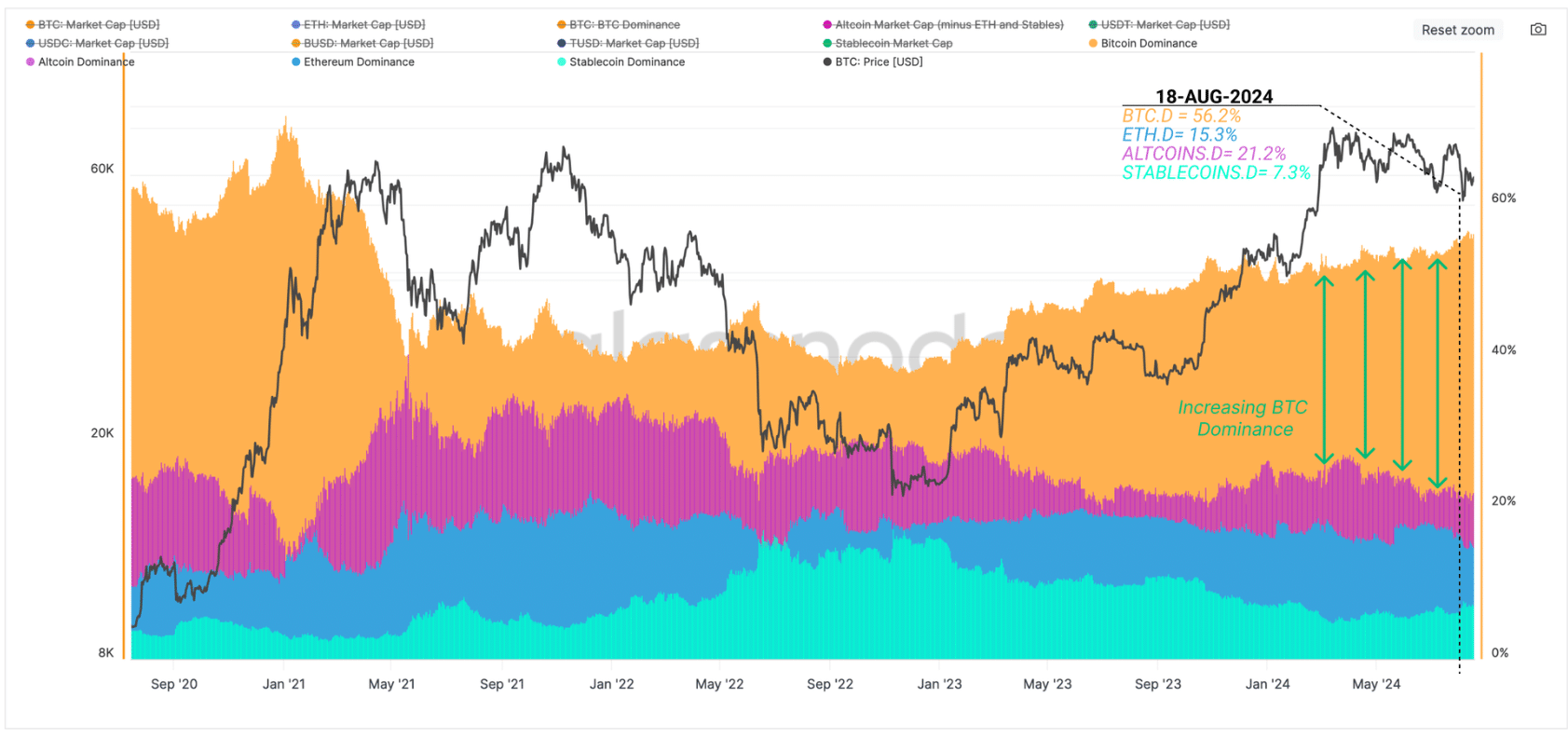

- Bitcoin dominance has elevated from 38% in 2022 to 56%, largely attributed to long-term holder accumulation.

- Quick-term holders are sitting on unrealized losses, with an overreaction sure to trigger additional dips.

Bitcoin [BTC] continues to dominate the cryptocurrency market, accounting for greater than half of the $2.1 trillion world crypto market cap.

In line with on-chain analytics platform Glassnode, because the crypto market hit the cycle low in November 2022, BTC’s dominance has grown from 38% to 56%.

However, Ethereum [ETH] dominance has remained comparatively flat within the final two years whereas altcoins have additionally misplaced 6.5% of their market share.

Lengthy-term holders drive Bitcoin dominance

Per Glassnode, Bitcoin’s development comes amid a rise in capital inflows in the direction of the asset as long-term holders present diamond palms.

