- Altcoins face a -$36B quantity hole as Bitcoin dominance climbs previous 64%, stifling rotation hopes.

- Regardless of BTC’s rally, threat urge for food for altcoins stays weak, delaying the subsequent altseason cycle.

Bitcoin’s [BTC] surge and consolidation previous the historic $100K stage has caused bullish sentiment. But, past BTC, the broader altcoin panorama stays alarmingly stagnant.

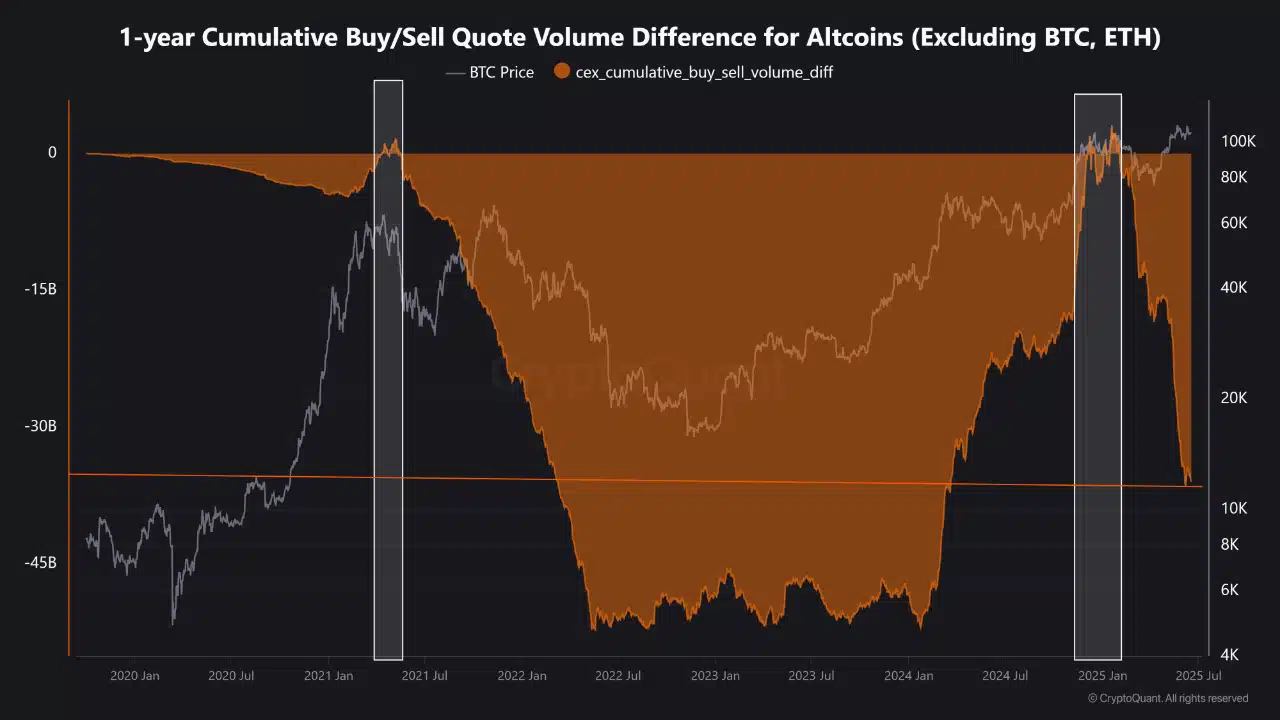

New knowledge reveals a brutal -$36 billion cumulative purchase/promote quantity hole for altcoins (excluding BTC and ETH) over the previous 12 months; a transparent signal that liquidity continues to be bleeding from the sector.

Regardless of the BTC dominance reaching excessive ranges, altcoin inflows stay conspicuously absent. This casts doubt on whether or not the long-awaited “altseason” will arrive in any respect.

Altcoin lag as purchase/promote hole deepens

The 1-year cumulative purchase/promote quote quantity distinction for altcoins has plunged to -$36B, its lowest level since 2022. This pattern exhibits a evident lack of investor conviction within the altcoin area.

Whereas Bitcoin has notched new all-time highs, altcoins stay in a net-sell zone, suggesting that almost all market contributors are nonetheless risk-off in terms of something past BTC and ETH.

Constructive flips on this metric have coincided with short-lived alt rallies. However as of June 2025, the sustained bleed implies that even in bullish macro situations, altcoins haven’t shaken off their bear-market inactivity.

BTC.D breaks out, alts get left behind

Bitcoin’s market cap dominance has surged to just about 65%, climbing over 1% since mid-June and reinforcing its grip on capital flows.

The information confirmed a pointy, near-parabolic rise in BTC dominance, pushed by Bitcoin ETFs, institutional inflows, and macro hedge demand.

This surge typically sidelines altcoins, as capital concentrates in Bitcoin because the crypto “secure haven.”

David Hernandez, crypto funding specialist at 21Shares, advised AMBCrypto,

“Bitcoin has firmly cemented itself above $100,000, and its resilience amid geopolitical shocks demonstrates its widespread adoption and creating funding case.”

He went on so as to add,

“As confidence in a wonderfully engineered ‘mushy touchdown’ wanes, and as international monetary currents diverge, Bitcoin’s elementary properties – its shortage, decentralization, and neutrality – make it an more and more related and compelling asset for traders navigating an unsure future.”

Traditionally, rising BTC.D indicators weak spot for altcoins, and except it reverses, even robust alt initiatives could keep suppressed and out of favor.

What’s going to it take for altseason to reach?

For altcoins to regain dominance, a number of situations have to align.

This features a stall or consolidation in Bitcoin’s rally, renewed threat urge for food throughout retail traders, and a reversal within the 1-year purchase/promote quantity differential. This might counsel capital rotation is underway.

Altseason sometimes follows BTC cooling off after a serious run. This results in speculative capital searching for increased returns in smaller caps. However proper now, there’s no indication of that shift.

Till alt liquidity improves and BTC.D retreats, hopes for an altcoin supercycle could stay on maintain.