- Bitcoin’s value hike has pushed spot buying and selling quantity to multi-year highs

- Market has seen an inflow of latest buyers this yr too

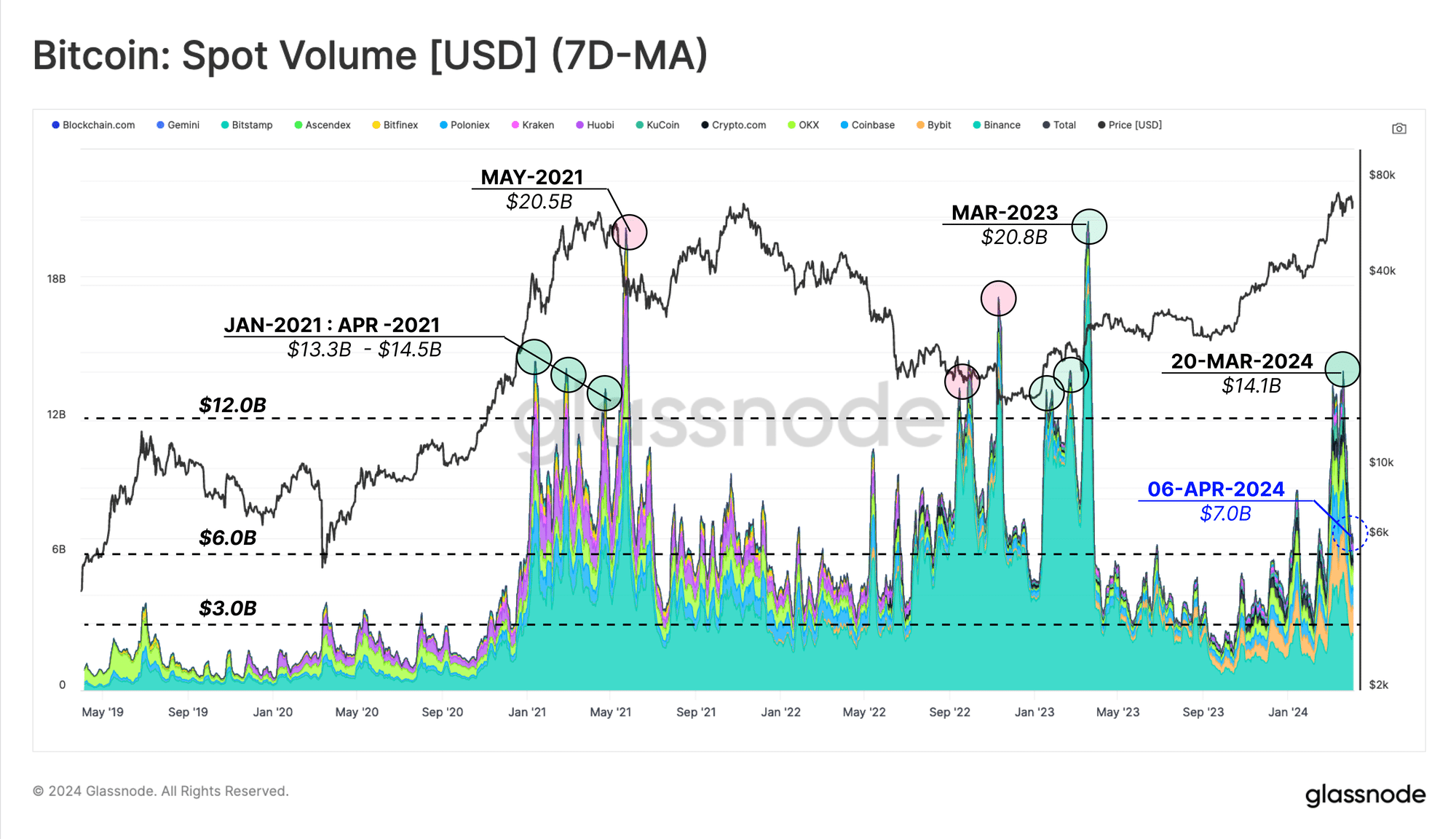

Bitcoin’s [BTC] value rally, which started in October 2023, has pushed its spot buying and selling quantity to the highs seen through the 2020-2021 bull market, in keeping with a Glassnode report.

In accordance with the on-chain knowledge supplier, whereas the latest headwinds confronted by BTC’s value have led to a slight retraction, the coin’s every day spot commerce quantity is at the moment sitting at round $7 billion.

Glassnode assessed the coin’s spot commerce quantity by evaluating the metric’s 180-day shifting common (gradual) and its 30-day shifting common (quick). This comparability confirmed that because the market rally started in October 2023, the BTC market “has seen the sooner common commerce considerably larger than the slower one.”

The on-chain knowledge supplier added that this means that the coin’s year-to-date development is “supported by sturdy demand in spot markets.”

