- Bitcoin confirmed sturdy bullish alerts, with excessive dominance and investor confidence at an excessive stage.

- Bullish tendencies confirmed indicators of continuous, however volatility dangers remained attributable to trade behaviors.

Bitcoin [BTC] continues to indicate sturdy bullish indicators, with the Worry and Greed Index reaching an excessive greed stage of 83. This means excessive investor confidence and rising optimism available in the market.

At press time, Bitcoin traded at $98,503.78, down 0.85% within the final 24 hours. Whereas this implies a robust bullish pattern, it raises questions on Bitcoin’s means to maintain this momentum or face a market correction.

Bitcoin concern and greed reveals…

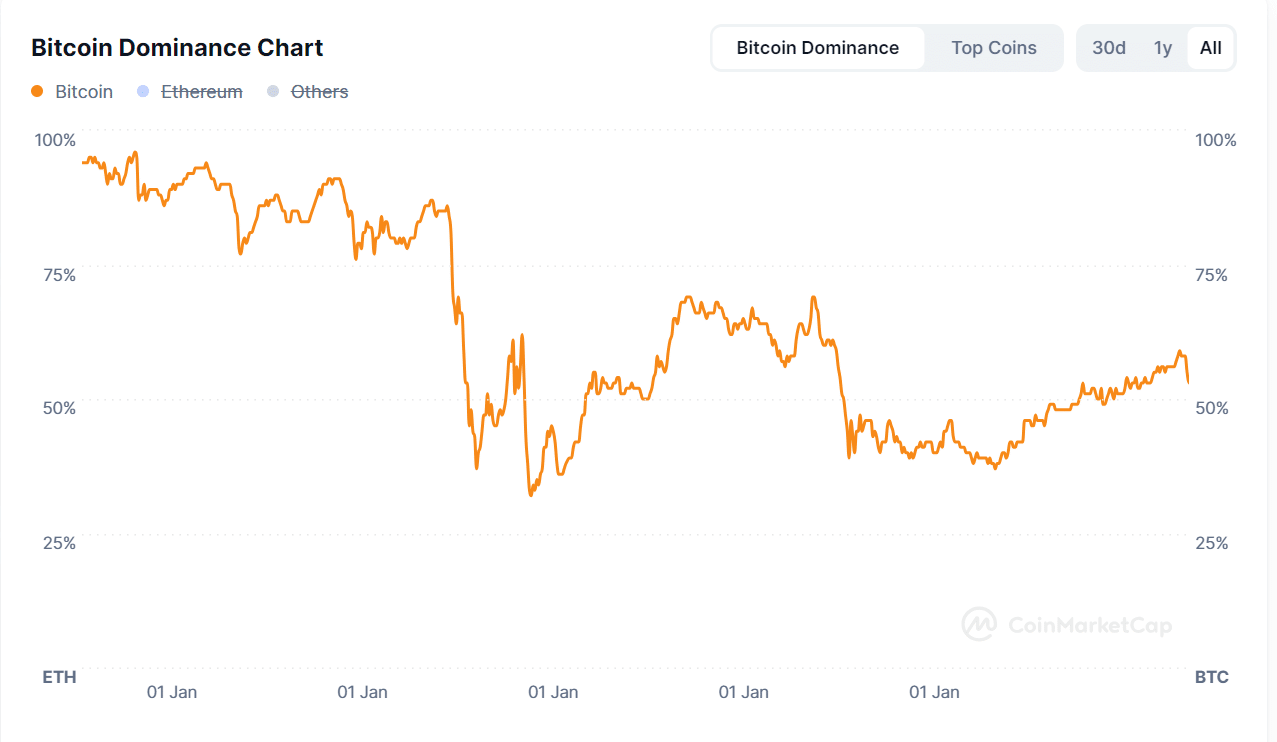

Bitcoin dominance was 54.5% on the time of writing, reflecting its important affect over the general crypto market. Nevertheless, it noticed a every day drop of -3.5%, which signifies a possible shift in altcoin curiosity.

