- U.S. Bitcoin ETF outflows continued into the brand new week.

- BTC worth has remained muted amid weak demand from U.S. traders.

U.S. spot Bitcoin [BTC] ETFs (exchange-traded funds) noticed a major bleed-out post-Labor Day, underscoring a sustained risk-off mode from traders.

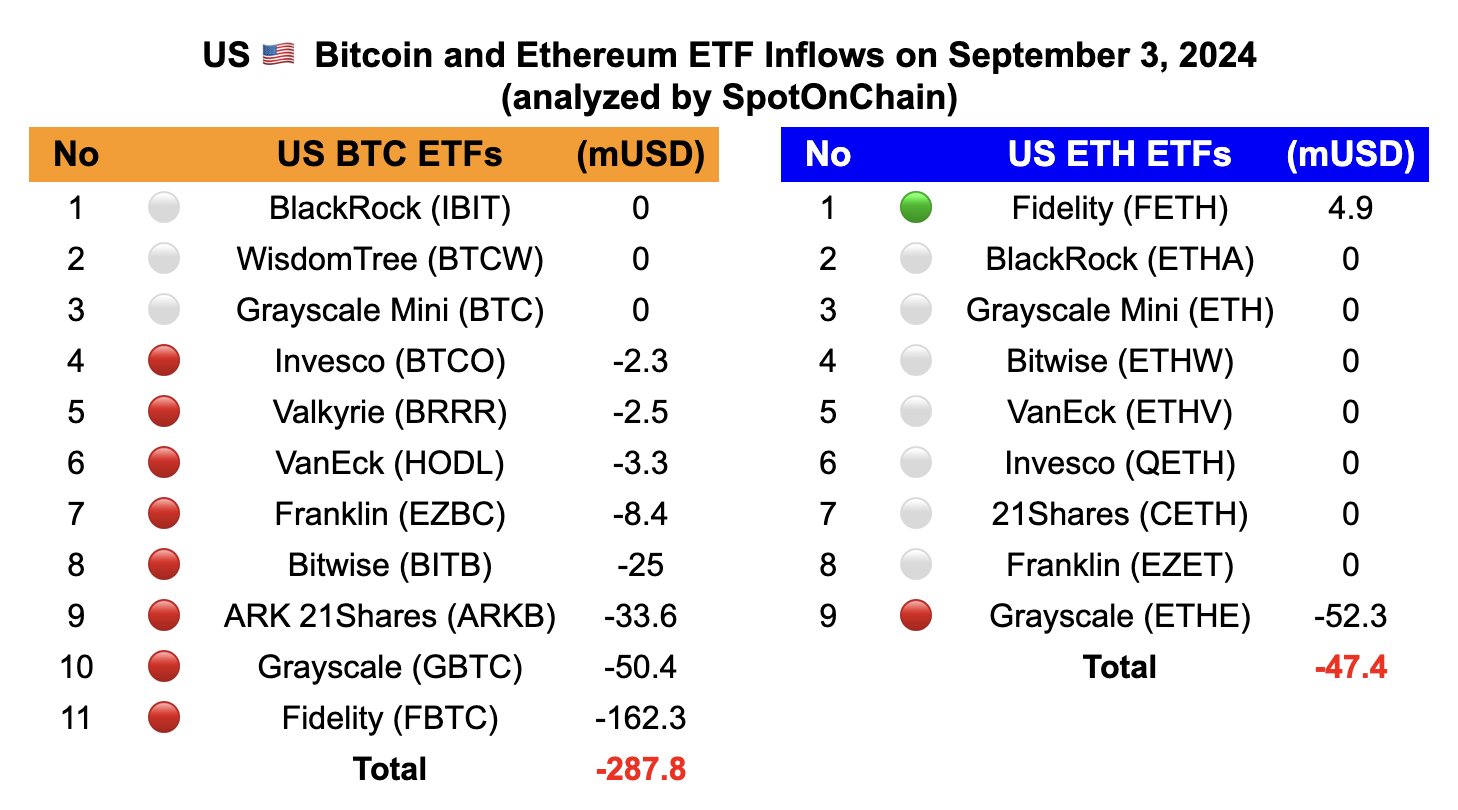

After an prolonged U.S. weekend, the merchandise recorded $288 million in outflows on the third of September.

Aside from BlackRock, Knowledge Tree, and Grayscale Mini, which recorded zero flows, the remaining posted damaging flows.