Moreover, along with the surge within the coin’s spot commerce quantity, BTC’s value rally has resulted in an uptick within the circulate of cash out and in of cryptocurrency exchanges. Glassnode stated,

“The month-to-month common of complete Alternate Flows (inflows plus outflows) is at the moment at $8.19B per day, considerably larger than the height within the 2020-2021 bull market,”

Surge in new demand

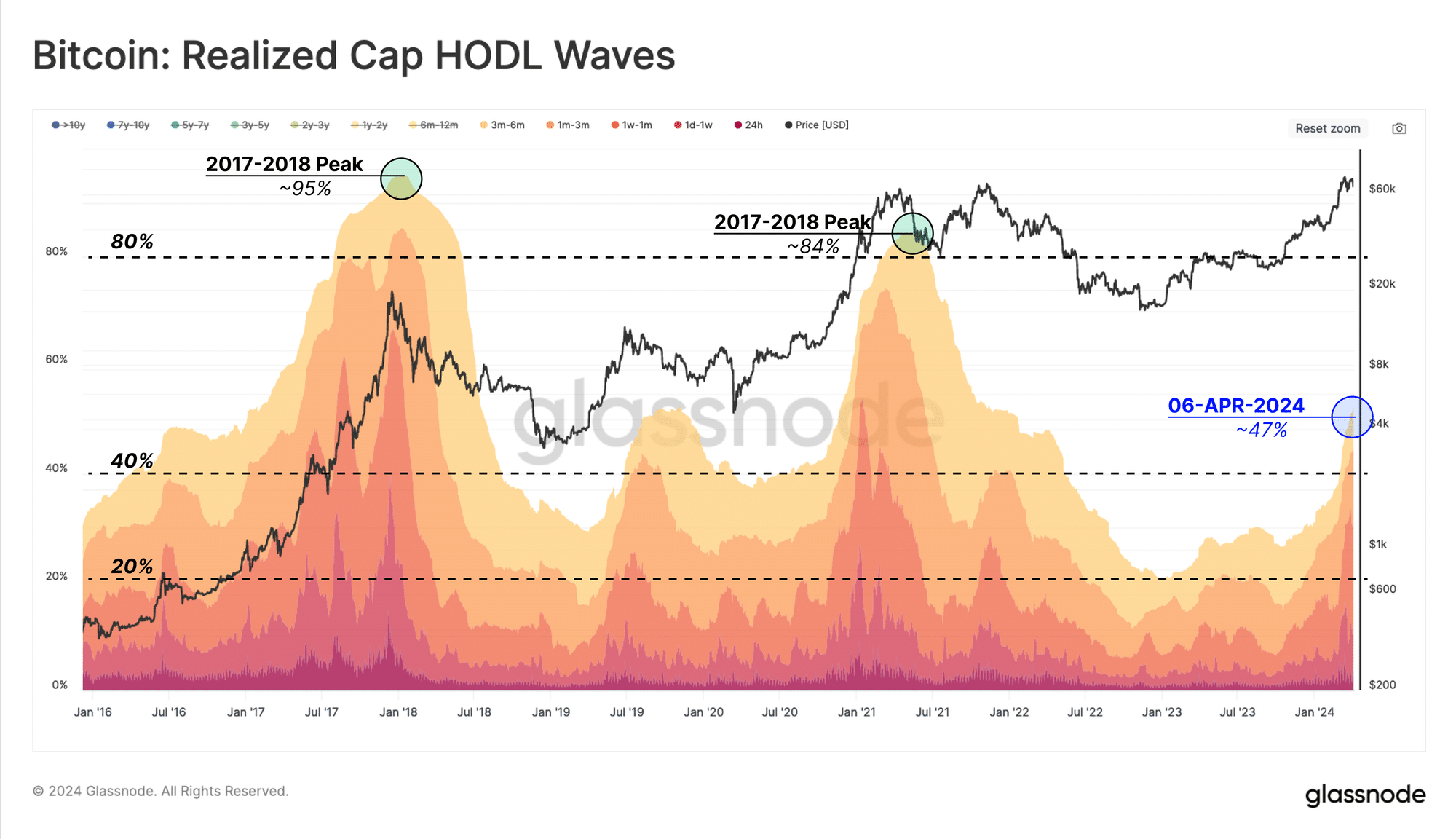

The continued rally has additionally led to a spike within the variety of new buyers holding BTC. As long-term holders distribute their long-held cash for good points, they’ve been scooped up by new buyers who intend to revenue from the market rally.

Glassnode assessed BTC’s Realized Cap HODL Waves and located that there was a rally within the “share of wealth held by cash youthful than six months.”

In truth, over the past yr, BTC’s provide held by addresses youthful than six months has grown considerably. The identical had a determine of 47%, at press time.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

In accordance with Glassnode,

“This implies that the capital held inside the Bitcoin holder base is roughly balanced between long-term holders and new demand.”

Lastly, it’s value stating that Glassnode additionally claimed that it’s key to concentrate to the habits of those new buyers as “their share of the capital will increase.”

This, as a result of this cohort of BTC holders is often extra price-sensitive than long-term holders (LTHs). They’ve their cash simply accessible and are prepared to dump as soon as BTC’s value falls beneath their value foundation.