- BTC’s weighted sentiment has been adverse for the previous three weeks.

- Different on-chain indicators trace at the opportunity of additional worth decline beneath $66,000.

As Bitcoin [BTC] extends its weekly loss by one other 4%, its weighted sentiment continues on its bearish pattern, in keeping with Santiment’s information.

In a submit on X (previously Twitter), Santiment famous that BTC’s weighted sentiment has been adverse for the previous three weeks.

The start of this bearish pattern, which occurred on 14th March, coincided with the coin’s worth falling from its $73,750 all-time excessive. Exchanging arms at $66,572 at press time, BTC’s worth has since fallen by 10%.

???? The group’s sentiment towards #Bitcoin and #crypto markets basically has wavered ever because the huge correction 3 weeks in the past. Even with the $BTC halving now simply 2 weeks away, dealer sentiment displays #FUD and #bearish expectations.

With costs bouncing again to $69K… pic.twitter.com/DYs5RYNR95

— Santiment (@santimentfeed) April 5, 2024

Utilizing historic precedents, Santiment added that BTC’s worth usually “transfer (in) the other way of the group’s expectation.”

During times when the market reaches euphoric highs and expects a continued rally, BTC’s worth retraces. Conversely, when sentiment grows poor and the market expects additional draw back, BTC’s worth has been recognized to provoke an uptrend.

This sample has performed out even in latest occasions.

Extra decline within the brief time period?

On 4th April, BTC’s worth rallied above the $69,000 worth degree briefly earlier than retracing to the $66,500 area. With new resistance shaped at $69,000, on-chain information suggests the opportunity of an extra decline within the main crypto’s worth within the brief time period.

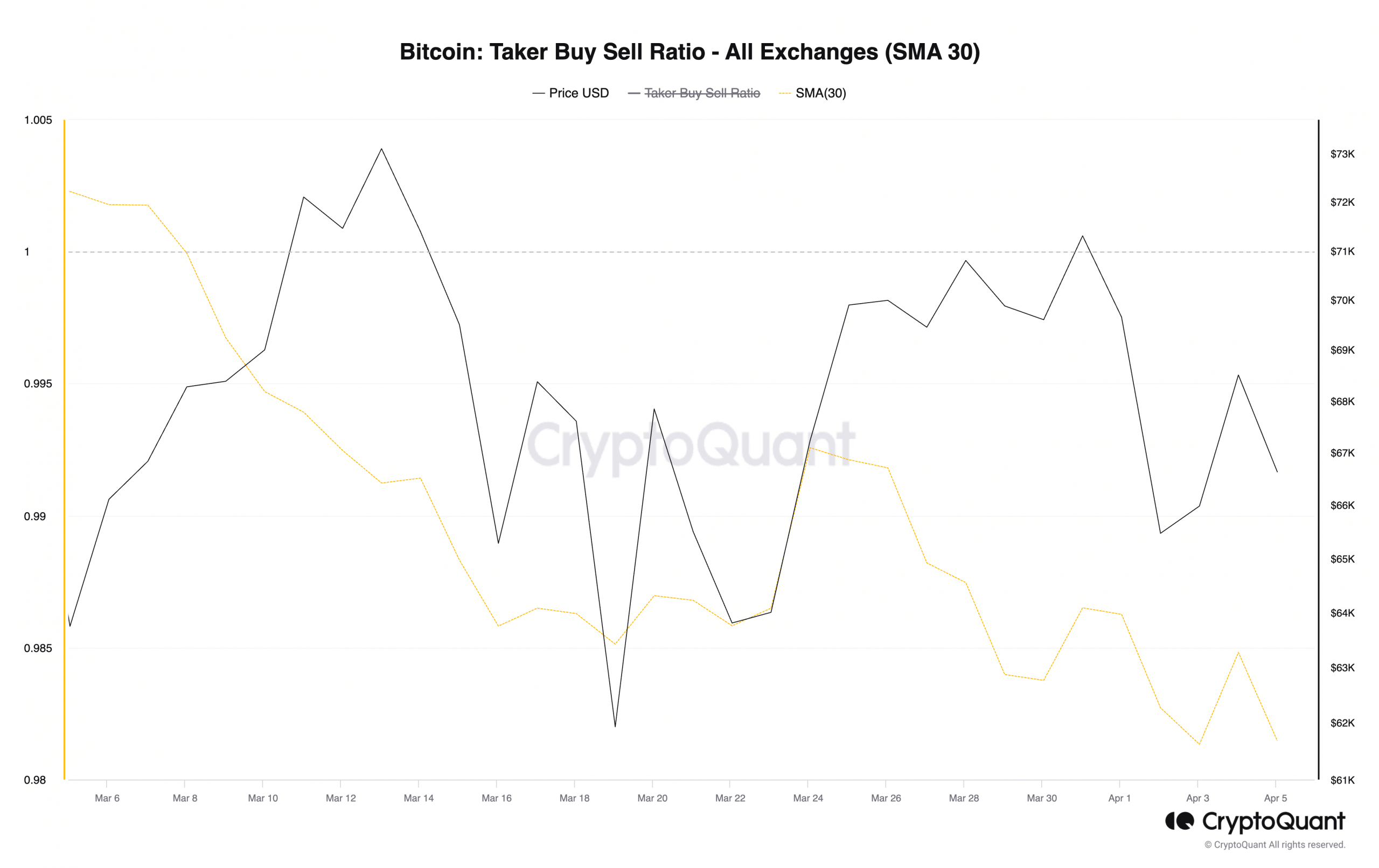

Firstly, the coin’s taker buy-sell ratio assessed on a 30-day easy shifting common (SMA) fell beneath the zero line on eighth March, foreshadowing the worth decline that commenced on 14th March.

The taker buy-sell ratio is a metric that measures the ratio between the purchase quantity and promote quantity in an asset’s futures market. A price larger than 1 signifies extra purchase quantity than promote quantity, whereas a price lower than 1 signifies extra promote quantity than purchase quantity.

Since eighth March, the worth of BTC’s taker buy-sell ratio has been lower than 1. The regular decline on this metric implies that there are extra sellers than patrons amongst these executing fast trades within the BTC market.

That is anticipated to proceed so long as sentiment stays bearish, placing downward stress on the coin’s worth.

Additional, in a latest report, pseudonymous CryptoQuant analyst Tugbachain discovered that BTC’s NVT Golden Cross closed March flashing a promote sign.

This indicator compares the 30-day shifting common of the coin’s community worth to transactions (NVT) ratio with its 10-day shifting common.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

It generates an extended sign when it returns a price lower than 1.6. Conversely, when the worth is above 2.2, it’s taken as a sign to enter brief positions.

In keeping with Tugbachain:

“On the finish of March, with the Bitcoin worth round $71,000, the NVT worth reaching ‘3.17’ ranges served as an indicator of reaching a neighborhood peak.”