- BTC was nonetheless in a bull market, based on Ark Make investments’s CEO.

- U.S. spot BTC ETFs noticed a 3-day influx streak, however can it increase BTC restoration?

Regardless of latest Bitcoin [BTC] losses and bear market calls, Ark Make investments’s CEO Cathie Wooden was optimistic in regards to the cryptocurrency’s outlook. In a Bloomberg interview, Wooden reiterated that the market was nonetheless in a bull market.

“Bitcoin is a bit bit midway via the 4-year cycle. We predict we’re nonetheless in a bull market, and U.S. deregulation is necessary for establishments transferring into this new asset class.”

The exec maintained her $1.5M BTC value goal by 2030.

Blended views on Bitcoin

Bitwise’s CIO Matt Hougan additionally echoed Wooden’s bullish sentiment, stating if the present macro uncertainty was lifted, the asset might high $200K by the tip of the 12 months.

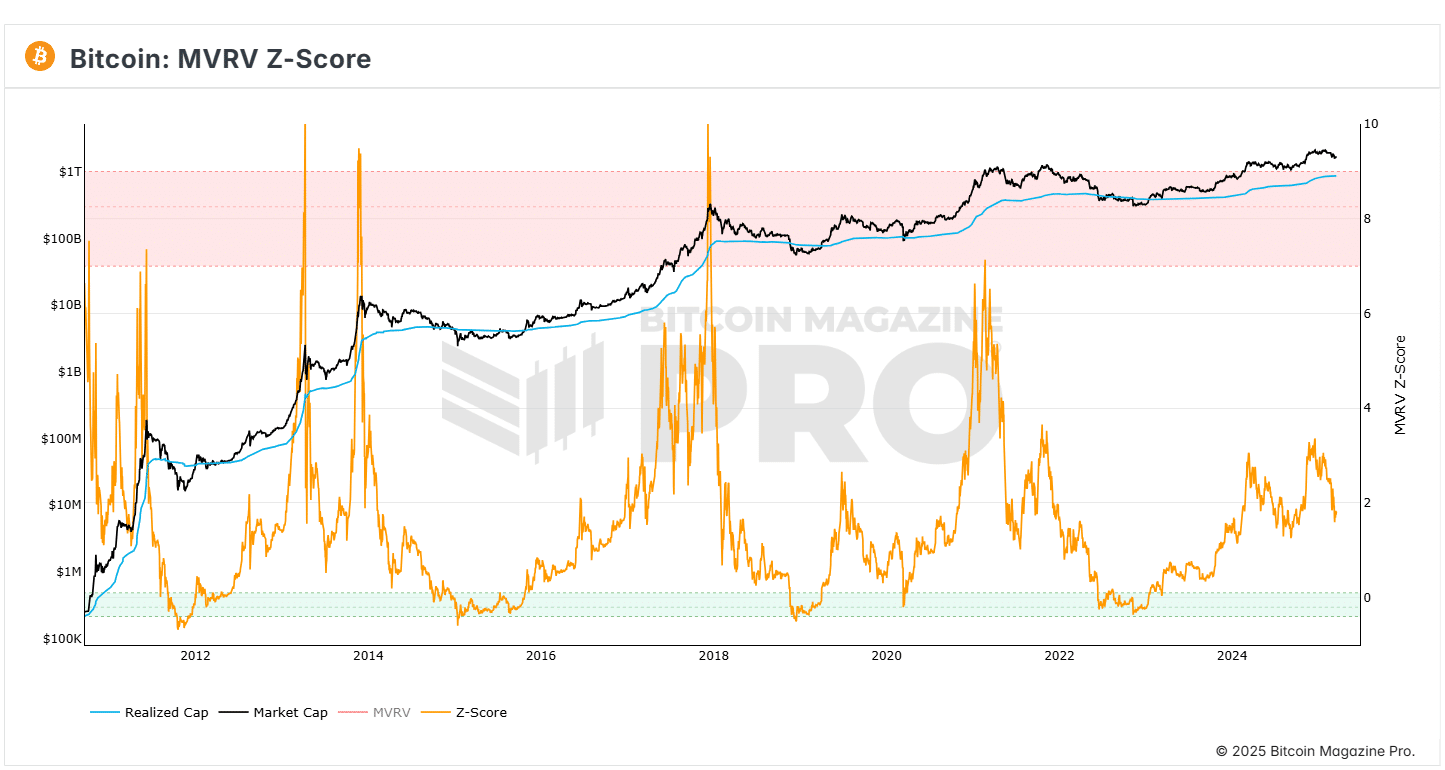

The bullish projections have been aligned with the MVRV-Z rating, a typical valuation mannequin and cycle high indicator. It was at 1.5 and near final 12 months’s native backside. Curiously, the indicator topped out in December practically on the identical stage it did in Q1 2024.

Nevertheless, in comparison with previous cycle tops above 6 (higher band), BTC had room for progress if historic tendencies have been repeated.