Constancy led the outflows as traders withdrew $162.3 million from its Bitcoin belief fund. Grayscale and Ark 21Shares adopted intently, with $50.4 million and $33.6 million, respectively.

BTC ETF traders’ risk-off mode persist

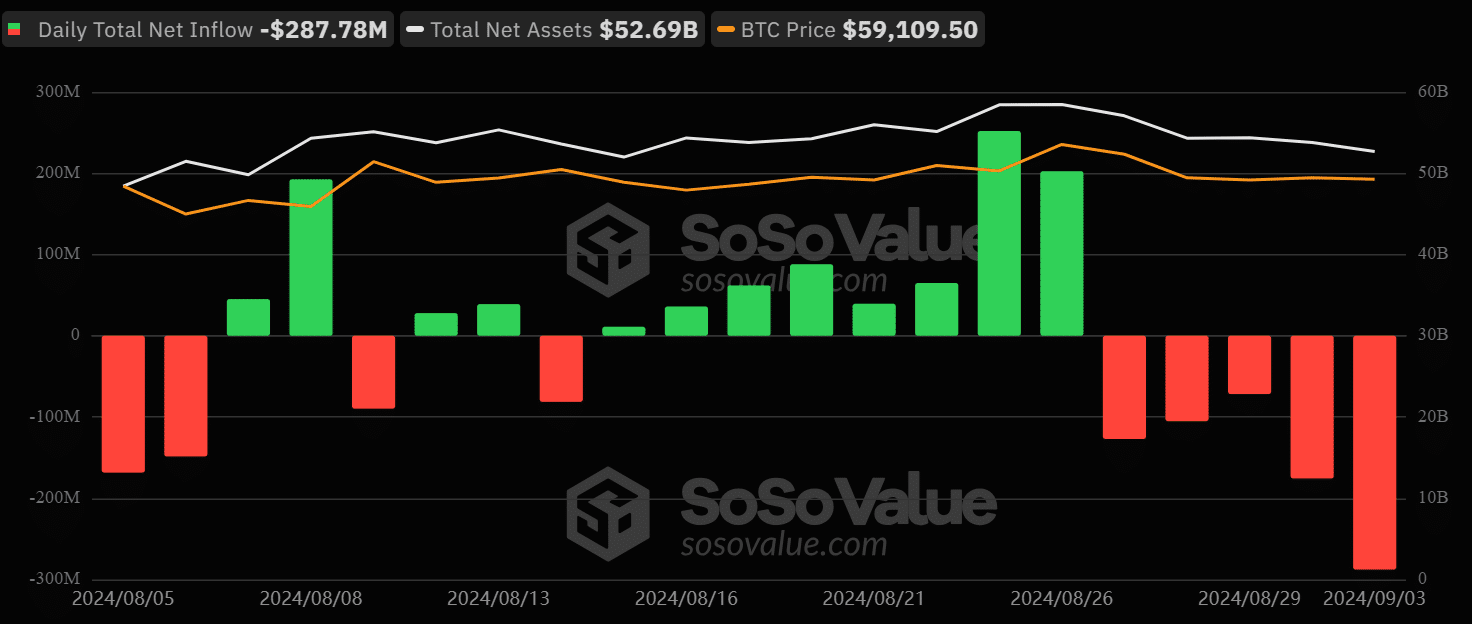

The post-Labor Day outflows bolstered the weak development that started final week. Soso Worth data confirmed that the merchandise have seen damaging every day outflows previously 5 buying and selling days.

The weak development recommended that ETF traders’ risk-off mode has been sustained into the brand new week. Final week, the merchandise recorded a cumulative outflow of $277 million.