This means that different cryptocurrencies could be gaining energy, which might impression Bitcoin’s dominance within the coming days.

Due to this fact, carefully monitoring Bitcoin dominance will present perception into market tendencies and any potential adjustments in dominance dynamics.

A surge in investor optimism

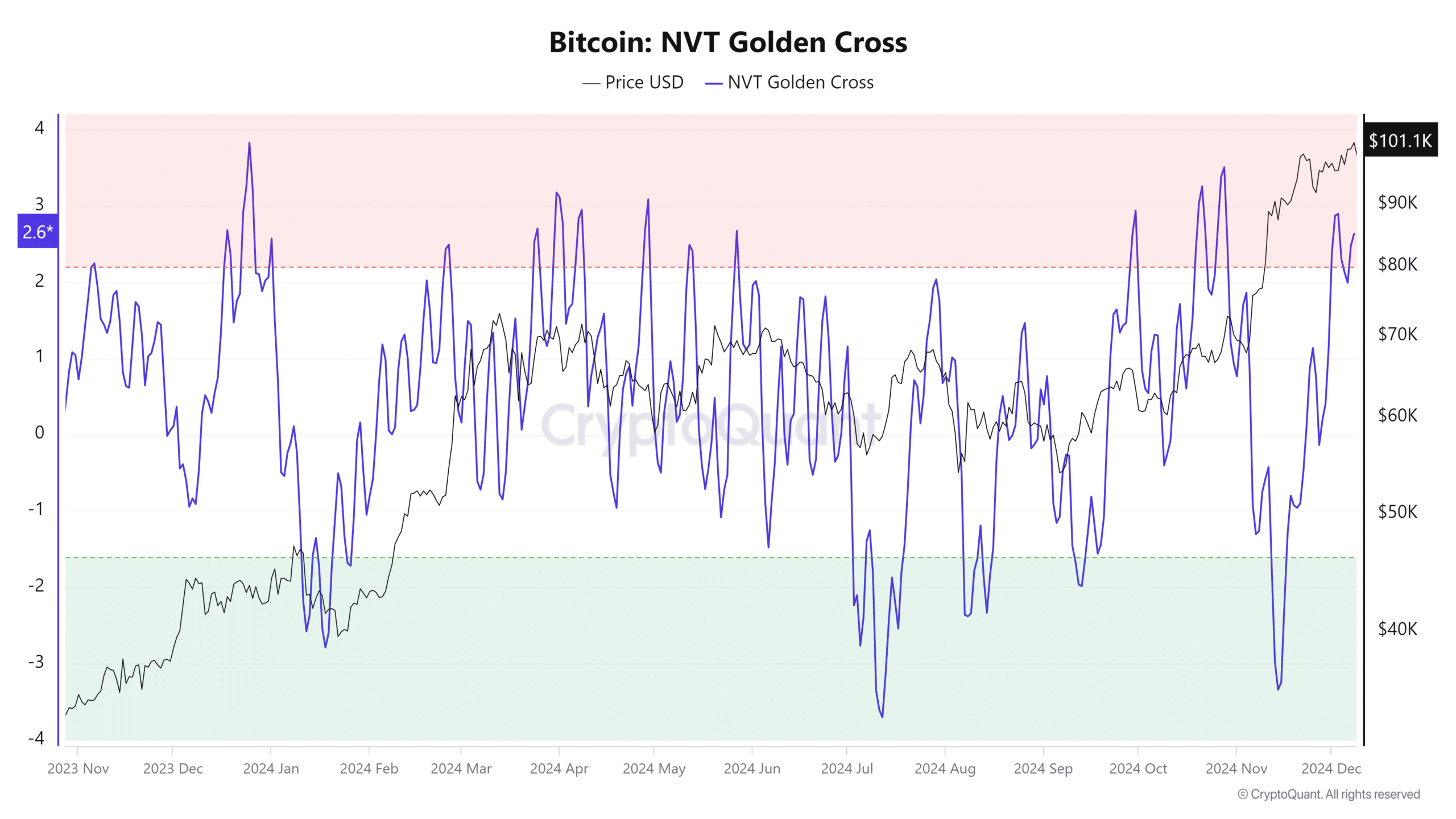

Bitcoin’s Community Worth to Transaction (NVT) golden cross skilled a notable 7.84% one-day surge, reaching 2.6. This surge signifies a rising investor curiosity in Bitcoin’s valuation in comparison with transaction quantity.

