- Bitcoin dominance has reached an area excessive, warning buyers of a possible market overheating.

- THIS highlights the subsequent finest “dip” alternative.

Two days in the past, Bitcoin [BTC] dominance surged to a formidable 57%, following a each day acquire of over 5% that pushed BTC above the $66K mark – a stage it hadn’t breached in additional than 150 days.

Now buying and selling at $67,350, Bitcoin has risen over 10% in only one week. This speedy ascent has led analysts at AMBCrypto to invest whether or not the market is nearing an overextension.

If that is so, a pullback to an area low may happen earlier than BTC makes an attempt to retest its all-time excessive.

Excessive bitcoin dominance alerts overheating

Previously week, each day good points exceeding 2% have helped Bitcoin recuperate from its $60K droop, confirming the extent as a brand new help.

Moreover, the surge was bolstered by a rising RSI, indicating sturdy momentum. Commerce quantity additionally spiked to a brand new native excessive, signaling elevated help from retail buyers.

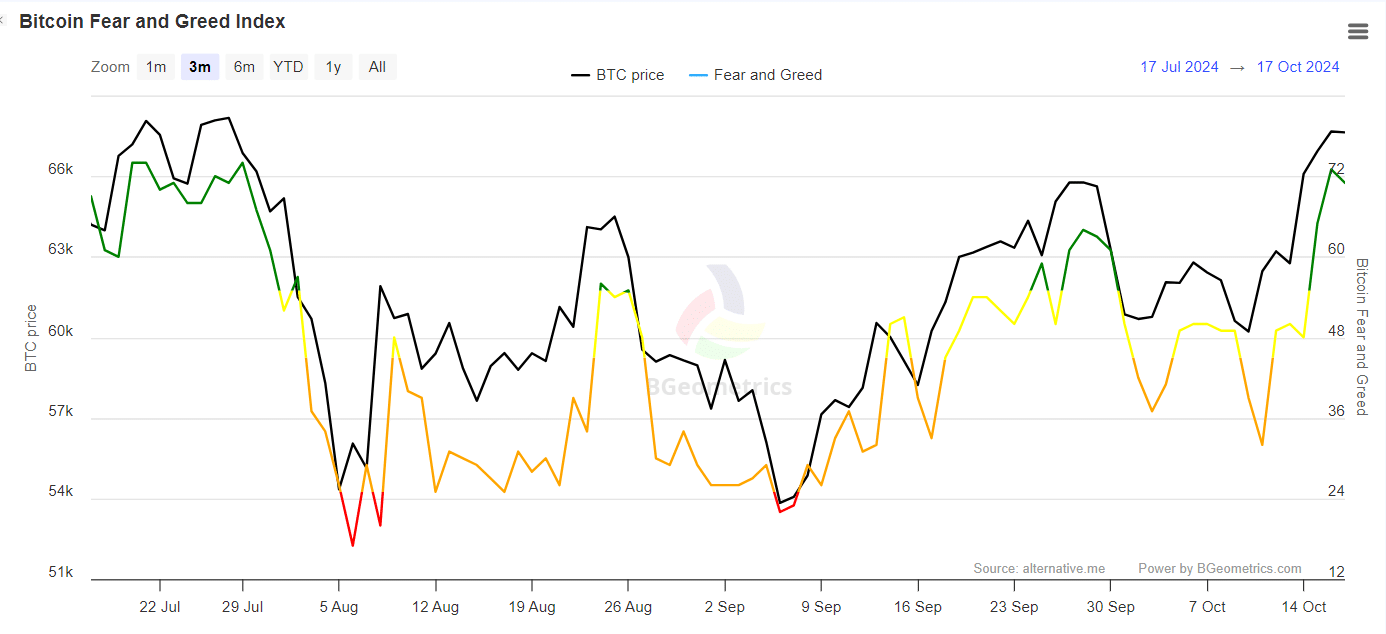

Because of this, Bitcoin dominance additionally climbed to a brand new excessive. Nonetheless, this bullish momentum has pushed BTC into “greed” territory, hinting at potential indicators of overheating available in the market.

Traditionally, a shift into greed typically coincides with the part in a cycle the place Bitcoin hits a market prime, continuously resulting in a subsequent value crash.

At this stage, many merchants exit, doubling down on their good points, whereas new patrons hesitate, fearing the inevitable correction.

Subsequently, these merchants normally look forward to a dip-buying alternative, capitalizing in the marketplace backside when Bitcoin dominance resurges.

At the moment, with Bitcoin dominance at a brand new excessive and different alerts pointing to a market prime, Bitcoin could also be primed for a correction.

This correction may shake out weaker fingers, leaving contemporary patrons to benefit from a possible dip.

Bitcoin may retrace to an area low

Bitcoin beforehand confronted rejection at $64K, which should be transformed into help to sign the potential dip. This state of affairs unfolds when new curiosity perceives this value vary as a beautiful entry level.