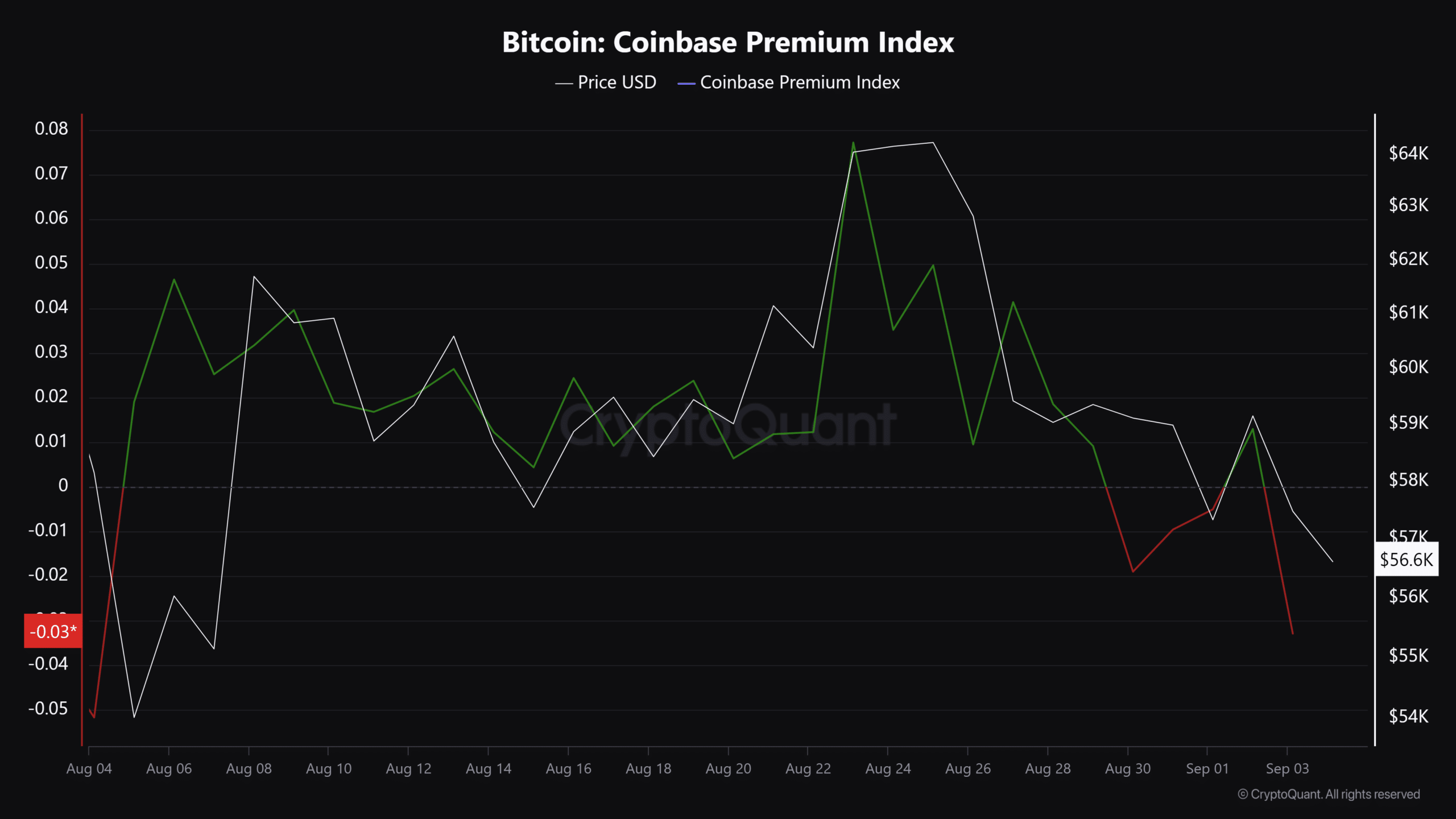

BTC’s worth has remained muted amidst sustained BTC ETF outflows.

Since final week, the digital asset has dropped under $60K and weakened additional because the risk-off mode persists throughout the market. BTC was valued at $56.6K at press time, down over 12% from a current excessive of $64K.

That mentioned, the low demand from U.S. traders might weigh on the crypto asset’s worth within the quick time period.

As illustrated by the Coinbase Premium Index, which tracks traders’ demand for BTC, its worth all the time will increase if there’s monumental demand from the U.S.

Nevertheless, the weak demand (marked by crimson) has uncovered BTC to downward strain since late August. A considerable reversal might solely occur if demand from U.S. traders confirmed a exceptional restoration.

Within the meantime, primarily based on historic tendencies, most analysts, together with QCP Capital, projected a weak efficiency for BTC in September.

Nevertheless, in response to a crypto buying and selling agency, BTC might begin a robust rally in October and the remainder of This autumn primarily based on previous patterns and choices market information.

‘October, nevertheless, has the strongest bullish seasonality…This seasonality play might clarify the constant name shopping for within the vol market (the desk noticed one other 150x 80k Dec calls lifted in Asia morning).’