The latest approval of Bitcoin exchange-traded funds (ETFs) by the SEC despatched jitters by means of the monetary world. Preliminary considerations about fading demand appear unfounded as Bitcoin ETFs proceed to shatter buying and selling quantity data. That is additional bolstered by three consecutive periods of web inflows into these funding autos.

Bitcoin ETF Inflows Sign Lengthy-Time period Investor Urge for food

A latest dip in ETF exercise sparked fears that the preliminary pleasure is perhaps short-lived. Nevertheless, these fears have been quelled by a resurgence in inflows.

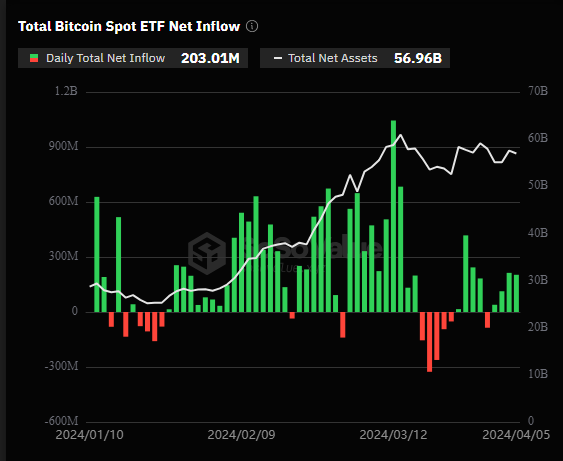

Based on information from SoSoValue, yesterday noticed a web influx of $203 million into Bitcoin spot ETFs, marking the third straight day of positive inflow.

This sustained inexperienced streak means that traders stay taken with gaining publicity to the highest crypto by means of ETFs, probably anticipating a value surge as a result of upcoming Bitcoin halving – a pre-programmed code replace that cuts manufacturing in half, traditionally main to cost will increase.

BlackRock’s Bitcoin ETF Leads The Pack

BlackRock, the world’s largest asset supervisor, has emerged as a frontrunner within the crypto ETF house. Their iShares Bitcoin Belief (IBIT) recorded the best web influx on a single day, exceeding $144 million.

BTC market cap presently at $1.3 trillion. Chart: TradingView.com

This spectacular determine has pushed IBIT’s whole web influx over the previous two weeks to over $14 billion. BlackRock’s dedication to Bitcoin ETFs is additional underscored by their latest choice to incorporate distinguished Wall Avenue establishments like Goldman Sachs, Citigroup, Citadel Securities, and UBS as Approved Members (APs) of their spot Bitcoin ETF prospectus.

These additions place these banking giants as first-time contributors within the ETF market, becoming a member of established gamers like JPMorgan and Jane Avenue.

The inclusion of such heavyweights is seen as a big vote of confidence in the way forward for Bitcoin ETFs and a possible catalyst for additional mainstream adoption.

Volatility On The Horizon For ETFs

Whereas the latest surge in demand paints a bullish image for Bitcoin ETFs, consultants warn that volatility could also be lurking on the horizon. CryptoQuant, a cryptocurrency evaluation platform, factors to alerts within the futures market that recommend potential value swings within the close to future.

A constantly excessive premium typically signifies sturdy institutional shopping for stress, notably in mild of the latest inflows witnessed in US Bitcoin ETFs. This elevated institutional exercise can contribute to cost fluctuations, creating alternatives for each good points and losses.

Regardless of the potential for short-term volatility, the general outlook for Bitcoin ETFs stays optimistic. The sustained demand, coupled with the backing of main monetary establishments like BlackRock, means that these funding autos are poised to play a big function in bridging the hole between conventional finance and the cryptocurrency world.

Featured picture from Vegavid Expertise, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site solely at your individual danger.