The availability of Bitcoin amongst these merchants has elevated considerably. The report famous that almost all of those merchants grew to become long-term holders after buying BTC close to the March all-time highs.

“Regardless of the tempestuous and uneven value motion, the resolve of Lengthy-Time period Holders stays resolute, with a transparent desire for HODL and buying cash,” Glassnode acknowledged.

These holders are sitting on income of round $138 million per day. This will increase the sell-side danger, however profit-taking actions have cooled down.

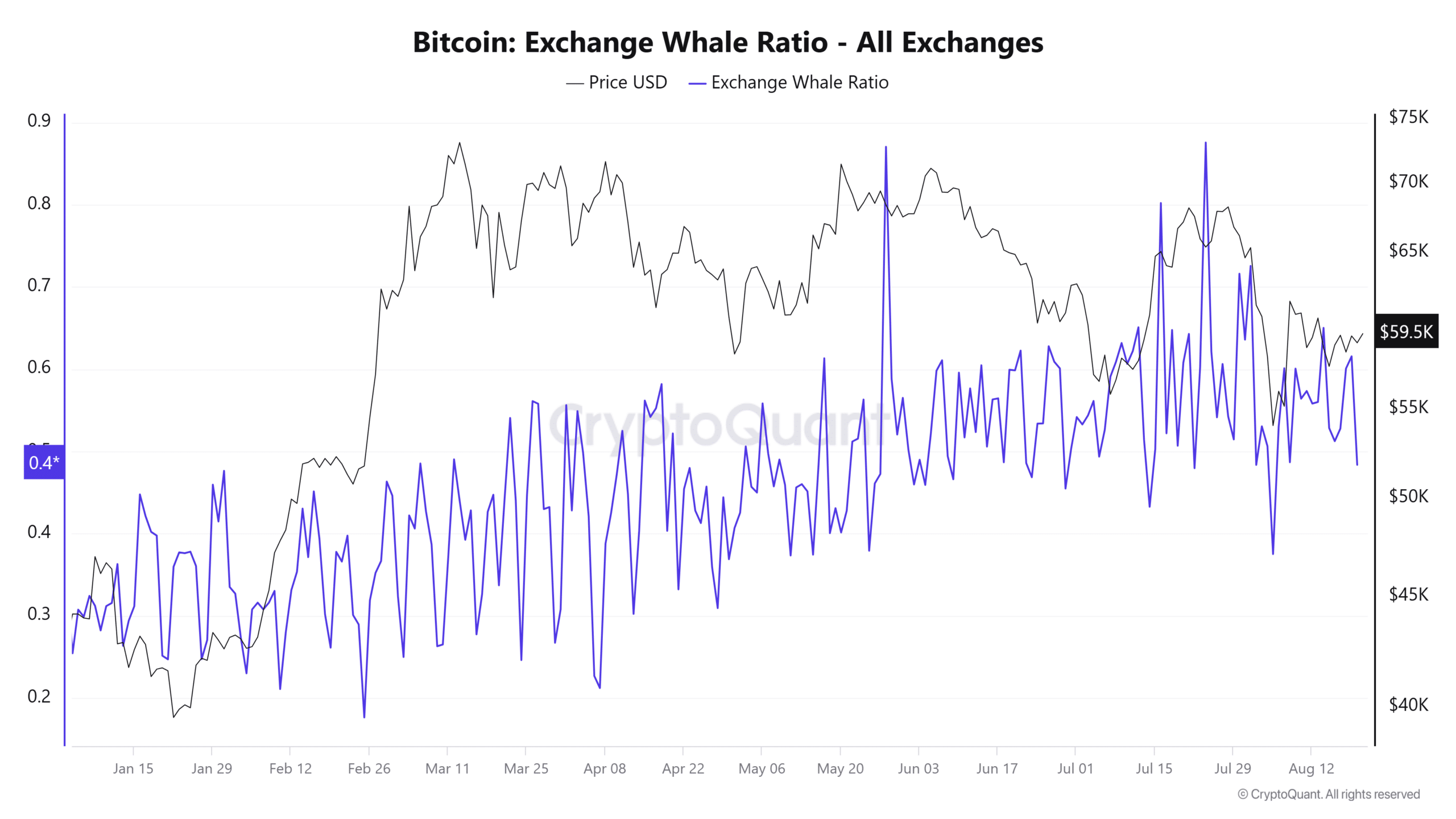

This commentary is additional strengthened by CryptoQuant knowledge that exhibits after intense profit-taking actions by whales in Could and July, the Trade Whale Ratio is now dropping.

Moreover, patrons seem like absorbing the offered cash, explaining why Bitcoin value has been rangebound in the previous couple of months since dropping from its ATH.

