- Retail demand falls 10% as whales ship 45K BTC to Binance.

- Bitcoin types cup-and-handle sample; liquidations rise whereas derivatives exercise cools.

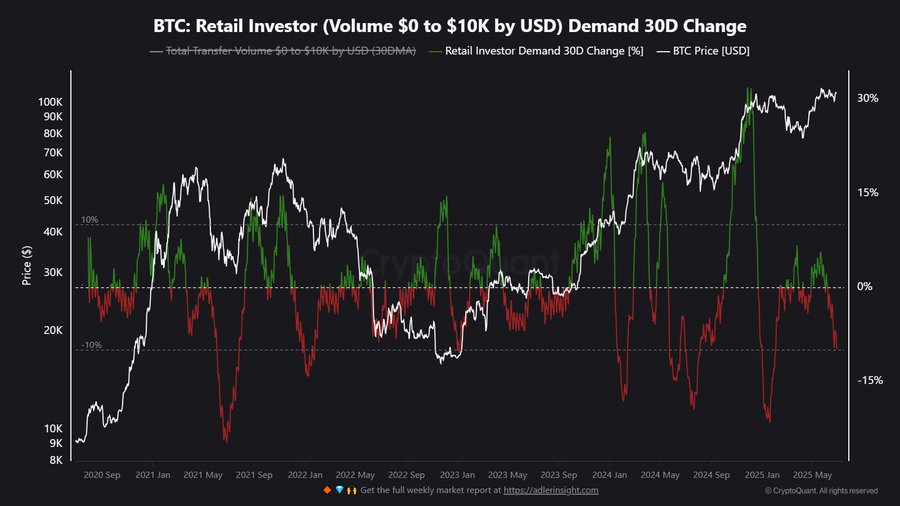

Retail investor participation in Bitcoin [BTC] has continued to fade.

In line with the 30-day demand change chart, BTC transfers between $0–$10K dropped over 10%, the bottom in six months.

This drawdown, marked in pink on the chart, displays dwindling conviction from smaller market contributors regardless of BTC hovering at $107,349.

Traditionally, such declines have preceded both consolidation or extra risky strikes, relying on whether or not whales step in.

Due to this fact, the shrinking presence of small traders could sign a rising reliance on institutional exercise to maintain market route.

BTC whales resurface, what are they planning?

