- Bitcoin holders have begun to promote at a loss after an prolonged interval of creating a revenue.

- Key technical indicators confirmed that the bears are in charge of the market.

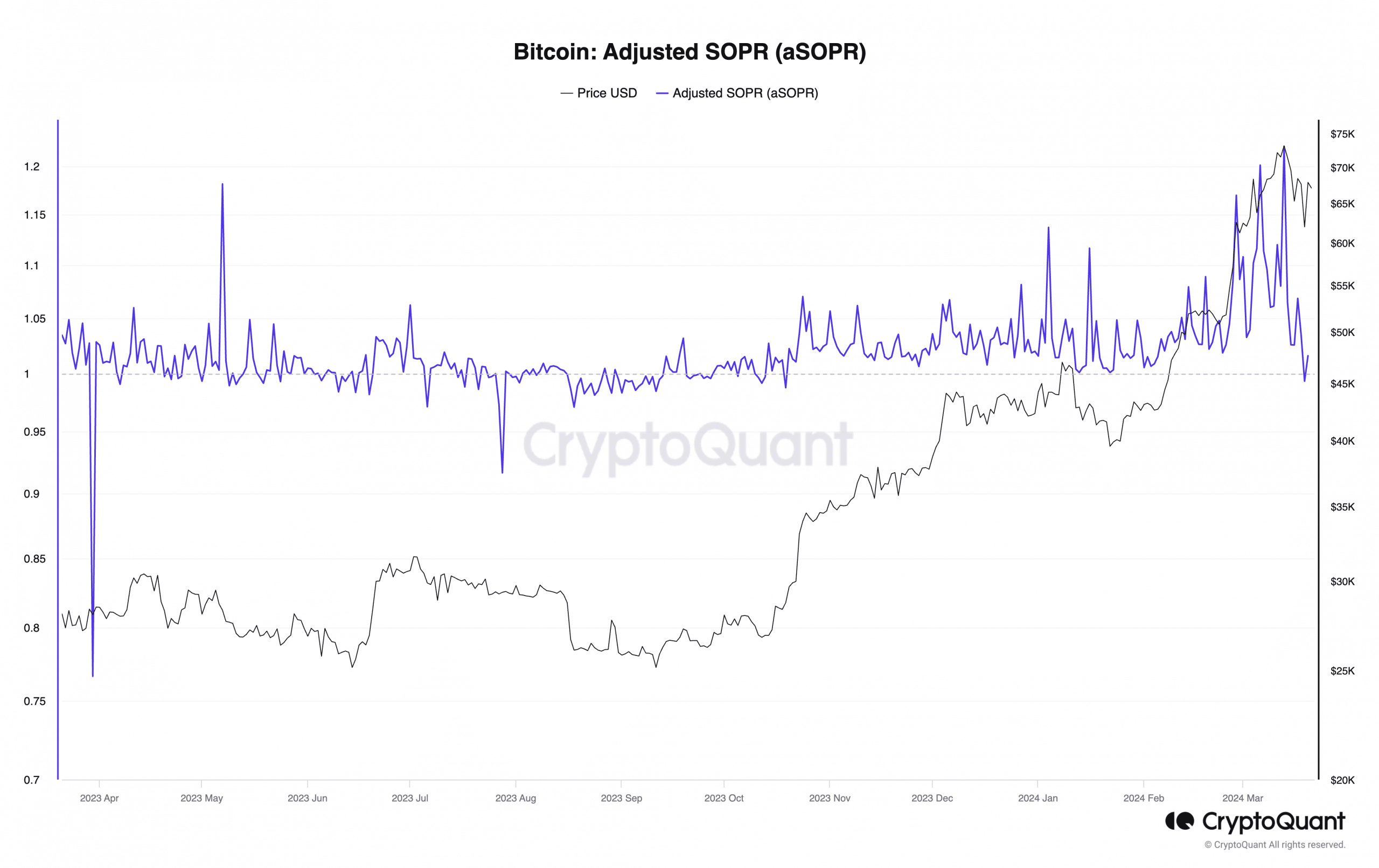

Bitcoin’s [BTC] Adjusted Spent Output Revenue Ratio (aSOPR) has fallen beneath 1 for the primary time since October 2023, based on CryptoQuant knowledge. This means that, on common, buyers at the moment are promoting their holdings at a loss.

BTC’s aSOPR measures the revenue or loss realized when the coin is spent by its holders. An aSOPR worth above 1 signifies that cash are being offered at a revenue general. Conversely, a price beneath 1 means that buyers are promoting at a loss.

Latest surge in profit-taking exercise

BTC’s current worth slip underneath $61,500 has led to a major surge in sell-offs amongst its holders. Based on CryptoQuant’s knowledge, the market has seen an increase in BTC’s provide on exchanges. Its change reserve has spiked by 1% up to now seven days.