Quick-term holders brought about $50K dip

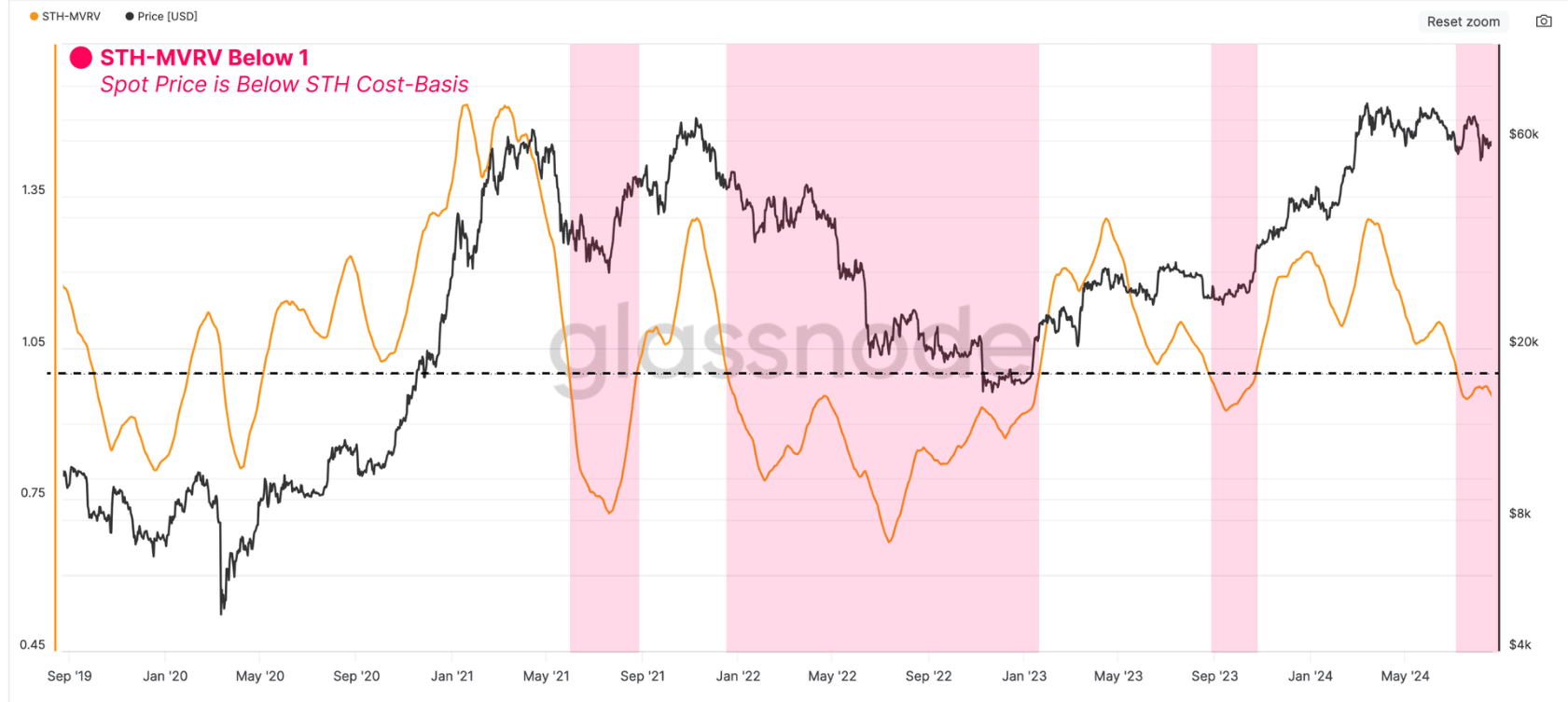

Glassnode additionally argued that an “overreaction” by short-term holders triggered Bitcoin’s drop beneath $50,000 earlier this month.

The short-term holder Market Worth to Realized Worth (MVRV) ratio sits beneath 1 suggesting that these buyers are sitting an unrealized losses. This ratio has been beneath the equilibrium level within the final 30 days.

Not like long-term holders, short-term Bitcoin holders are way more reactive to cost actions, with their responses behind native tops or bottoms in keeping with Glassnode. That is what occurred on fifth August when BTC crashed to a multi-month low at $49,000.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

If these buyers keep in losses beneath $59,000 for prolonged intervals, the analysts stated it’s going to enhance the probability of market panic and a extreme bearish momentum.

A take a look at leveraged buying and selling factors in the direction of a slight shift to the bullish facet. The lengthy/quick ratio on Coinglass confirmed a gradual enhance in lengthy positions since 18th August.