Moreover, as BTC turns into extra weak to speculative swings, the chance of elevated quick positions in futures buying and selling rises, with merchants focusing on $64K as the subsequent dip.

This example additional reinforces the concept that BTC could be awaiting a correction earlier than making an attempt to check its ATH.

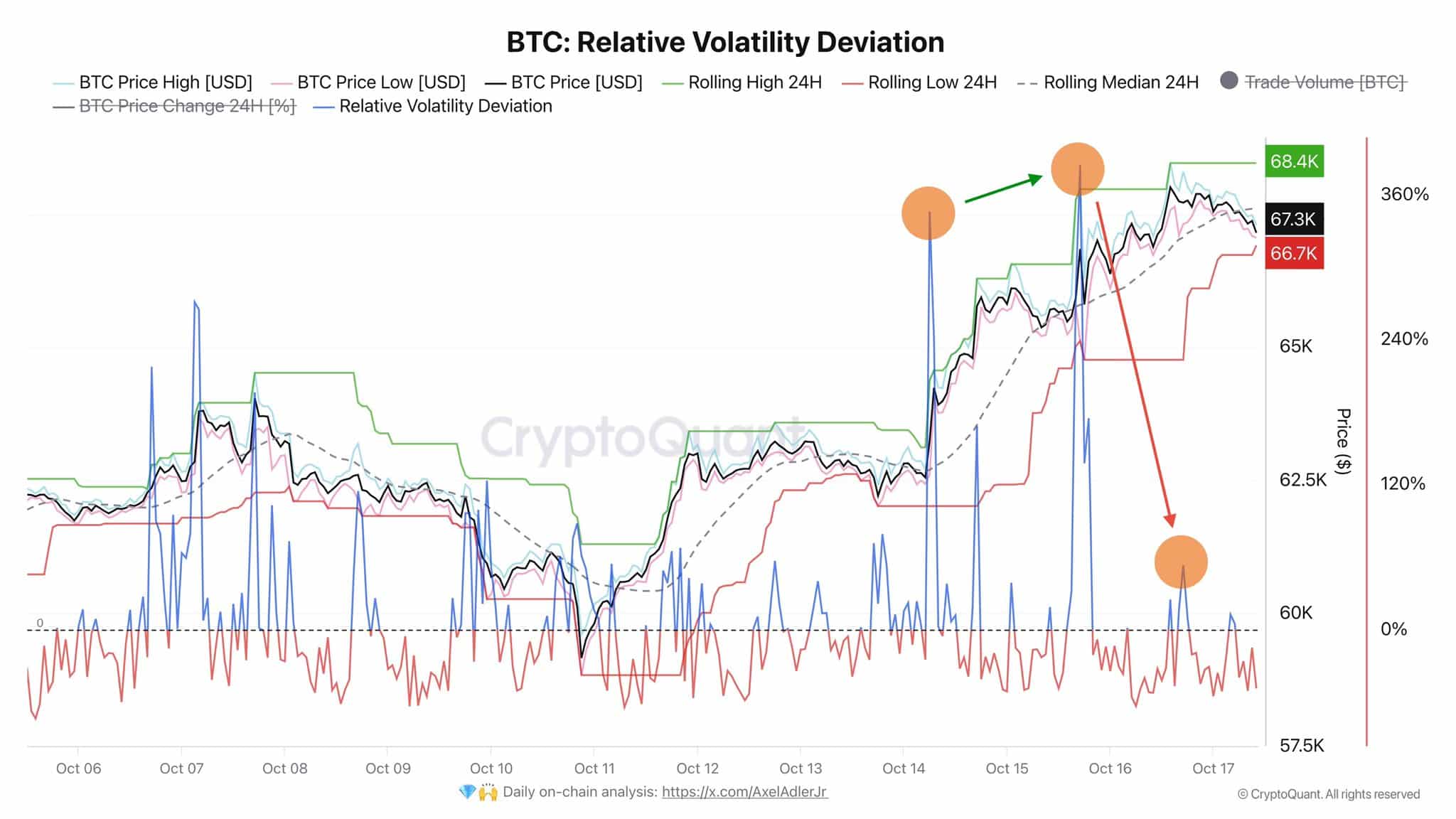

Moreover, a outstanding analyst has additionally cautioned buyers as volatility has shifted into unfavorable territory, influenced by the surge in Bitcoin dominance.

At the moment, the value fluctuates between $68.4K and $66.7K, whereas Open Curiosity on prime exchanges has risen to $20.3B, making BTC much more weak to sudden value swings.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Total, the excessive Bitcoin dominance alerts a market overextension, backed by different variables. The speedy ascent to $67K has pushed the market into greed, suggesting that the present value represents a market prime.

Whereas AMBCrypto evaluation means that $64K is the subsequent goal for a possible native low, this presents the most effective dip-buying alternative.