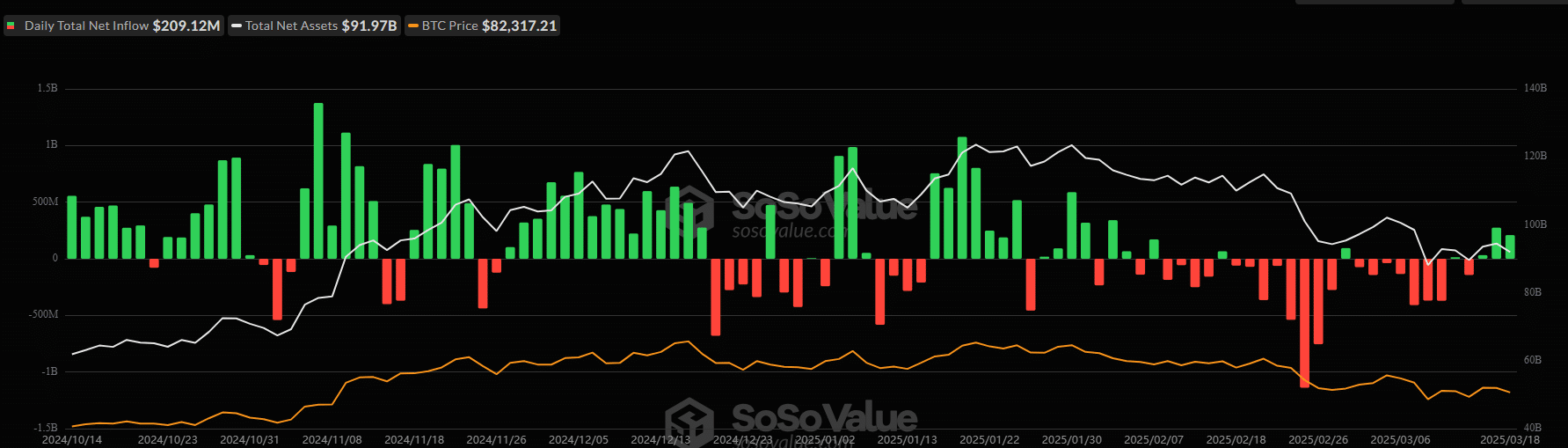

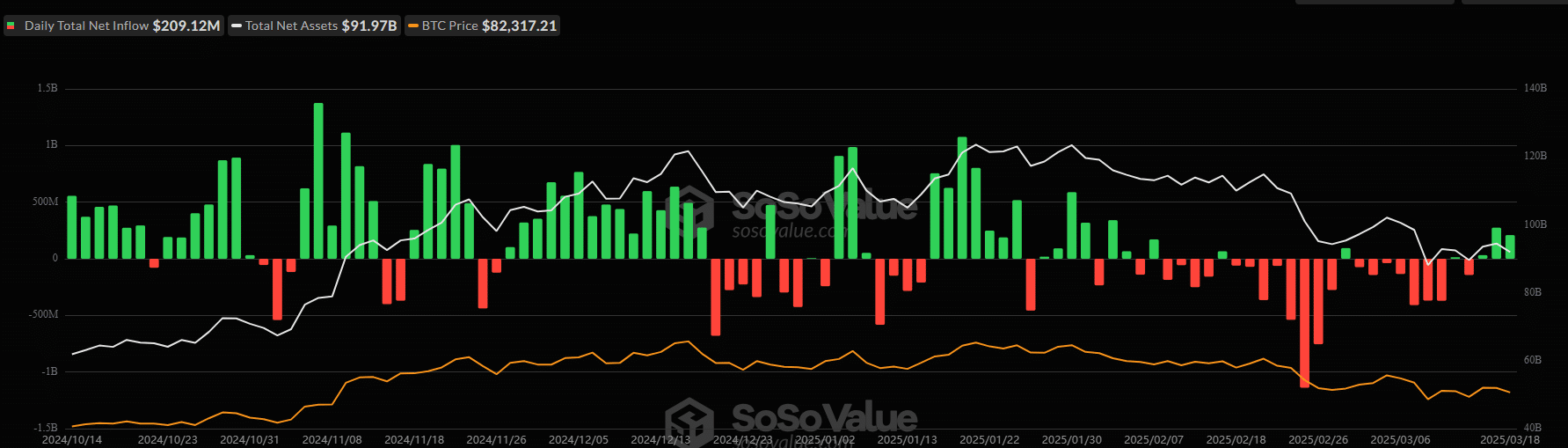

However, CryptoQuant’s CEO, Ki Younger Ju, made a bear call and famous that the bull market was over for the following 6–12 months. The analyst cited weak ETF flows and quantity to push BTC past $100K.

Right here, it’s value noting that the ETF merchandise logged three consecutive days of inflows, reversing the worrying outflow pattern seen up to now three weeks.

On the seventeenth of March, they noticed $274.5M inflows, adopted by one other $209M demand on the 18th of March, per Soso Worth knowledge.

Supply: Soso Value

Whether or not the renewed demand will prolong and increase BTC restoration within the brief time period stays to be seen. As of this writing, BTC was valued at $83K forward of the Fed fee announcement.