As of this writing, 2.006 million BTC had been held throughout cryptocurrency exchanges. When an asset’s reserve climbs this manner, it suggests a rally in promoting strain.

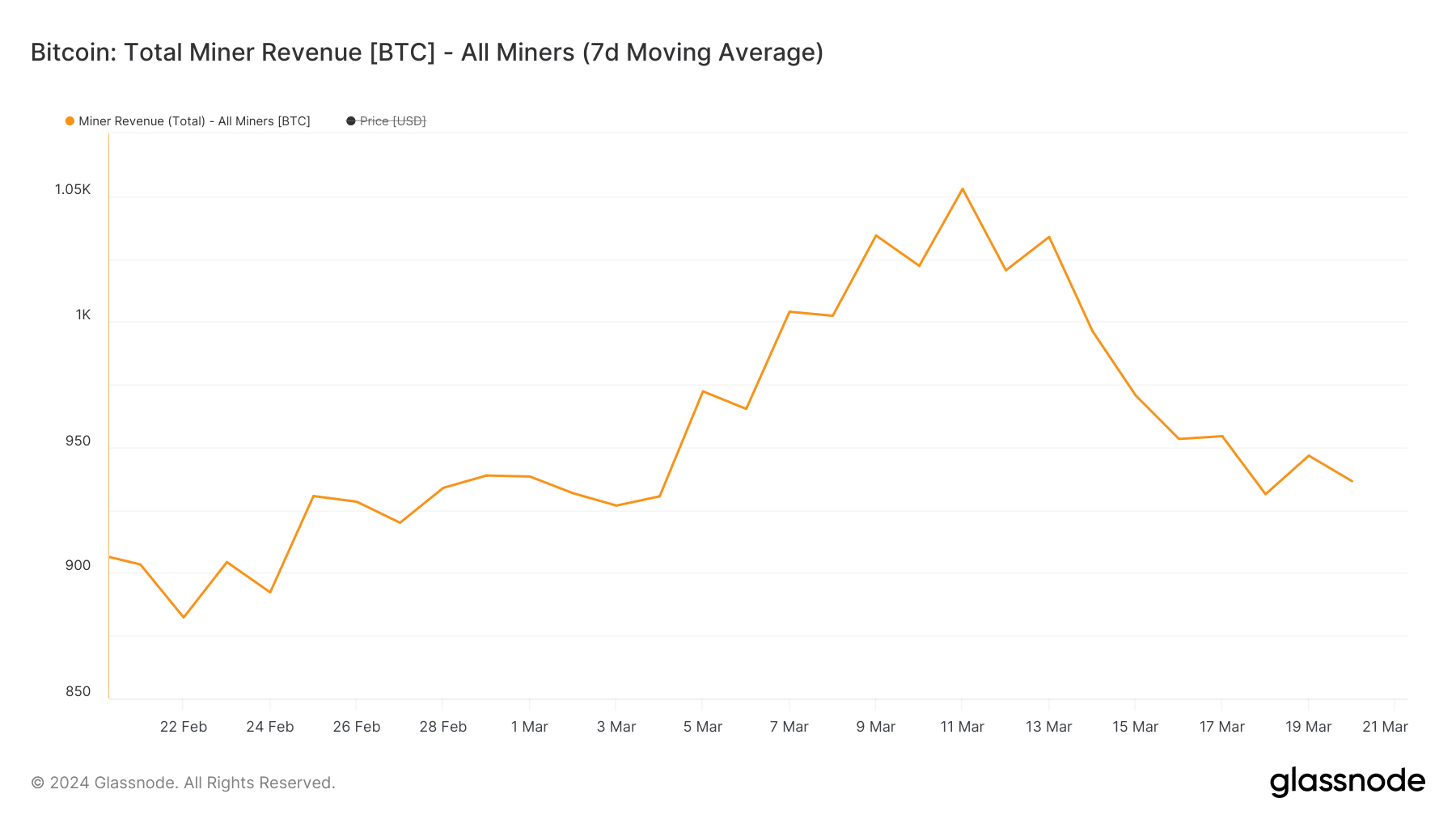

Miners have additionally distributed their holdings to chop losses, inflicting their reserve to plunge to a three-year low. The current decline in BTC’s worth has led to a gradual lower in miner income from charges, making coin distribution a extra appropriate choice for community miners.

Per Glassnode’s knowledge, the share of miner income derived from charges has declined by 44% since sixth March.

Moreover, within the coin’s futures market, its open curiosity witnessed a 14% decline between the fifteenth and twentieth of March, based on Coinglass’ knowledge.

When an asset’s open curiosity falls on this method, it suggests a lower within the variety of excellent contracts. It is because market contributors are exiting their positions with out opening new ones.

