With over $10 billion in open curiosity worn out in simply two months, the Bitcoin panorama has skilled a major reboot, and analysts are predicting that the value of the flagship crypto will quickly get better.

The abrupt change has prompted discussions concerning the cryptocurrency’s future value trajectory. Whereas some market consultants see this as a chance for a contemporary begin, others warning that there’s nonetheless a heavy diploma of uncertainty.

Bitcoin Open Curiosity Down

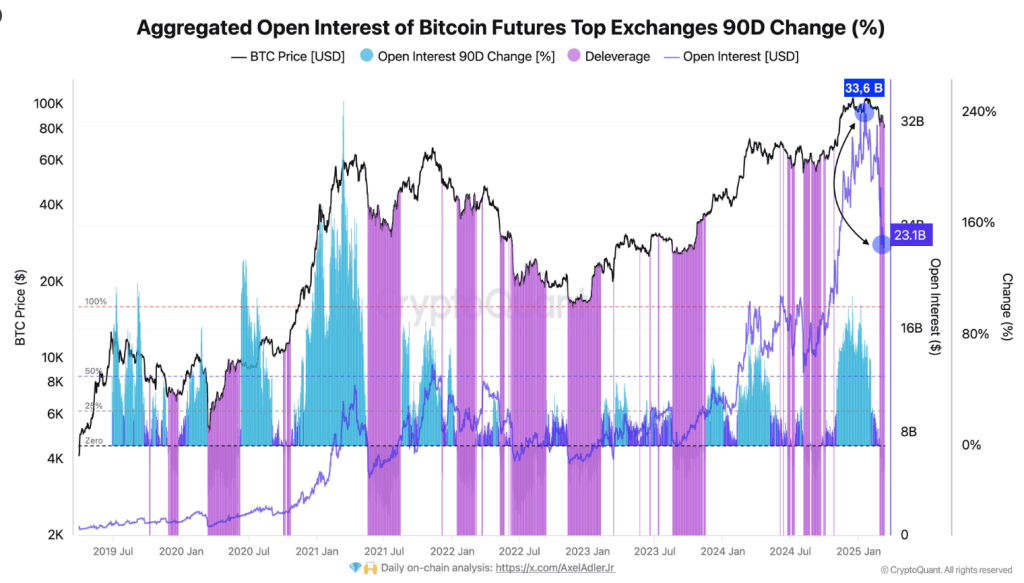

Studies present that Bitcoin’s open curiosity hit a peak of $33 billion on January 17. Nonetheless, by early March, greater than $10 billion had been worn out. This huge liquidation wave was fueled by varied components, together with widespread political noise and broader market situations.

???? The $BTC market is deleveraging : A Pure Reset ?

On January seventeenth, Bitcoin’s open curiosity reached an all-time excessive of over $33B, indicating that leverage available in the market had by no means been this excessive.

Following the latest panic triggered by political instability linked to… pic.twitter.com/KPLQ63SHx3

— Darkfost (@Darkfost_Coc) March 16, 2025

The determine reveals that the open curiosity of Bitcoin’s 90-day futures was down by 14% from February 20 to March 4. On account of the compelled withdrawal of many merchants, the market needed to change gears. Others fear that extra volatility may come subsequent, whereas others see this as a optimistic adjustment.

Merchants Watching For Indicators Of Stability

Merchants at the moment are on the lookout for stability since open curiosity has dropped considerably. Some individuals declare that proper now the market is extra suited to long-term enlargement. Others stay cautious, seeing that extra market swings might come earlier than Bitcoin units up a robust basis.

Warning Required

The founding father of Into The Cryptoverse, Benjamin Cowen, cautions that the present bull cycle could also be in peril if costs fall beneath the decrease $70,000s. He suggests {that a} shut within the low $60,000s could possibly be a warning that the bull market is coming to an finish, drawing comparisons to the 2017 cycle. However, retaining costs over $70,000–$73,000 would defend the market’s construction.

In the meanwhile, Bitcoin is staying round $82,900. Cowen says {that a} macro decrease excessive might occur later this 12 months if the value falls beneath key help ranges. This could imply that the image for the market is extra bearish by Q3. If previous developments are correct, although, this part of consolidation might result in one other huge rise within the subsequent few months.

Optimism In The Air

In the meantime, Bitcoin’s long-term prognosis stays hopeful. In response to Josh Mandell, a widely known analyst and millionaire who has over 79,000 followers on X, if the value of Bitcoin closes above $84,000 on the finish of the month, it’d attain $100,000.

Bitcoin’s Value Motion Stays Unsure

Latest liquidations spotlight how shortly issues can change, and the Bitcoin market has seen sharp value swings previously. Whereas some buyers see this as an opportunity to get belongings at lowered charges, others would quite see how the market responds.

For now, every thing is a mix of uncertainty and optimism — a wait-and-see environment. As they are saying, something can occur within the cryptoverse.

Featured picture from Gemini Imagen, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.