- Bitcoin choices see bullish sentiment, with rising whales hinting at potential positive aspects in November.

- Ethereum choices present indecision as costs hover close to lows, contrasting Bitcoin’s sturdy momentum.

The crypto choices expiration, dated the twenty fifth of October, yielded various outcomes for Bitcoin [BTC] and Ethereum [ETH], in response to information from Greeks.live.

The expiration occasion, involving a mixed notional worth of $5.28 billion, illustrated totally different investor conduct for the 2 main cryptocurrencies.

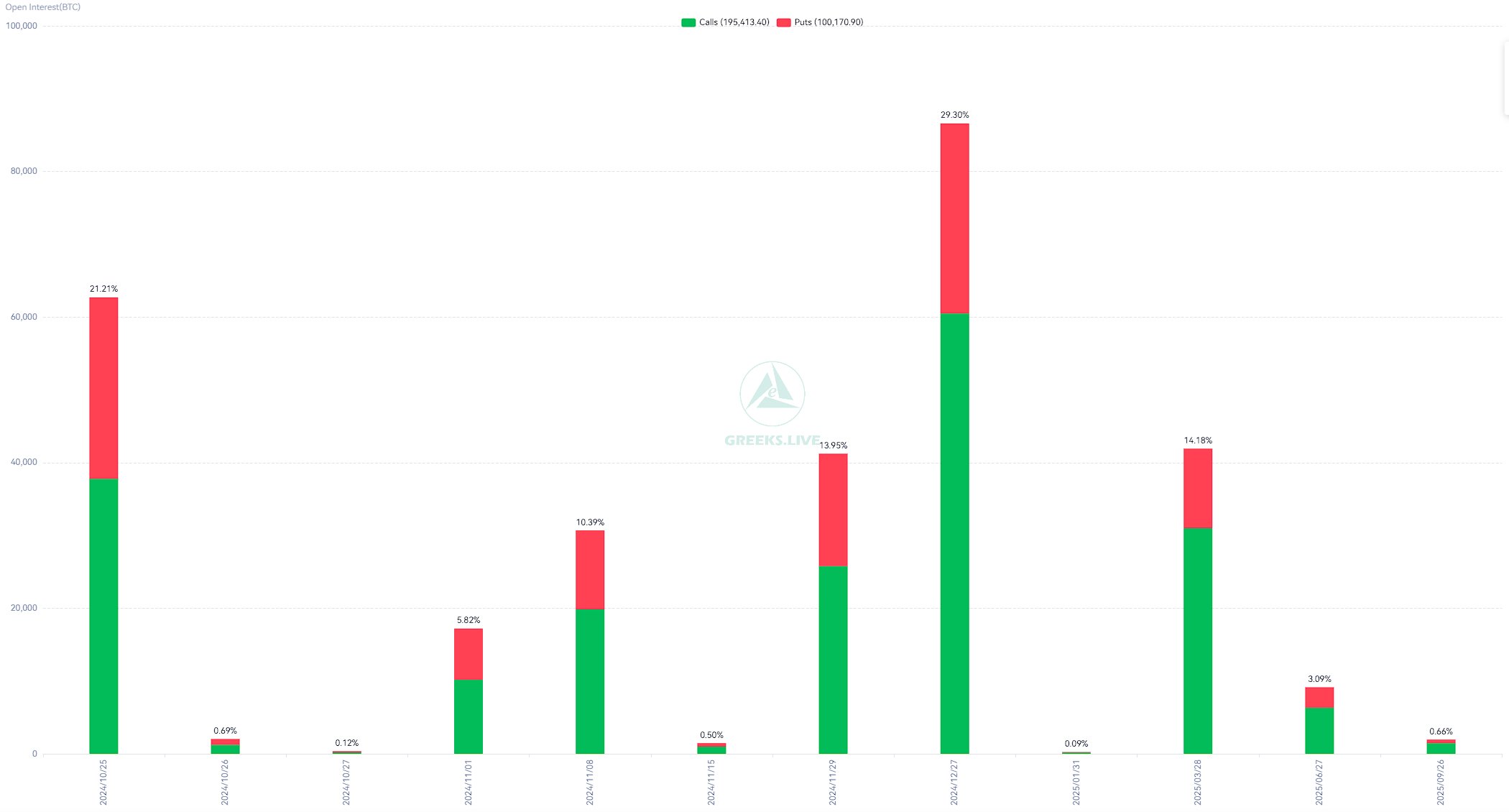

BTC choices expiration

On the twenty fifth of October, 63,000 Bitcoin options contracts expired, showcasing a Put-Name Ratio of 0.66, signaling a typically bullish sentiment amongst merchants.

The ratio indicated that the variety of name choices exceeded put choices, suggesting that merchants had been extra inclined towards upward value actions.

In the meantime, the Max Ache level, the place probably the most choices would expire nugatory, was recorded at $64,000.

The overall notional worth of expired BTC choices was $4.26 billion, highlighting vital exercise available in the market.

Bitcoin traded round $67,000 on the time of expiration, retracing from a current excessive of $68,000. But, BTC remained near its all-time excessive of $70,000.

Bitcoin’s implied volatility (IV) — dated the eighth of November — has stabilized at 55%, indicating a possible alternative for merchants as they anticipated the U.S. elections, which might introduce vital market shifts.

Rise in Bitcoin whales

Supporting the bullish sentiment, current information from Santiment revealed an increase within the variety of Bitcoin whales over the previous two weeks.

During this era, 297 new wallets holding at the least 100 BTC had been added, reflecting a 1.93% enhance and bringing the full variety of such wallets to 16,338.

Traditionally, a rise in massive Bitcoin holders typically aligns with upward value momentum, suggesting potential additional positive aspects for Bitcoin.

The rise in whale addresses coincided with Bitcoin’s current value motion, the place it briefly surpassed $68,000 earlier than a minor correction again to $67,000.

This whale accumulation might point out sustained curiosity amongst massive traders, probably supporting Bitcoin’s resilience forward of anticipated market volatility in November.

ETH choices expiration

On the twenty fifth of October, 403,426 Ethereum choices contracts expired as properly, with a Put-Name Ratio of 0.97, reflecting an virtually balanced sentiment between bullish and bearish positions.

The Max Ache level was set at $2,600, indicating the place the very best variety of choices would expire nugatory.

The notional worth of expired ETH choices reached $1.02 billion, emphasizing Ethereum’s vital market presence, although its efficiency remained extra stagnant in comparison with Bitcoin.

Lifelike or not, right here’s ETH’s market cap in BTC’s terms

On the press time, Ethereum traded at $2,468, close to its Max Ache level, suggesting restricted value motion.

This contrasted with Bitcoin’s stronger value dynamics, as the previous’s market conduct confirmed indicators of investor indecision, compounded by challenges associated to identify Ethereum ETFs.