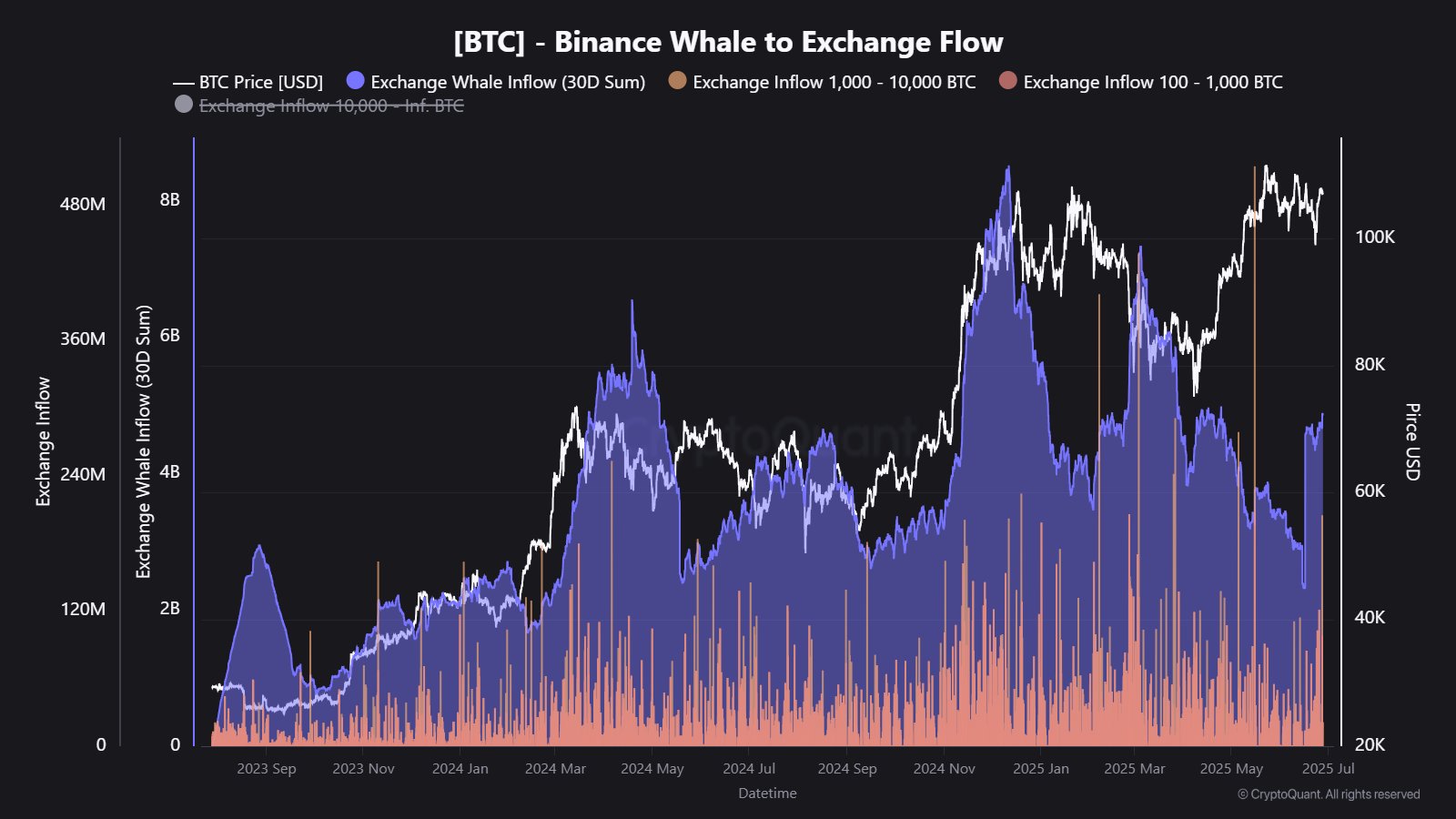

Having mentioned that, whales are doing the alternative.

During the last thirty days, greater than 45,420 BTC—price roughly $4.88 billion—flowed into Binance.

This inflow in Alternate Whale Influx represents a pointy pivot towards lively positioning, usually seen earlier than massive worth swings.

Not like earlier accumulation phases, this circulate coincides with weakening retail demand, suggesting whales are both getting ready to distribute or react to market catalysts.

Bitcoin’s subsequent breakout!

Bitcoin’s worth construction now reveals a basic cup and deal with formation, with a possible breakout zone close to $111,897. After bouncing from the $101,506 stage, BTC has reclaimed greater floor, hovering close to $107,389.

This bullish sample usually indicators potential upward actions however requires affirmation via a transparent breakout and robust quantity.

The following buying and selling classes are important, particularly if BTC can break resistance convincingly. Conversely, a failed breakout could set off profit-taking and result in a retest of decrease help ranges.

Will liquidation stress above $108K set off a brief squeeze?

The Binance Liquidation Heatmap confirmed thick liquidity bands between $108K and $111K. That is the place most over-leveraged quick positions are more likely to be worn out if BTC pushes greater.

Furthermore, these liquidation zones usually act as magnets, drawing worth motion into risky territory.

A breakout via $108K could set off a cascade of quick liquidations, quickly pushing the value towards the $115K–$118K vary.

Nevertheless, failure to breach this zone might lead to one other spherical of sideways consolidation and indecisive sentiment.

Derivatives pullback: Are merchants hedging or hesitating?

In the meantime, derivatives markets are truly fizzling out.

Futures Quantity dropped 25.88% to $49.19 billion, and Open Curiosity hovered flat at $71.37 billion. Choices weren’t spared as Quantity sank 28.01%, and Open Curiosity slipped 3.88%.

Merchants are clearly hedging or pulling again—reflecting warning and concern of being misaligned forward of potential volatility.

But, such contractions have usually set the stage for explosive breakouts as soon as market conviction returns.

Can BTC keep momentum amid diverging indicators?

Bitcoin’s outlook stays blended. Whereas technicals recommend a bullish setup, falling retail demand and cautious derivatives’ exercise suggest hesitation.

Whale inflows could inject liquidity, however except they convert into lively shopping for, the value dangers stagnation. Due to this fact, a confirmed breakout above $111K—fueled by quick liquidations—stays the important thing set off to look at.