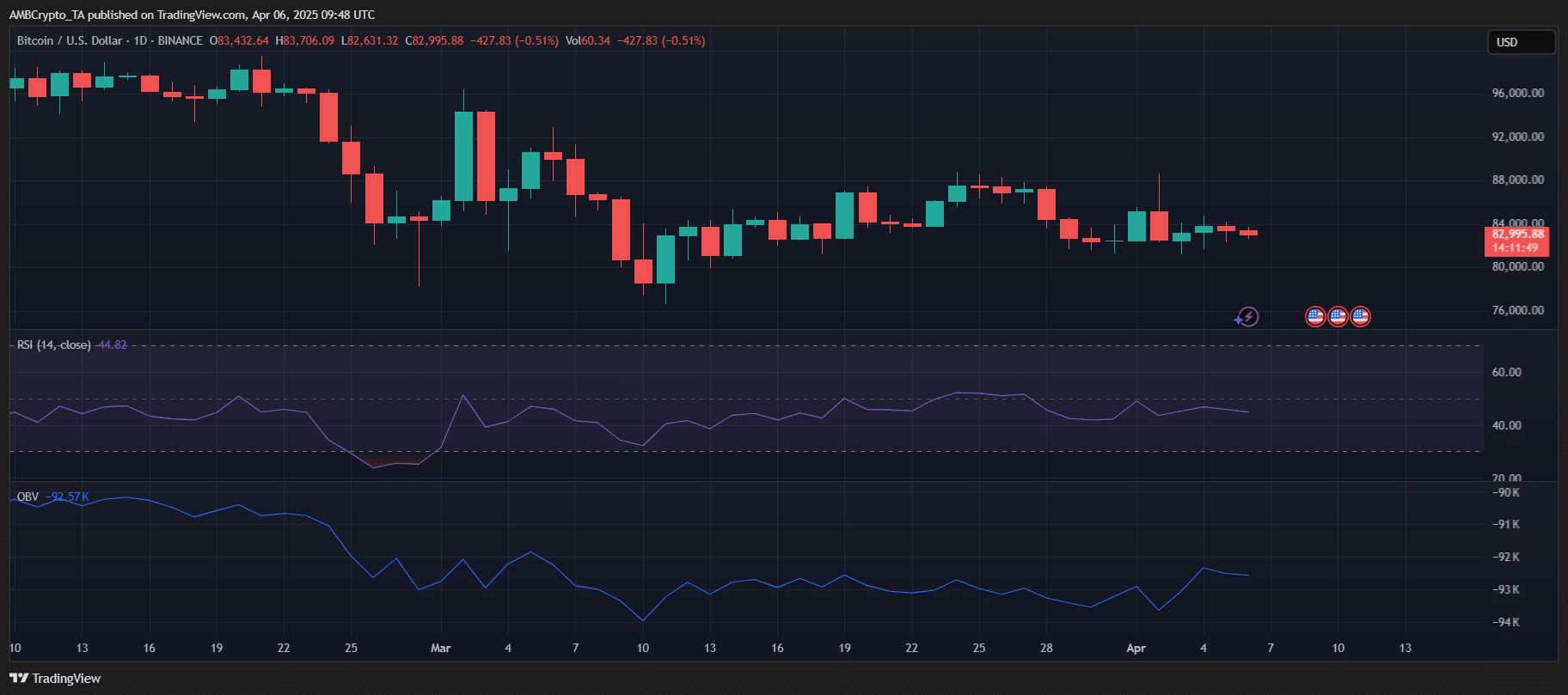

As BTC flirted with highs round $84K in early March, many of those merchants piled in, solely to be caught in a sluggish bleed somewhat than a dramatic crash.

It’s the worst form of loss: dragged out, confidence-chipping, and murky in path. The information reveals this group is now shouldering the brunt of realized losses – a transparent reminder that FOMO patrons nonetheless study the exhausting method.

Echoes of FTX

The present drawdown mirrors the FTX crash in magnitude, however not in temper. Again then, the losses had been pushed by panic, contagion, and vanishing liquidity.

At this time, markets are hesitant, liquidity is respectable, and BTC remains to be holding above $80K.

The ache, nevertheless, is actual. Market watchers are observing previous patterns carefully, and with loss ranges now breaching 2024’s correction, comparisons to November 2022 have gotten tougher to disregard.

If historical past rhymes, then short-term capitulation might nonetheless be lurking simply across the nook.