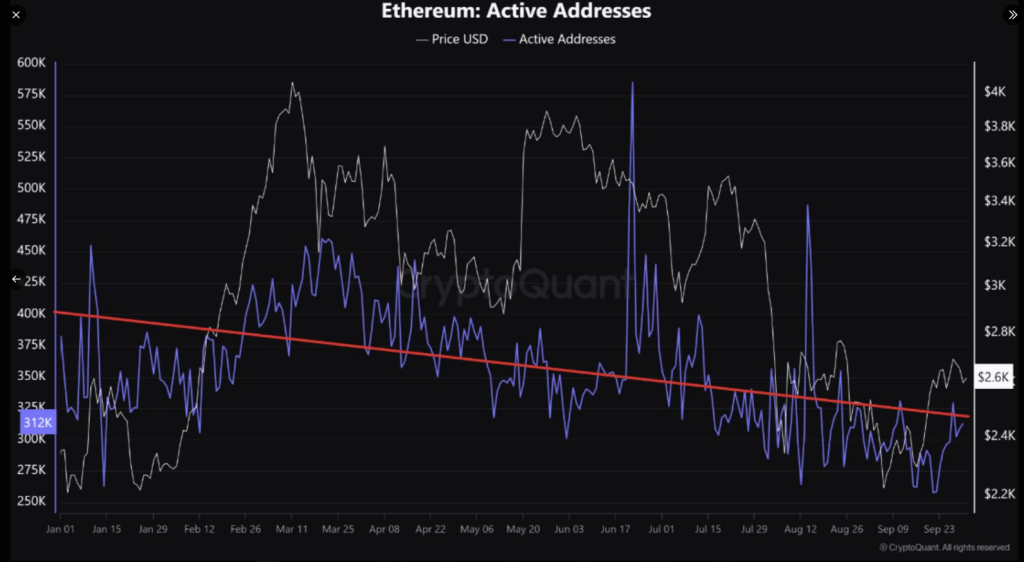

The cryptocurrency market is presently experiencing a considerable decline, as each Bitcoin and Ethereum have skilled a considerable lower in lively addresses. This development, which has endured all through 2024, has triggered apprehension concerning the way forward for these outstanding cryptocurrencies. The implications for market dynamics may very well be profound as investor enthusiasm diminishes.

Associated Studying

Declining Energetic Addresses

In response to the most recent stats from CryptoQuant, Bitcoin’s lively addresses have contracted by about 1.17 million to 855,000, whereas Ethereum has decreased by about 382,000 to 312,000. This equates to a 27% drawdown for Bitcoin and an 18% decline for Ethereum year-to-date.

The absence of new investors getting into the market seems to be the first reason behind this decline. That is important for sustaining favorable momentum, as current members dominate buying and selling exercise within the absence of latest capital inflows.

Since early 2024, lively Bitcoin and Ethereum addresses have been declining

“For the bulls to dominate the market, the inflow of latest traders is an important situation.

1. Bitcoin 1.17M -> 855K

2. Ethereum 382K -> 312K” – By @burak_kesmeciFull publish ????https://t.co/gZftQidnxa pic.twitter.com/q5cdpv7x6t

— CryptoQuant.com (@cryptoquant_com) October 1, 2024

The anticipated pleasure surrounding the approval of spot ETFs has not translated into elevated exercise on the blockchain. Nonetheless, the present consumer base carries lots of traders who would have anticipated such developments. The continued quantitative tightening of the Federal Reserve continues to strip liquidity from the market, including extra stress to the state of affairs.

Market Sentiment And Future Prospects

There are, nevertheless indications {that a} potential rebound is close to within the face of those challenges. For instance, funding charge on Ethereum has remained constructive for the previous week, that means there may be rising curiosity amongst traders in lengthy positions. This suggests that whereas plunges within the value of Ethereum have been ongoing, a very good majority of the market stays optimistic concerning its efficiency going ahead.

BTC and ETH addresses decline: BTC drops to 855K, ETH to 312K in 2024

For the reason that begin of 2024, the variety of lively Bitcoin and Ethereum addresses has continued to drop. Bitcoin addresses fell from 1.17 million to 855,000, whereas Ethereum addresses declined from 382,000 to…

— CoinNess International (@CoinnessGL) October 1, 2024

It’s fairly attention-grabbing that giant Ethereum holders have been accumulating their property, quite than promoting them off. These massive holders decreased their outflows from 311,950 to 139,390, suggesting they’ve confidence within the long-term prospects of the altcoin. Buyers that do this type of motion often count on the costs to get better quickly.

Moreover, Bitcoin’s Change Movement A number of has skilled a considerable decline. This metric contrasts with short-term inflows and outflows with these over a lengthier interval, indicating that present buying and selling exercise is considerably decrease than historic averages. A low Change Movement A number of usually means that traders are holding their property in anticipation of future value will increase quite than actively buying and selling them.

Associated Studying

Bitcoin & Ethereum: Broader Perspective

The broader bitcoin market is negotiating a sophisticated terrain molded by geopolitics issues and legislative adjustments. Latest occurrences have helped traders to be usually extra cautious. As an illustration, regardless of market volatility inflicting Ethereum to tumble to about $2,390, Bitcoin has managed to stay fixed above $61,100.

Featured picture from Vecteezy, chart from TradingView