Such a rise sometimes signifies bullish sentiment and a extra assured market outlook. Moreover, it means that Bitcoin’s community metrics might entice extra traders, which might additional drive costs upward.

THIS boosts bullish sentiment

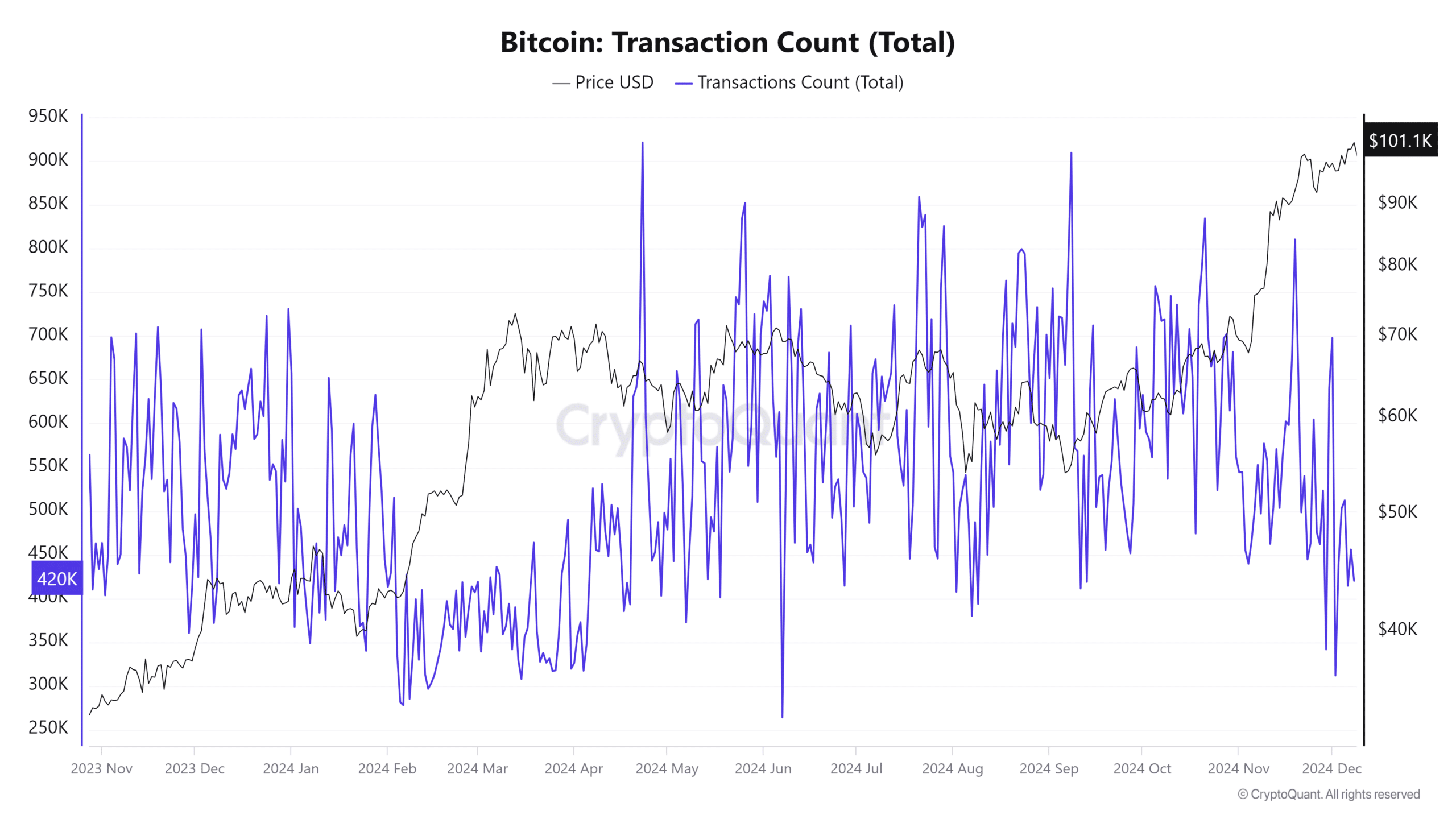

Bitcoin’s transaction rely noticed a every day improve of 0.94%, reaching 428.184k transactions. The rise in exercise highlighted a extra lively BTC community and better engagement amongst customers.

Such exercise indicated stronger investor curiosity and a better probability of continued bullish tendencies.

Due to this fact, a better transaction rely strengthened Bitcoin’s place available in the market and helps the general bullish outlook.

