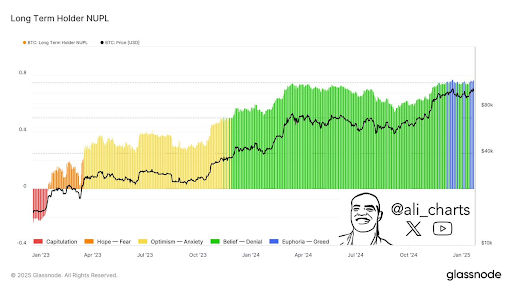

In a current improvement, crypto analyst Ali Martinez revealed that Bitcoin long-term holders have formally entered greed territory. This might profit the worth within the brief time period, though the long-term penalties might be extreme. The greed part means that long-term Bitcoin holders are actually excessively optimistic about BTC’s future trajectory.

Bitcoin Lengthy-Time period Holders Formally Enter Into Greed Territory

In an X post, Martinez acknowledged that long-term Bitcoin holders, having skilled each part of the market cycle, are actually letting greed take over. By way of market sentiment, these holders have moved from capitulation to hope, optimism, after which perception and are actually within the greed part.

Associated Studying

This extreme optimism usually leads these traders to build up extra BTC impulsively with out contemplating rational analyses. Within the brief time period, this greed phase is bullish for the Bitcoin worth since this market sentiment may spark extra shopping for stress and drive the flagship crypto increased.

This shopping for stress for Bitcoin already appears to be like to be evident as on-chain analytics platform Santiment revealed that the variety of wallets holding 100 to 1,000 BTC has damaged an all-time excessive (ATH), rising to fifteen,777 wallets. The platform additionally talked about that Bitcoin whales peaked up steam this week with the US inauguration and a brand new BTC ATH as transactions exceeding $100,00 surged to their highest stage in six weeks.

This greed part is sweet for the BTC worth, because it may proceed to ship the flagship crypto to new highs. Nevertheless, in the long run, this extreme optimism may put BTC in overbought territory, ultimately sparking a large wave of sell-offs that may ship the Bitcoin worth tumbling.

This greed part amongst Bitcoin long-term holders appears to be like to be sparked by optimism round Donald Trump’s pro-crypto administration and the strategic BTC reserve particularly. This nonetheless poses a threat for the Bitcoin worth for the reason that flagship crypto might be buying and selling properly above its precise worth if the BTC reserve isn’t ultimately created.

What Wants To Occur For BTC To Keep Bullish

In one other X put up, Ali Martinez warned that the Bitcoin worth wants to remain above $97,530 to stay bullish. In line with him, this worth stage is the important thing assist stage to observe for BTC, as holding above it’s essential to sustaining the present bullish momentum. Bitcoin is presently consolidating round this vary after hitting a brand new ATH of $109,000 earlier this week.

Associated Studying

In the meantime, crypto analyst Crypto Rover highlighted the $102,000 assist space as an important for the BTC worth proper now. His accompanying chart confirmed that the flagship crypto may drop to as little as $98,000 if it drops beneath this assist stage.

On the time of writing, the Bitcoin worth is buying and selling at round $104,900, up over 2% within the final 24 hours, in line with knowledge from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com