- February 2025 noticed steep declines for Bitcoin and Ethereum, leaving traders anxious for March.

- Historic tendencies counsel March might deliver extra weak point for each BTC and ETH costs.

February 2025 has been a brutal month for the market, with each Bitcoin [BTC] and Ethereum [ETH] seeing their steepest declines in over ten years.

As the 2 dominant forces within the area wrestle to regain momentum, uncertainty looms massive over the market’s future.

With historic information pointing to March as a sometimes weak month for crypto, traders are left questioning whether or not this current downturn is just the start of an extended droop or if a restoration is on the horizon.

BTC and ETH efficiency

February 2025 was marked by heightened volatility for Bitcoin and Ethereum, with each belongings dealing with important corrections.

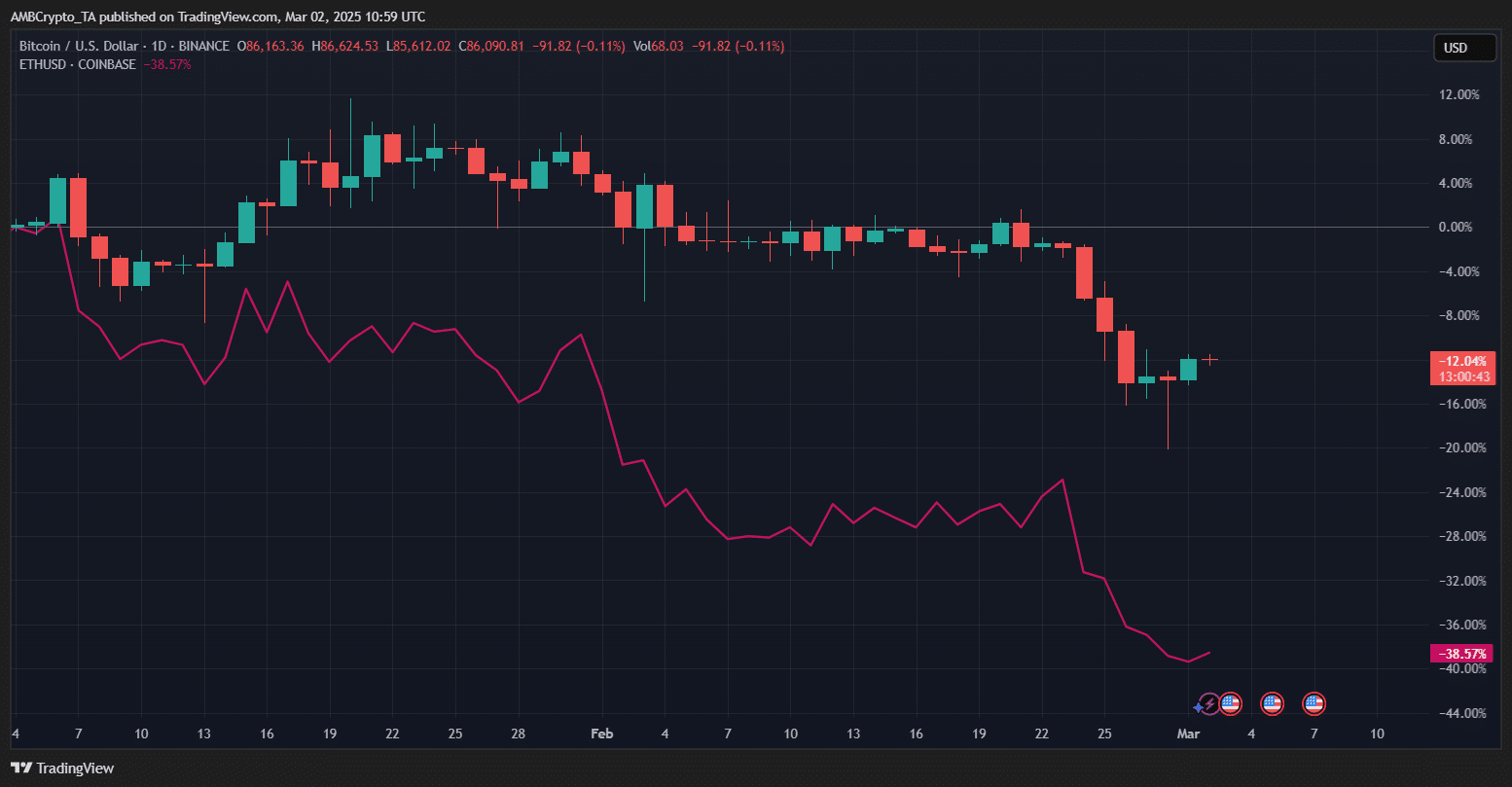

BTC began the month sturdy, hovering close to native highs, however bearish strain regularly took over, resulting in a steep decline of over 12%.

In the meantime, ETH struggled much more, underperforming BTC with a staggering 38% drop.

The widening hole between the 2 suggests shifting investor sentiment, doubtlessly pushed by liquidity considerations and sector-specific weaknesses.

Whereas BTC discovered some help, ETH’s sharp downturn raises questions on its resilience amid broader market turbulence.

March weak point: A historic development

Bitcoin and Ethereum have historically offered little relief in March. BTC’s common March return stood at simply 3.42%, with a median of 0.51%, indicating muted or damaging efficiency in a few years.

ETH fared barely higher with an 8.22% common return, however the median of 1.80% suggesting inconsistency.

Notably, BTC posted March declines in 2014, 2015, 2018, and 2020, whereas ETH suffered in 2018 and 2022.

Given BTC’s -17.39% and ETH’s -31.95% February declines in 2025, historic information suggests continued warning for March, reinforcing a seasonally weak interval for each belongings.

Bitcoin and Ethereum: Can they rebound in March?

Bitcoin enters March after a brutal February, shedding 17.39% — certainly one of its worst month-to-month performances lately.

