- The stablecoin ratio channel signifies a possible shopping for alternative for Bitcoin and altcoins.

- Rising stablecoin market cap suggests liquidity buildup, hinting at attainable bullish momentum forward.

The stablecoin ratio channel is signaling a possible market shift, hinting at a shopping for alternative for Bitcoin [BTC] and altcoins.

A rise in stablecoin market caps usually marks an accumulation part, as traders transfer funds from threat property to stablecoins, ready for optimum entry factors.

Traditionally, when this ratio reaches important ranges, it has preceded vital worth actions, suggesting that the market could also be making ready for a brand new development.

An uptrend on the horizon?

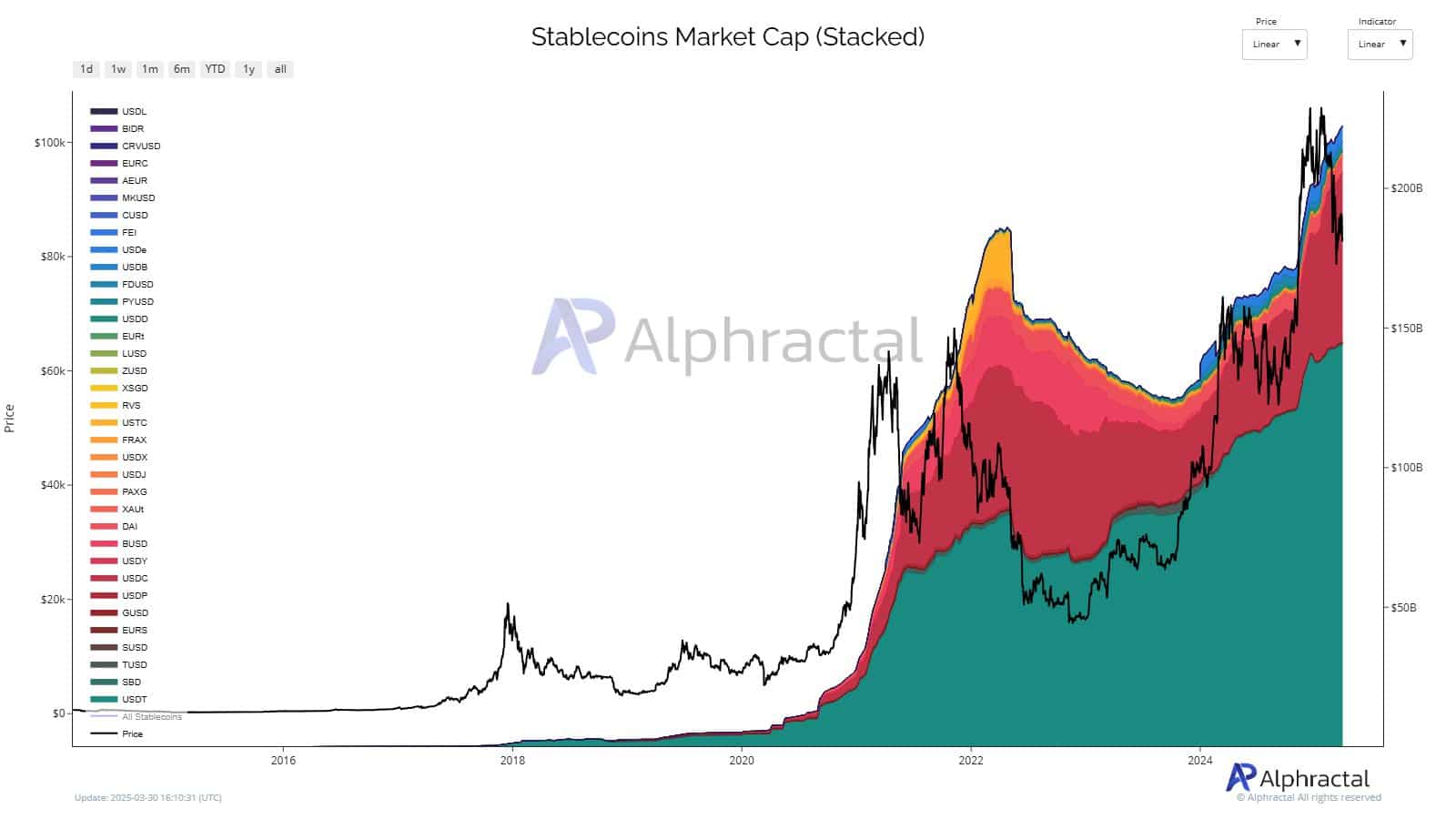

The stablecoins market cap chart reveals a cyclical sample the place stablecoin provide tends to broaden throughout bearish phases and contract when the market turns bullish.

At present, the surge in stablecoin market cap suggests elevated liquidity, indicating that traders could also be accumulating secure property whereas ready for an optimum re-entry into Bitcoin and altcoins.

Traditionally, such expansions have usually preceded notable worth rallies.

In the meantime, the stablecoin ratio channel chart reveals the indicator reaching a traditionally vital accumulation zone.

Earlier cycles counsel that when the ratio hits this stage, it usually indicators a bullish shift in Bitcoin’s worth motion.

The current drop close to the oversold area signifies that the market may very well be coming into an accumulation part, hinting at potential upward momentum forward.