Investor confidence grows

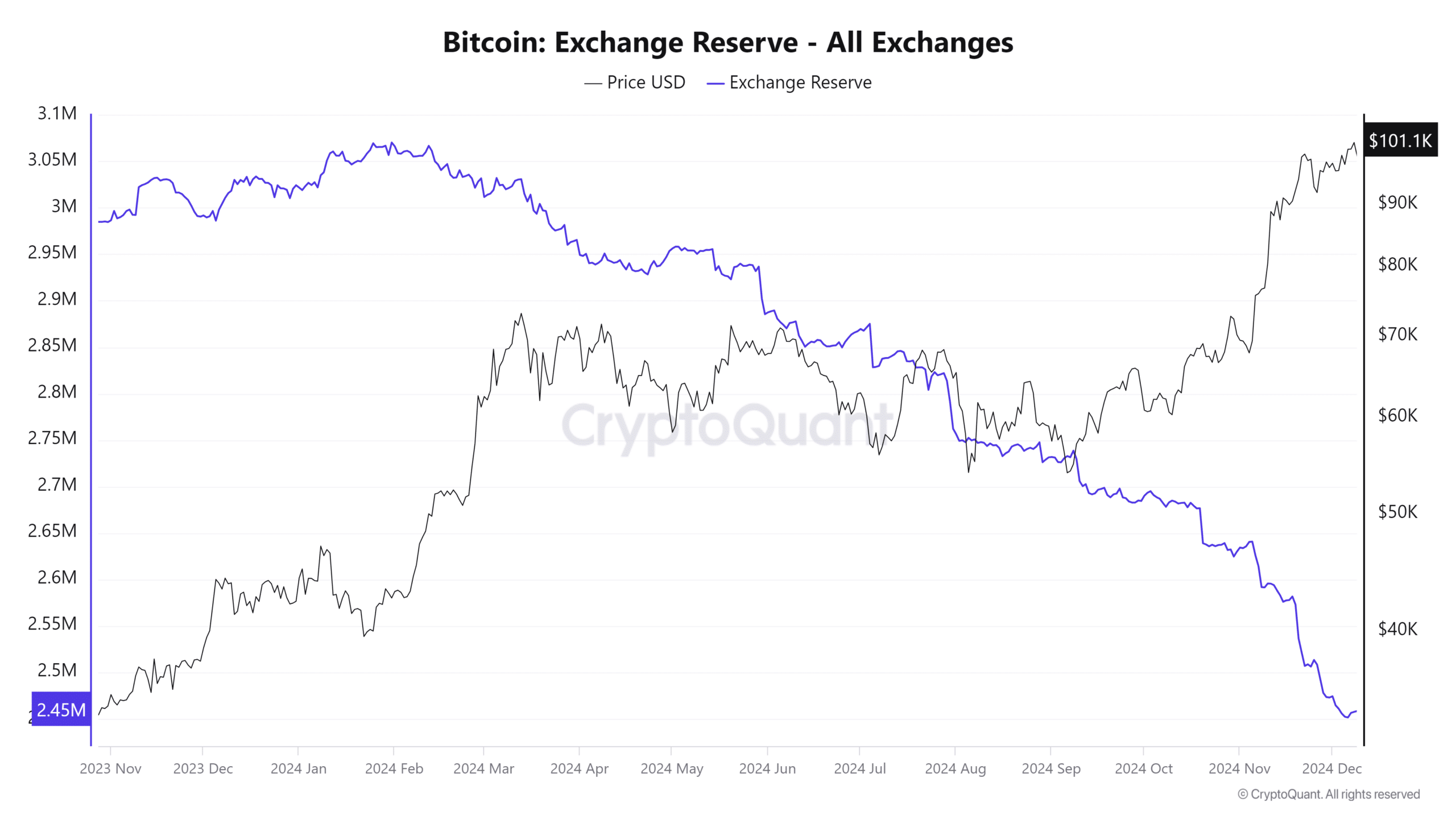

Bitcoin trade reserves dropped by 0.04% in 24 hours, now at 2.4573 million BTC at press time.

This pattern reveals that BTC holders are more and more shifting their belongings off exchanges, presumably into wallets or long-term storage. Such a transfer decreases the promoting strain in the marketplace and strengthens bullish sentiment.

Bullish traders maintain regular

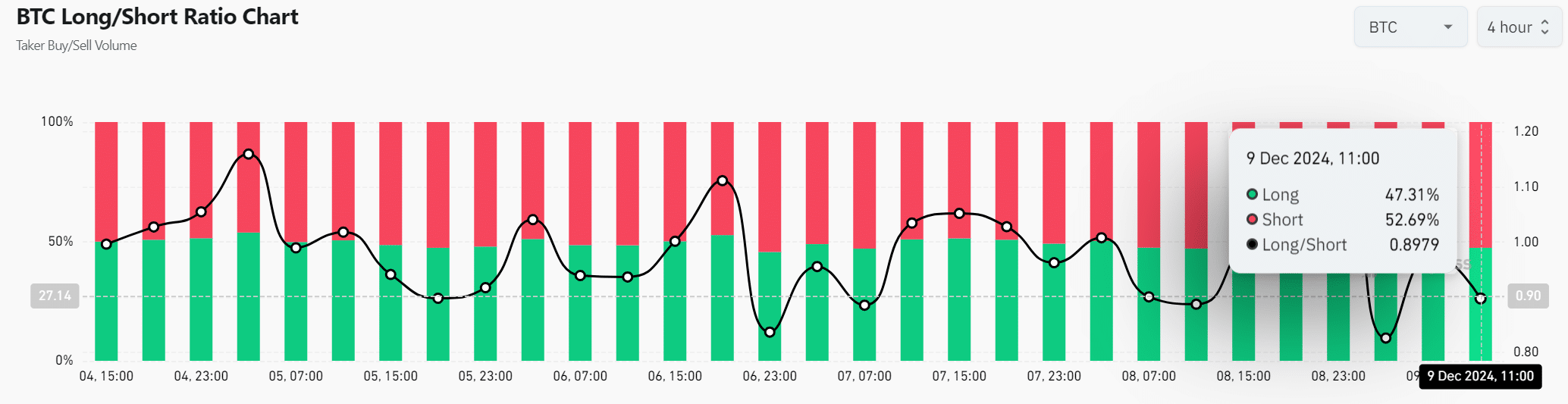

Bitcoin’s Lengthy/Brief Ratio was 47.31% lengthy and 52.69% quick, leading to a ratio of 0.8979. These numbers confirmed that quick sellers nonetheless have a slight benefit, however the excessive lengthy curiosity displays sturdy bullish sentiment.

Due to this fact, BTC stays resilient, with a optimistic outlook regardless of market fluctuations.

Bitcoin’s Worry and Greed Index at 83 suggests an especially bullish market outlook.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Nevertheless, with latest metrics exhibiting a mixture of positive aspects and drops throughout dominance, transaction counts, and trade reserves, a correction stays potential.

Due to this fact, Bitcoin might proceed its bullish run if present tendencies maintain, however merchants ought to stay vigilant about potential market volatility.