- Bitcoin shorts may contribute to larger costs in a brief squeeze situation

- At press time, bulls remained in management regardless of the latest highs and rising expectations of draw back

AMBCrypto beforehand checked out the opportunity of lengthy liquidations if Bitcoin retraces after attaining it most-recent all-time excessive. Properly, regardless of being overbought, promote stress remained weak throughout the board and at press time, BTC holders had been nonetheless going robust.

One of many principal the reason why Bitcoin promote stress has not taken over is as a result of market confidence was nonetheless robust after the latest high. Heavy Bitcoin ETF inflows within the final 24 hours contributed to this. ETF flows have proved to be a comparatively correct measure of market confidence. Actually, in keeping with Bloomberg’s Eric Balchunas,

“HOOVER CITY: Bitcoin ETFs took in a record-smashing $1.4b yesterday (the Trump impact). $IBIT alone was +$1.1b. That’s +$6.7b in previous mo and $25.5b YTD. All instructed they feasted on about 18k btc in in the future (vs 450 mined) and at the moment are 93% of the best way to passing Satoshi’s 1.1mil btc.”

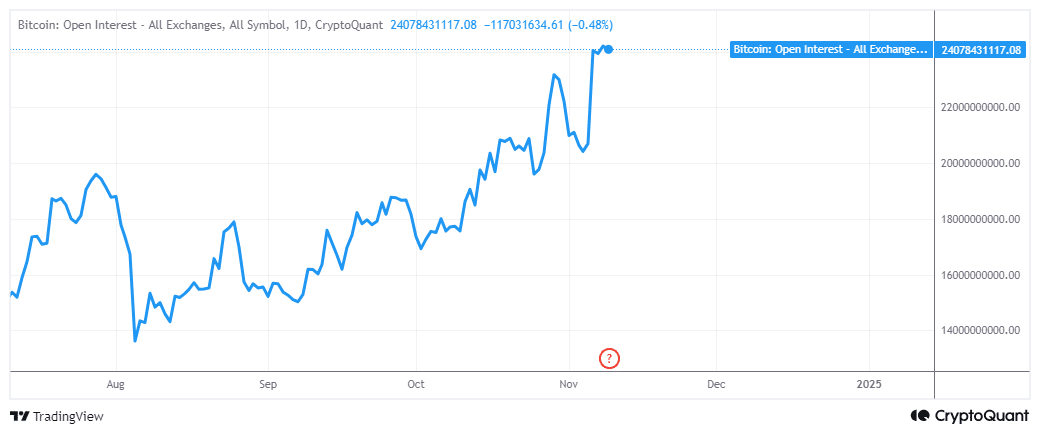

The surge in ETF inflows could push Bitcoin to larger highs. A latest cryptoQuant analysis lately regarded into the opportunity of such an consequence forming a brief squeeze. In accordance with the evaluation, whereas the Open Curiosity was excessive, the funding charges had been damaging.

Damaging funding charges traditionally point out a shift in market sentiment, particularly, to a bearish outlook within the derivatives section. This shift was supported by Coinglass’s BTC lengthy/brief ratio which revealed that shorts had been larger than longs over the past 3 days.

This surge briefly positions was possible as a result of derivatives merchants anticipated the earlier high to behave as a resistance stage. Or a minimum of short-term revenue taking to set off one other pullback. Nonetheless, shorts could be prone to liquidations if the value pushes up.

In the meantime, Bitcoin’s Open Curiosity seemed to be levelling out after attaining a brand new ATH. Figures for a similar peaked at $24.19 billion on 8 November.

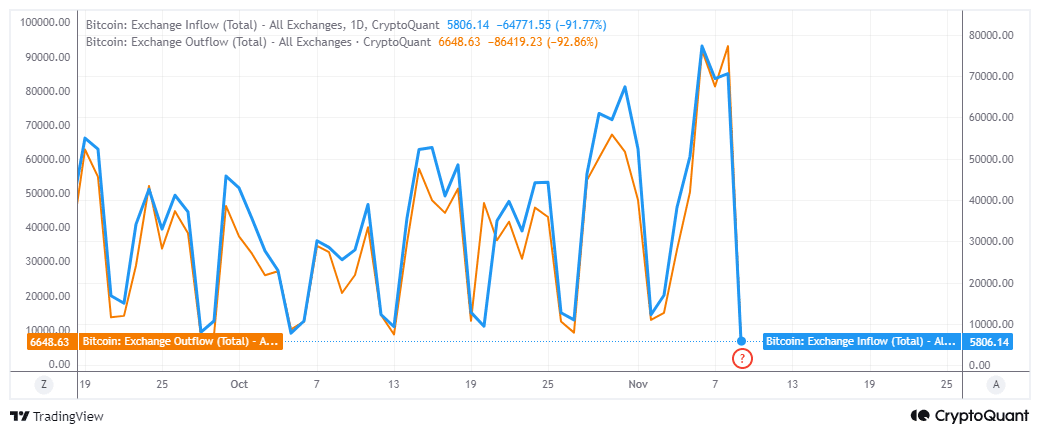

Change flows point out that demand was nonetheless larger than promote stress

Change movement information dropped significantly lately, indicating indicators of potential bullish exhaustion. Regardless of this discovering, nevertheless, the quantity of BTC flowing out of exchanges was nonetheless barely larger than BTC change inflows.

Bitcoin had 6,648 BTC in change outflows on 9 November, in comparison with 5,806 BTC in inflows. This recommended that demand was nonetheless in favor of the bulls and the value may nonetheless tick up.

Primarily based on the aforementioned information, it appeared clear that there was nonetheless some bullish momentum stopping the bears from taking on. This, mixed with the demand coming from Bitcoin ETFs, could clarify the prevalence of optimism. Nonetheless, this doesn’t essentially imply that the state of affairs will stay like that.

BTC’s price action demonstrated that the bulls have been struggling to push larger. This can be an indication that demand is cooling down, which can then pave the best way for a bearish retracement as soon as promote stress begins to achieve traction.