Traditionally, March has been a weak month, with a median return of -0.39% and a median of 0.51%, reinforcing considerations of continued draw back strain.

From a technical standpoint, BTC is struggling beneath its 50-day SMA ($97,570.68) and hovering close to its 200-day SMA ($82,231.19).

The RSI at 36.85 prompt that the asset was nonetheless in bearish territory, however not but deeply oversold. A quick bounce off the $80,000 help zone is seen, however the broader development stays downward.

OBV at -92.82K mirrored weak accumulation, additional dimming the possibilities of a powerful restoration.

Until Bitcoin reclaims key ranges above $90,000 with quantity help, any short-term rally may very well be met with promoting strain.

Ethereum fared even worse than Bitcoin in February, crashing 31.95% — the steepest decline for the month in its historical past.

Traditionally, March has been lackluster for ETH, averaging 2.82%, however the median return of 1.18% suggests blended efficiency.

The technicals painted a equally bearish image. ETH remained considerably beneath its 50-day SMA ($2,890.37) and 200-day SMA ($2,926.03), with the RSI at 37.82, displaying delicate restoration from oversold situations.

The OBV at 10.61M prompt some accumulation, which might assist ETH stabilize, however momentum remained weak.

For Ethereum to interrupt out of its droop, it must reclaim the $2,500-$2,600 zone and see stronger shopping for quantity. In any other case, any rebounds in March could also be short-lived.

Investor sentiment and market psychology

Throughout market downturns, investor psychology performs a vital position in shaping worth motion. Worry, uncertainty, and doubt (FUD) usually result in panic promoting, exacerbating declines past basic justifications.

As costs drop, retail traders are likely to capitulate, whereas institutional gamers search discounted entries.

The present sentiment suggests warning, however not outright capitulation. Nonetheless, if macroeconomic considerations persist, sentiment might flip excessively bearish, creating alternatives for contrarian patrons.