As of this writing, BTC’s futures open curiosity was $36 billion.

Anticipate additional drawbacks?

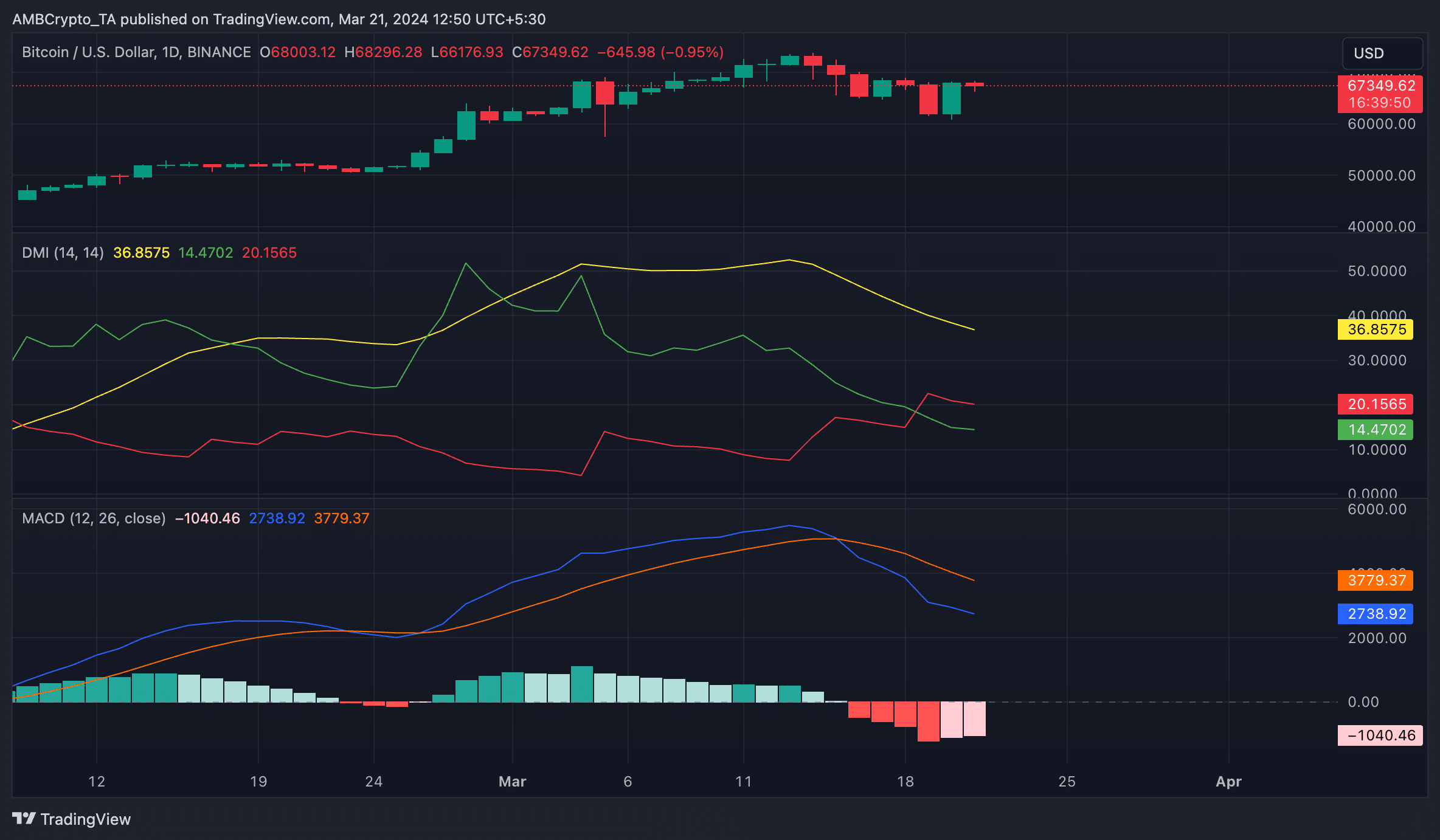

An evaluation of BTC’s worth actions on a each day chart revealed that bearish sentiment has grow to be vital available in the market.

Readings from the coin’s Shifting Common Convergence Divergence (MACD) confirmed that its MACD line crossed beneath the sign line on fifteenth March, inflicting the indicator to return solely crimson bars.

The intersection typically means that an asset’s short-term momentum is weakening relative to the longer-term momentum.

Lifelike or not, right here’s BTC’s market cap in ETH terms

This crossover alerts a shift in the direction of bearish momentum and is interpreted by merchants as a sign to think about promoting or coming into brief positions.

Additionally, BTC’s constructive directional index (inexperienced), at 14.70, rested beneath its unfavorable index (crimson), confirming that the bears had regained management of the market.